While most of the new provisions of the Tax Cuts and Jobs Act (TCJA) went into effect in January of 2018, there are some additional tax code changes that will change or take effect at the end of 2018.

Investors may want to consider how these strategies may impact their financial planning.

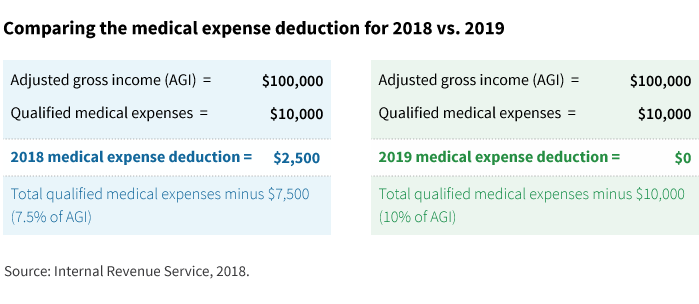

Deduction for medical expenses

The TCJA preserved the deduction for medical expenses and reduced the threshold for deducting expenses from 10% to 7.5% of adjusted gross income (AGI) for tax years 2017 and 2018. But beginning in 2019, the threshold for deducting medical expenses reverts to 10% of AGI.

- The 10% threshold applies to all taxpayers. For several years following the enactment of the Affordable Care Act, taxpayers age 65 or older were subject to a 7.5% threshold while other taxpayers were subject to a 10% threshold

- Qualified medical expenses include “payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments affecting any structure or function of the body”

- The definition also includes “Payments for transportation primarily for and essential to medical care that qualifies as medical expenses, such as payments of the actual fare for a taxi, bus, train, ambulance, or for transportation by personal car, the amount of your actual out-of-pocket expenses such as for gas and oil, or the amount of the standard mileage rate for medical expenses, plus the cost of tolls and parking.” For 2019 the mileage deduction associated with medical expenses is 18 cents per mile, up from 17 cents in 2017

- For more detail, consult IRS publication 502, “Medical and Dental Expenses”

Tax treatment of alimony changes in 2019

The tax reform law made changes to the treatment of alimony payments, which is expected to have an impact on divorce negotiation.

- Previously the payment of alimony was deductible for income and the receipt of alimony was considered taxable income

- Under the TCJA, alimony payment is no longer deductible and alimony received is not considered taxable income

- This change goes into effect with divorce agreements finalized after 2018

- Agreements finalized before 2019 are grandfathered under the old rules

Investors should be mindful that these changes go into effect at the end of 2018. The changes may influence the 2018 tax filing, and also could change tax-planning strategies looking ahead into 2019. It is important to consult a financial advisor or tax expert when making planning decisions that could affect your overall financial plan.

314976

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.