ESG investing is one of the fastest-growing trends in the financial industry. Assets managed in this discipline grew by more than one third between 2016 and 2018 to reach $12 trillion, according to data from the U.S. SIF Foundation (the Forum for Sustainable and Responsible Investment). Among individual investors, 75% express some degree of interest in sustainable investing, according to a 2017 survey for the Morgan Stanley Institute for Sustainable Investing. For Millennials, the figure was even higher — 86%. Mutual funds and ETFs that follow ESG criteria have increased to 221 from 130 in 2012, according to Cerulli Associates (Source: wsj.com, 3/21/19). Amid this growth, it's worthwhile to be prepared if clients raise the topic.

Explaining the basics of ESG investing

ESG is an acronym, standing for the words Environmental, Social, and Governance. These are three rapidly emerging themes in the current and future investing landscape. In aggregate, they cover a spectrum of risks and opportunities for business profitability above and beyond traditional financial metrics. Let's take a closer look.

Among individual investors, 75% express some degree of interest in sustainable investing, according to a 2017 survey for the Morgan Stanley Institute for Sustainable Investing.

Environmental issues are supremely important in today's world, with climate change and other sustainability issues confronting not only investors but also society as a whole. Temperature extremes, wildfires, flooding, and coastal erosion routinely make headlines and generate calls for new practices and solutions. Examples of possible changes include improvements in the use of energy, water, and materials, increases in recycling and re-use, and employment of more natural ingredients and inputs.

Social factors are those that impact people individually or as demographic groups. For example, investors increasingly want to know how the labor practices of a firm improve employees' well-being, or the effect of privacy practices on users of technology.

Governance issues relate to ongoing company oversight. Strong governance policies and structures can help to ensure that all stakeholders of a company benefit over the long term. Some of these practices include alignment of management incentive pay with long-term strategy, and improvements in diversity among board members and executive ranks.

Pursuing strong returns and positive non-financial impact

At this point, some advisors might ask if there is any real difference between ESG investing and "regular" investing. As more investors recognize the long-term fundamental importance of ESG issues, they are indeed being considered more broadly.

An example is the sustainable approach at Putnam Investments, which is distinctive in two ways. First, Putnam believes that material ESG issues are core business issues and that analysis of them is part of — and additive to — traditional fundamental analysis. Second, Putnam manages dedicated portfolios that seek both excellent financial returns against conventional benchmarks and excellent sustainability performance.

ESG investing has deep roots and many branches

ESG's predecessor, socially responsible investing, was considered a specialized niche for decades and often relied on exclusionary approaches. More recent tools and products that focus on ESG integration have helped the field to evolve in recent years. As in any healthy field of investing, numerous variations continue to develop.

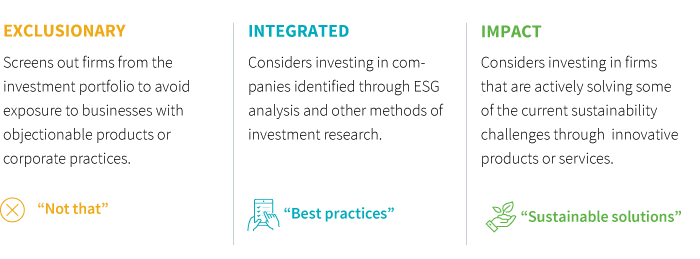

The Sustainable Investing team at Putnam breaks down this overall investment field to three principal styles:

Putnam Investments offers investors two fund choices that emphasize sustainable investing: Putnam Sustainable Leaders Fund and Putnam Sustainable Future Fund. The former invests in companies committed to excellence in sustainable business practices. The latter seeks out firms that aim to develop sustainable solutions, creating positive environmental or social benefit.

How ESG can fit in a portfolio

Many institutional and individual investors now recognize that there is no need to consider ESG investments as separate allocation categories. Put another way, ESG investments can be the building blocks of a diversified investment portfolio, designed for maximum financial performance plus sustainability and impact goals. The industry offers sustainable strategies in equity and fixed-income asset classes, making it possible to build diversified and sustainability-focused portfolios.

Tracking developments in the ESG space

Increasingly, investment advisors will need to need to become fluent with evolving ESG themes. Advisors can consult putnam.com and subscribe to blog posts from Katherine Collins, Putnam's Head of Sustainable Investing. With 30 years of investment experience, and as the founder of a sustainable investment firm before joining Putnam, Katherine, along with her team, blogs about the development of the sustainable investing discipline and emerging ESG issues.

316299 3/19

For informational purposes only. Not an investment recommendation.

This material is provided for limited purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Putnam product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice. The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication. The views are provided for informational purposes only and are subject to change. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Investors should consult a financial advisor for advice suited to their individual financial needs. Putnam Investments cannot guarantee the accuracy or completeness of any statements or data contained in the article. Predictions, opinions, and other information contained in this article are subject to change. Any forward-looking statements speak only as of the date they are made, and Putnam assumes no duty to update them. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those anticipated. Past performance is not a guarantee of future results. As with any investment, there is a potential for profit as well as the possibility of loss.

Diversification does not guarantee a profit or ensure against loss. It is possible to lose money in a diversified portfolio.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. You can lose money by investing in a mutual fund.

Putnam Retail Management.