With the continued rise in health care expenses and more employers shifting the burden for meeting those expenses to employees, it’s not surprising to see significant growth in the use of health savings accounts (HSAs).

HSAs can offer tax advantages to account owners that exceed other tax-deferred savings. These accounts, which are also portable, can help savers prepare for health expenses in the future.

While HSAs are not new to the marketplace, their popularity has accelerated in the past decade. HSAs were introduced by legislation passed by Congress in late 2003 (the Medicare Modernization Act of 2003) and became available in 2004.

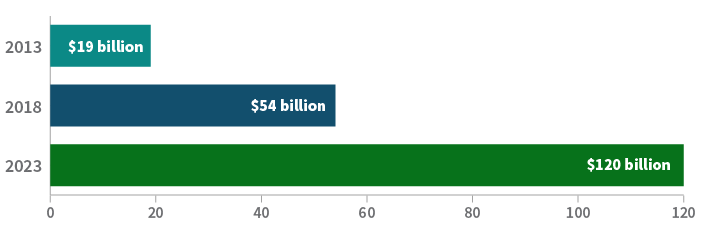

Recent growth of HSA assets

Source: Devenir Research, 2023.

Triple-tax advantaged

Unlike retirement savings accounts, HSA contributions and earnings are never taxed assuming distributions are utilized for qualified health expenses. These accounts are referred to as “triple-tax advantaged” since contributions are made pretax, any earnings grow free of taxes, and distributions are not taxed as long as they are applied toward qualified medical expenses.

Additional benefits

- Flexibility for employee and employer contributions. For 2024, the individual contribution limit is $4,150 and the family contribution limit is $8,300. Taxpayers who are 55 or older may contribute an additional $1,000 catch-up contribution

- Wide range of health care expenses are considered eligible for HSA purposes, including prescription medications, doctor and hospital visits, Medicare premiums, over-the-counter medicines, dental and vision expenses, physical therapy, and even long-term care (LTC) expenses up to certain limits, etc.

- Unlike flexible spending accounts (FSAs), unused HSA balances roll over from year to year and can be invested once the account balance reaches a minimum amount outlined by the plan

- As long as you meet the requirements (i.e., enrollment in a high-deductible health care plan, or HDHP), you can contribute to an HSA. Unlike other accounts, like Roth IRAs, there are no eligibility limits based on income

- Unlike retirement accounts, there are no required minimum distributions (RMDs) for HSAs

- HSAs also differ from 401(k) plans. You don’t have to establish an HSA through an employer. As long as you meet the requirement of being enrolled in an HDHP you can open up your own HSA through a provider

- You can use HSA funds to pay for other family members' expenses (spouse and dependents) even if you don’t have family coverage for insurance (i.e., you have self-only coverage and contribute to an HSA up to the individual limits)

- You have an unlimited amount of time to use HSA funds for previous qualified expenses as long as you have the necessary documentation

- Like retirement accounts such as 401(k)s and IRAs, HSAs are fully portable when moving from one employer to another. You may also rollover the funds from an employer HSA to an individual account. With a 401(k) plan, you cannot generally transfer your plan until you have separated from service. There is no similar requirement for transferring an HSA

Looking beyond the basics

There are some aspects of HSAs that many may not be aware of and could be overlooked.

Here are a few examples:

- You CAN transfer funds from your IRA to your HSA (See our earlier post, "Little known strategy provides for IRA to HSA transfer."

- A Qualified HSA Funding Distribution allows investors to transfer funds from an IRA to an HSA tax free and penalty free (no 10% early withdrawal penalty). The amount transferred cannot total more than what the investor would be allowed to contribute to an HSA for that year, including other HSA contributions made

- This can provide a tax benefit since distributions from pretax, traditional IRAs are considered ordinary income, unlike distributions from an HSA for qualified medical expenses, which are tax free

- Before making an IRA to HSA transfer, you need to consider that the HSA owner must stay enrolled in an HSA plan for at least 12 months following the transfer to avoid the transfer being considered a taxable event also potentially subject to a 10% early withdrawal penalty

- You can use HSA funds to pay for Medicare premiums, coverage through COBRA, and certain LTC insurance premiums (subject to limitations). However, you cannot use HSA funds to pay for private insurance coverage including Medigap policies

- If you leave your HSA to a beneficiary, there are different rules depending on who the beneficiary is. A spousal beneficiary can treat an inherited HSA as if it were their own. For other beneficiaries, inherited HSA funds are considered taxable income; therefore it is generally best to spend down an HSA to offset qualified medical expenses while at least one spouse is still living

- If you’re still working at age 65 and contributing to an HSA, be careful before enrolling in Medicare since HSA contributions are no longer allowed. There may be opportunities if you are still covered by an employer plan to delay Medicare enrollment and keep contributing to an HSA. However, it’s important to know the requirements to avoid potential Medicare late enrollment penalties. (Read “Three key things to understand about Medicare” for more details.)

Understanding HSAs

In order to take advantage of the tax benefits and avoid penalties, it is important to take a deeper look at HSAs and understand how they work. See "IRS Pub 969, Health Savings Accounts and Other Tax-Favored Health Plans" for more details.

336339

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.