While there may be tax advantages to a Roth IRA conversion, another special benefit is that investors can change their minds.

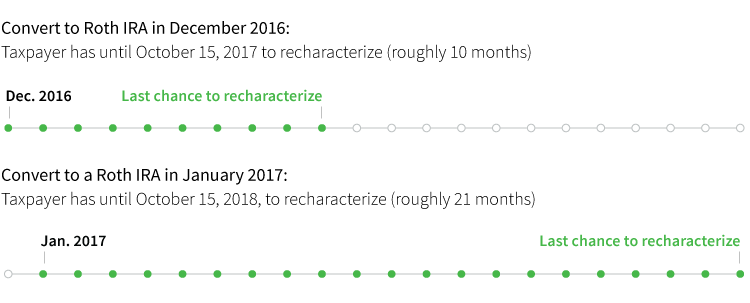

Those converting to a Roth IRA have the ability to “undo” this conversion through a process called recharacterization as long as the action is taken before the tax filing deadline plus a six-month extension. The deadline generally falls on October 15 of the calendar year after the conversion.

Completing the conversion early in the calendar year provides the IRA owner with more time to decide whether or not to recharacterize.

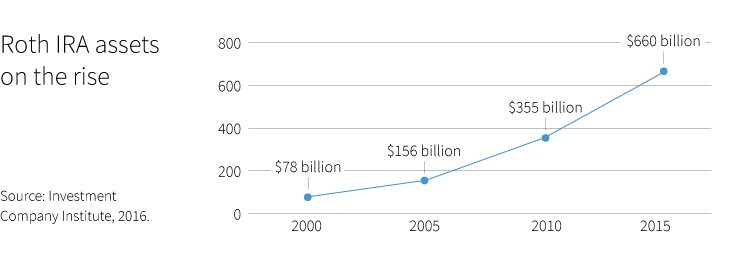

Roth IRAs grow in popularity

Since their establishment by the Taxpayer Relief Act of 1997, Roth IRAs have grown in popularity. Initially, Roth IRA conversions had income limitations, but those restrictions were lifted in 2010. Conversions are available to all taxpayers, regardless of income.

Converting a traditional IRA to a Roth may help investors diversify their tax liability by creating a source of tax-free income in retirement. The strategy may also be used to leave a tax-free legacy to the next generation. Some investors choose to convert current accounts if they know they will likely be going into a higher tax bracket in the future.

Overall, the number of conversions has been on the rise with increased IRA assets, and today, more IRA contribution dollars are invested in Roth IRAs compared with traditional IRAs.

Why recharacterize?

There are many reasons why investors may choose to reverse the conversion. When an IRA is converted, the taxable income could potentially move a taxpayer into a higher tax bracket. The higher income may trigger the 3.8% investment surtax. Extra income from the conversion may also increase adjusted gross income and lead to tax liability for Social Security benefits, or result in higher Medicare Part B or Part D premiums.

Market fluctuations may also contribute to the decision. If there is a market downturn between the time an investor makes the conversion and the time he or she needs to file a tax return, a recharacterization may be a good idea to avoid paying higher taxes on an asset that has lost value.

Making the conversion early in the calendar year gives an investor more time to consider the value of the strategy. These deadlines show the difference that a month can make:

It is also important for investors to remember that they don’t have to recharacterize the entire amount. A recharacterization can be accomplished with only a portion of the Roth account.

As with any tax planning strategy, it is important to meet with a financial professional to determine the potential advantages of the strategy and whether converting the account fits into an existing retirement plan. Learn more about a Roth IRA conversion in Putnam’s investor education article, “Converting a Traditional IRA to a Roth IRA.”

Also, Putnam’s Roth conversion calculator offers a quick view of whether a Roth IRA conversion may be beneficial.

304877

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.