In a move that may help retirees keep more of their savings longer, the federal government wants to update the life expectancy projections used to calculate required minimum distributions (RMDs) from retirement accounts.

On August 31, 2018, the president signed an executive order (No. 13847), “Strengthening Retirement Security in America.” It directed the Treasury Department to examine life expectancy tables used to compute required minimum distributions (RMDs) to determine whether modifications were needed to reflect current longevity statistics.

The Treasury Department determined that the tables need modifications, and last week it released a proposal to update the data.

The changes would reduce RMDs and allow investors to retain larger amounts of assets in their retirement plans to account for the possibility they may live longer.

Existing rules

Retirement account owners are generally required to begin RMDs after they reach age 70½ (referred to as the required beginning date, or RBD).

Some employees participating in employer retirement plans may be able to delay RMDs. Participants in an ERISA-qualified workplace retirement plan can delay RMDs while they are still working (the “still working exception”). However, there are certain requirements. The participant may not own 5% or more of the company, the plan must allow delayed RMDs, and the participant must be employed throughout the year. In this case, RMDs can be delayed until April 1 of the year following the year that the employee stopped working.

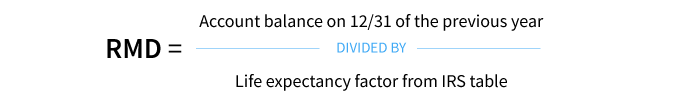

How does the RMD “math” work?

- The calculation for account owners is based on the IRS Uniform Life Expectancy Table

- There is an exception for an account owner whose spouse is the sole beneficiary and is more than 10 years younger. In this case, a different life expectancy table applies ( Joint Life and Last Survivor Expectancy Table). This calculation will result in a lower RMD.

- Beneficiaries of retirement accounts must generally use the Single Life expectancy table, which will result in a higher distribution amount than the Uniform Table.

Changes on the way?

On November 8, Treasury released a Notice of proposed rulemaking, that proposes changes to the life expectancy tables used to calculate RMDs.

It is important to note that this is a proposal, subject to a public hearing and potential modifications. If this rule is finalized, changes would apply for distribution calendar years beginning on or after January 1, 2021.

If RMDs are reduced, savers could keep larger amounts in their retirement accounts to manage longevity risk with the possibility they may live longer.

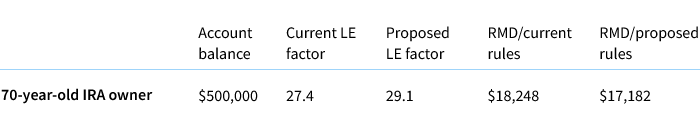

Retirees would be required to withdraw less from their accounts

End result: Required distribution decreased by $1,066

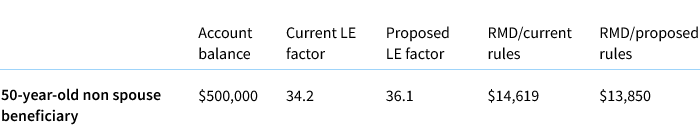

Also applies to beneficiaries

In this example, the beneficiary would be required to withdraw roughly $800 less under the proposed rules.

Address longevity risk and reduce taxes

Updating the data could help retirees (and their beneficiaries) who are not relying on their entire required distributions to meet current income needs, or those who want to maintain a larger balance in their account to offset potential longevity risk.

The modification would also help retirees save on taxes due from required retirement distributions.

There are some additional proposals being considered on Capitol Hill that could impact RMDs. The SECURE Act, a sweeping retirement bill that is currently stalled in the Senate, includes two provisions:

- Increase the RMD age from 70½ to 72

- Eliminate the option for younger non-spouse beneficiaries to “stretch” retirement account distributions based on their remaining life expectancies

Year-end plan

For retirees approaching the required beginning date, reviewing the RMD process is part of the planning discussion. It is extremely important to set up and maintain a payment schedule that complies with the RMD rules. Failure to take RMDs may result in an IRS-imposed penalty equal to 50% of the amount that should have been withdrawn.

For more details on RMDs, see Putnam’s investor education piece, "Required minimum distributions and your IRA."

319415

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.