Now that the 2017 tax season is in the rear view mirror, it’s time to look ahead to 2018.

After the most dramatic changes to the nation’s tax code in over 30 years, many taxpayers are wondering how the Tax Cuts and Jobs Act (TCJA) will affect next year’s tax return.

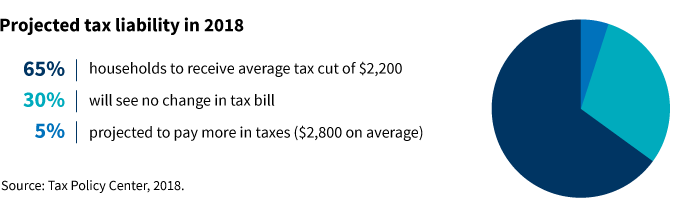

The Tax Policy Center analyzed the impact of the TCJA and found that, on average, income taxes will be reduced across income groups in all states. The individual tax cut is estimated to average 1.8%, the study found. Still, nearly one third of taxpayers will see no change in their tax bills, and a smaller portion of filers will owe more next year. For higher-income taxpayers (defined as in the top quintile) who will see a higher tax bill, the average tax increase is expected to be roughly $8,000.

Who is more likely to have a higher bill?

The impact also varies by state. Taxpayers living in areas with high state and local taxes, such as California, Connecticut, New York, New Jersey, Maryland, and Washington D.C., are more likely to have a higher tax bill than those living in other states. In addition, residents in parts of Illinois, Massachusetts, and Oregon may face a higher tax bill.

Taxpayers who may have had large miscellaneous deductions in the past may also need to pay more taxes next year. These may include unreimbursed business expenses as an employee, which is among many deductions repealed by the tax law.

Consider this example of a couple living in a high-tax state.

Reductions in tax rates as well as limitations and the repeal of certain deductions may lead some investors to re-think their approach to tax-efficient planning. Individuals may want to meet with a financial advisor to consider strategies that may help mitigate their tax liability. For example, investors who are no longer able to itemize under the new law may want to think about ways to make the most of their charitable donations. Consider the strategies in the Putnam Wealth Management Center’s blog, “Charitable giving strategies for the new tax landscape.”

311324

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.