Roth conversions are one of the most useful strategies to hedge the risk of higher taxes in the future. Taxpayers may be considering a Roth conversion amid uncertainty about personal tax circumstances in the future, or the prospects of Congress making policy changes resulting in higher taxes, or both. However, the cost of doing a Roth conversion is important to understand since in most cases it will result in realizing additional ordinary income. There may be other factors to weigh before moving forward with a conversion.

In addition to potentially creeping into a higher income tax bracket as a result of a conversion, here are some other considerations:

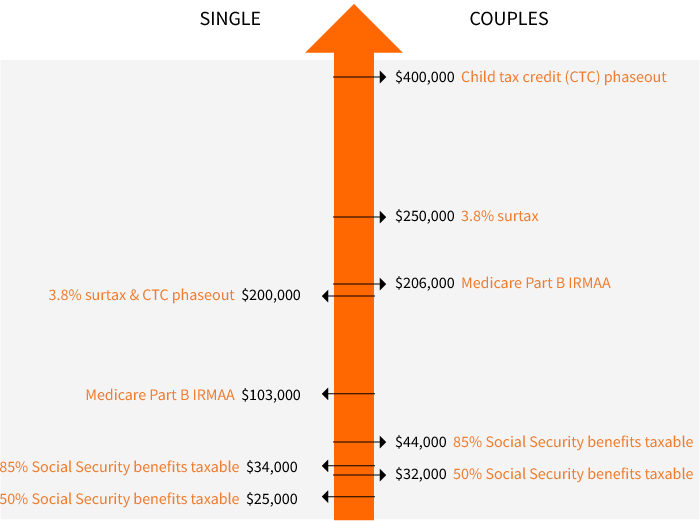

Key income thresholds to factor when considering a Roth conversion

Source: Based on 2024 tax figures. For couples, figures are based on married couples filing a joint tax return. Social Security taxation thresholds include adjusted gross income (AGI) plus non-taxable interest plus ½ of Social Security benefits. Income threshold for determining higher Medicare Part B premiums is based on modified adjusted gross income (MAGI), which includes non-taxable interest. MAGI is based on income reported on the tax return from two years prior. For more details on the Income Related Monthly Adjusted Amount (IRMAA) consult Medicare.gov. Conversion of after-tax contributions to a Roth will not result in taxable income.

Income-related considerations

Taxation of Social Security benefits

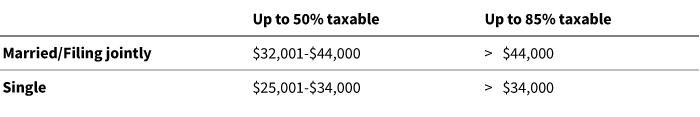

Certain retirees receive Social Security tax free. The income threshold for receiving tax-free benefits is fairly low and has not changed since taxation of benefits began in 1984. For that reason, many retirees have to report at least a percentage of their benefits on their tax return. Up to 85% of Social Security benefits are subject to taxation.

Base amount of modified AGI causing Social Security benefits to be taxable

For those at lower income levels, extra income resulting from a Roth conversion may subject their benefits (or more of their benefits) to taxation.

3.8% surtax on net investment income

A surtax applies to investment income such as capital gains, dividends, and interest for those with a modified adjusted gross income (MAGI) above $200,000 for single filers and $250,000 for married couples filing a joint tax return. While income resulting from a Roth conversion is not subject to the 3.8% surtax, it could increase MAGI to the extent other income — such as capital gains — is subject to the surtax. Taxpayers near that threshold who are expecting to report investment income on their return should proceed carefully before executing a Roth conversion.

Higher Medicare premiums

As you approach Medicare eligibility at age 65, you need to be aware that income may impact your Medicare Part B (medical insurance) and Part D (prescription drug coverage) premiums. This adjustment is referred to as the income-related monthly adjustment amount (IRMAA). For Medicare Part B in 2024, those with a MAGI higher than $103,000 ($206,000 for married couples filing a joint tax return) will pay higher premiums. Note that this test is based on your tax return from two years prior. For that reason, taxpayers reaching age 63 should be aware of these potential adjustments since additional income from a Roth conversion may impact the amount of their premium. For more detail, see "Three things to understand about Medicare."

Other factors to consider

Here are some other areas where realizing additional income from a Roth conversion may have a negative impact:

- Income threshold phaseout for certain tax credits or deductions such as the Child Tax Credit (CTC), credits for higher education (American Opportunity Tax Credit or the Lifetime Learning Credit), or the deduction for qualified business income (QBI)

- Ability to deduct traditional IRA contributions or contribute to a Roth IRA

- Eligibility for federal financial aid when submitting the FAFSA form

- Changing domicile. If a taxpayer is moving to a lower-tax state, it may make sense to wait until the change of residence is finalized before converting to a Roth

Seek professional assistance

Voluntarily adding additional income by converting traditional retirement assets to a Roth should only be done with careful thought and analysis. For example, since 2018 taxpayers are no longer able to recharacterize (undo) a Roth conversion. Given the factors outlined, this decision can be quite complicated, and consulting with your advisor and tax professional is critical. For example, a taxpayer must consider the likelihood of being subject to lower tax brackets post-retirement. Or, if a portion of retirement savings will be left to heirs, what are their likely tax brackets? Are there liquid funds available (outside of a retirement account) to pay the taxes on a Roth conversion? Lastly, it's important to understand the rules for tax free withdrawals from a Roth (qualified distributions) that include a five-year holding period and one of several other requirements (for example, attaining age 59½). For more information see “Converting a Traditional IRA to a Roth IRA.”

335536

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.