Changes to retirement accounts could be on the horizon as Congress considers legislation to enhance 401(k) plans and other retirement accounts.

The House Ways and Means Committee recently passed the SECURE Act (“Setting Every Community Up For Retirement Enhancement Act of 2019”). The bill, introduced by Committee Chair Richard Neal (D-MA) with bipartisan support from Kevin Brady (R-TX), proposes a number of changes to retirement accounts.

A similar bill — the Retirement Enhancement and Savings Act (RESA) — originally drafted a couple years ago, was recently updated by the Senate Finance Committee, also with bipartisan support.

Many of the provisions in these two bills are virtually identical, including:

- Require DC plans to provide a lifetime income calculation. New disclosure would require benefit statements for plan participants to illustrate (at least once during a 12-month period) the monthly payments the participant would receive if the total account balance were used to provide lifetime income.

- Provide incentives to small businesses. The bill would increase the tax credit available to offset plan start-up costs and introduce a new credit (up to $500 annually) to promote auto enrollment. Both credits apply for up to 3 years.

- Repeal maximum age for Traditional IRA contributions. Currently, those over age 70½ cannot make a contribution.

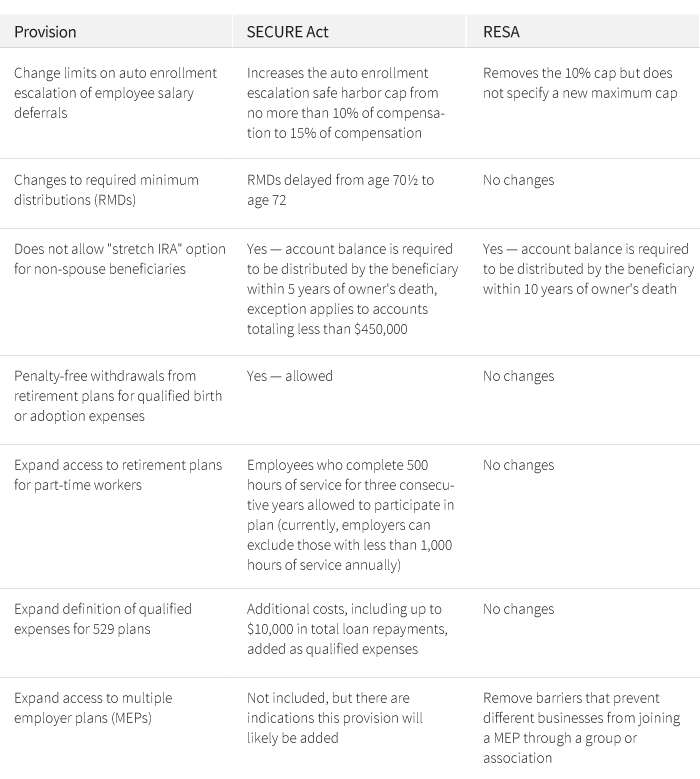

However, there are some key areas where the bills differ:

Next steps

The SECURE Act will next be considered by the full House, while the latest version of the RESA bill was introduced in the Senate. Expect congressional leaders to engage in conversations around reconciling the bills.

Discussion on the bills is ongoing in both chambers, and there could be changes to the specific details in the weeks ahead.

Links to detailed summaries on both bills can be found at SECURE Act and RESA Act.

316728

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.