While there are no major changes from last year, due to rising inflation, many tax figures annually adjusted for inflation will increase in 2023. For example, the unified gift and estate lifetime exclusion increases to more than $13 million in 2024.

Many taxpayers see the new year as a time for a fresh look at financial plans.

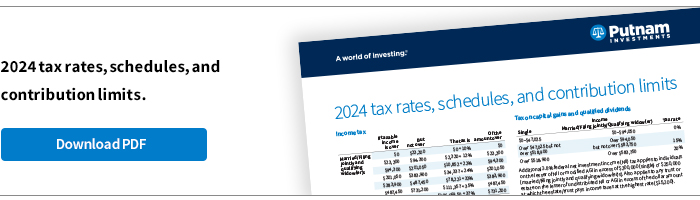

A first step in planning for the year ahead is for taxpayers to determine their tax bracket. Putnam’s “2024 tax rates, schedules, and contribution limits” can be a useful reference to review with a financial advisor.

With changes in tax brackets and contribution levels, there are areas where individuals may want to consider revisions to their tax strategy for the year ahead. For example, the maximum amount a participant can defer salary into a defined contribution plan increases to $23,000 from $22,500. Contributions to health savings accounts (HSAs) also rose to $4,150 for individuals and $8,300 for families.

Here’s a look at some of the key tax figure changes for 2024:

Seek advice

To make adjustments to current financial plans, it is important to consult with an advisor with knowledge of your individual financial situation.

335602

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.