Year-end is typically an opportune time for investors to review their tax situation and financial plan. Given the current tax reform debate on Capitol Hill, this year presents some unique challenges and opportunities.

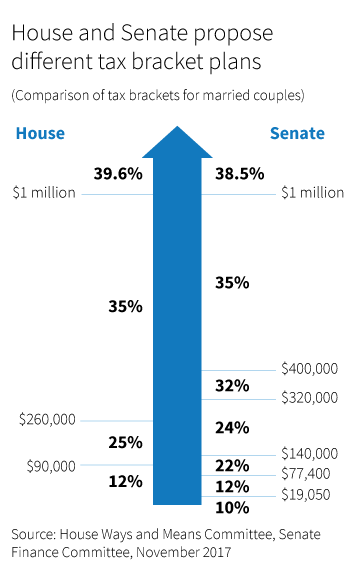

Both the House and Senate proposals seek to reduce taxes for individuals and corporations to varying degrees, and to offset those reductions with reforms to the tax code that could eliminate or limit many popular tax deductions or credits.

As with any legislative process, this will take time to complete and there is no guarantee which proposals, if any, will survive in a final vote. But given some of the broader discussion around tax rates and deductions, there may be some opportunities for investors to consider before year-end.

Here are some tax-planning ideas to consider in the current environment.

1. Timing of income

Compare the current tax situation with the proposed new tax brackets. It may be beneficial for some investors to defer certain income into 2018 if the tax brackets appear favorable.

2. Accelerating deductions

In both proposals, most itemized deductions would be eliminated. For example, the Senate version seeks to eliminate deductions for state income taxes, sales taxes, and local property taxes. The House plan eliminates most deductions including medical expense deductions.

Investors working on tax planning in the final months of 2017 may want to consider taking advantage of as many deductions as possible this year, while they are still available. These deductions may be eliminated, or more taxpayers may end up utilizing the standard deduction in the future as both bills seek to nearly double the amount from current levels.

Possible actions include:

- Pay local property taxes before the end of the year.

- Build up state sales tax deductions before the end of the year by making large purchases. This may be a particular advantage for residents of states like Florida or Texas, which do not have state income taxes.

- Prepay student loan interest before the end of the year.

Taxpayers must also be aware that if their income and circumstances places them at a level that triggers the alternative minimum tax (AMT) in 2017, then they would not be allowed to take advantage of many deductions including miscellaneous 2% deductions, state income taxes or property tax deductions. In this case, accelerating these deductions into 2017 would not benefit the taxpayer.

3. AMT considerations

For individuals subject to the AMT in 2017, proposals to repeal the AMT may influence certain strategies. For example, it may be preferable to wait to exercise incentive stock options (ISOs) until next year if it appears that the AMT may be eliminated. Currently, the “bargain element” – the difference between the strike price of a stock option and the market price of the underlying stock when the option is exercised — is considered taxable for those subject to the AMT.

If a taxpayer is subject to the AMT, the marginal tax rates are lower (to 26% or 28%). It may be appropriate to push some income into 2017 if these marginal rates are lower than what the individual would be facing in 2018. One way to create income before the end of 2017 would be to convert Traditional IRA assets to a Roth.

4. Strategies for business owners

For business owners using a pass-through tax structure, both congressional proposals may provide benefits. The House seeks to lower the pass-through rate to 25%, and the Senate proposes a reduction deduction of pass-through income of 17.4%. Business owners may want to discuss whether they should defer income into 2018 if their projected tax liability may be lower.

Both plans limit the use of the net operating losses (NOLs) to 90% of income beginning in 2018. If a business owner has a significant amount of NOL carryforward, it may make sense to “use up” this loss in 2017 — a Roth IRA conversion is one way to do this by creating additional ordinary income.

5. Investment income

The House and Senate both included a provision that limits an individual taxpayer’s ability to select share lots when selling stock and paying capital gains. Today, investors have more flexibility. In the future, this could change, and investors may be limited to selling shares on a “first in, first out” basis (FIFO). For these investors, it may make sense to consider strategic sales of certain stock share lots in 2017 before the rules change.

While the Senate version is attempting to amend the Affordable Care Act, the related 3.8% Medicare investment income surtax is not going away. Investors need to be mindful about the timing of income, as investment income could be subject to a long-term capital gain. Also, individuals may want to discuss harvesting losses before the end of the year to offset gains in their portfolios.

6. Retirement

Eligible taxpayers may want to consider donating IRA assets to a charity to avoid the tax liability of extra income from required minimum distributions.

Also on the table is a proposal to eliminate Roth recharacterization. Depending on current and potential future tax brackets, individuals may want to think about a Roth conversion before the end of the year as they could still do a recharacterization for the 2017 tax year.

Tax strategies require expert advice

Expert financial advice is more important than ever given the potential for some major shifts in the tax landscape. When considering tax strategies, it’s also important to work with a qualified tax professional. As the tax reform debate continues, the lack of clarity presents a challenge for investors and planners. At the same time, the potential for change creates an environment where the timing of many strategies is critical. The final months of 2017 may present some unique opportunities to implement tax-smart strategies and take advantage of the current tax rules before proposals become law.

309251

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.