Families with assets held in custodial accounts for minors are wondering how the new tax law will impact those accounts, as the Tax Cuts and Jobs Act changes the tax calculation for these accounts.

The “kiddie tax” applies to unearned income of minors, and includes assets held within custodial UTMA or UGMA accounts. Unearned income above a certain threshold - $2,100 for 2018 - is subject to the kiddie tax. It basically prevents families from holding investments in the name of a minor child to avoid or limit taxation.

The kiddie tax applies if one of these requirements are met:

- The child was under age 18 at the end of the tax year

- The child was age 18 but less than 19 at the end of the tax year, and the child's earned income did not exceed one-half of the child's own support for the year (excluding scholarships if the child was a full-time student), or

- The child was a full-time student who was at least age 19 but under age 24 at the end of the tax year, and earned income did not exceed one-half of the child's own support for the year (excluding scholarships)

Tax rate changes

In the past, a minor’s unearned income above the threshold was taxed at the parents’ highest marginal tax rate.

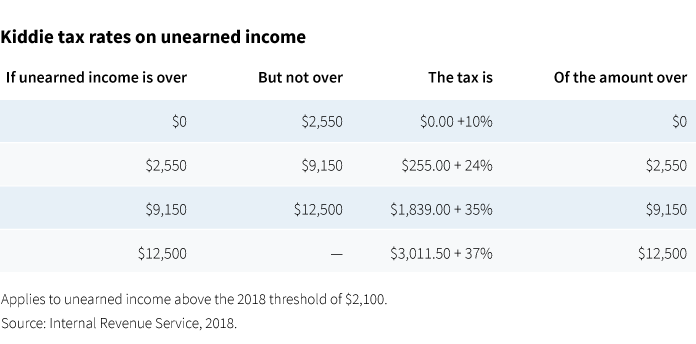

Under the Tax Cuts and Jobs Act, unearned income above the threshold is taxed at trust tax rates.

Which taxpayers may pay less?*

- Taxpayers subject to the highest marginal tax rates. These taxpayers may benefit depending on the amount of income subject to the kiddie tax. For example, assume the minor’s unearned income totals $10,000 over the kiddie tax threshold. Under the old rules, the $10,000 would be taxed at the parent’s highest marginal rate. If you used the new tax brackets, and assumed a 37% rate, the result would have been a kiddie tax of $3,700. Under the new rules, applying the $10,000 in unearned income against the trust tax rates, the kiddie tax is only $2,136.

- Taxpayers with lower amounts of unearned income subject to the kiddie tax. For example, assume income totals $2,000 above the threshold amount and parents are in the 24% marginal tax bracket. Under prior rules, the kiddie tax would have been $480. Under the new rules, the kiddie tax is $200.

Which taxpayers may pay more?

Taxpayers with a relatively large amount of unearned income within a custodial account may pay more taxes. Assume the parents are in the 24% marginal tax bracket and there is $20,000 in unearned income above the threshold subject to the kiddie tax. Under the old rules, the kiddie tax would have been $4,800. Under the new rules, applying the trust tax rates, the kiddie tax is $5,786.

Planning considerations for tax mitigation

Depending on the amount of unearned income generated by custodial accounts, investors may want to review the underlying investments within those accounts. For example, parents may want to select other investments that may not generate as much income or dividends on a regular basis subject to the kiddie tax. Or, if the funds within the custodial account are earmarked for education, it may make sense to transfer the account to a 529 college savings plan. Earnings grow tax free in a 529 plan, and distributions are not subject to taxation provided they are used for qualified college or elementary/secondary school tuition (up to $10,000 annually) expenses. However, there are specific rules applied to assets in a 529 plan that originated from a custodial account, so it’s critical to consult with a financial advisor or tax professional.

* Examples do not include the potential impact of the 3.8% surtax on net investment income

312068

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.