Social Security recipients will see the biggest cost-of-living increase in decades next year.

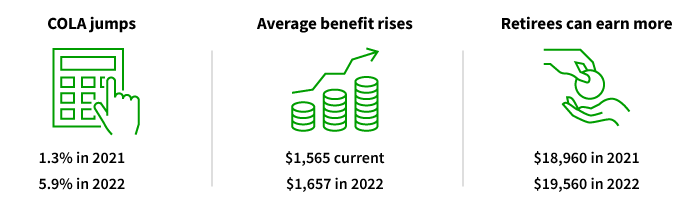

The Social Security Administration announced last week that the COLA (cost-of-living adjustment) for retirement benefits will be 5.9% in 2022, marking the highest level since 1982 when the COLA was 7.4%. Last year, the COLA was 1.3%.

The COLA is calculated based on consumer price index data in the third quarter.

The COLA adjustment is one of several key changes for Social Security next year. Here are the highlights:

- Based on the COLA calculation, the average estimated Social Security retirement benefit will increase from $1,565 to $1,657

- The Social Security wage base increases to $147,000 from $142,800. This reflects an increase of roughly 3% from last year. For individuals, the added payroll tax burden of the increased wage base is approximately $320

- The maximum amount an individual can earn before Social Security retirement benefits are reduced will increase to $19,560 from $18,960

- In the year the individual reaches full retirement age, the limit increases to $51,960 from $50,520

- Once full retirement age is reached, there are no reductions in benefits due to earnings (note that for 2022 full retirement age is 66 years, 10 months)

Source: Social Security Administration, 2021.

Some changes impact current workers

The 2022 changes will impact millions of retirees as well as current workers paying into the system. Some workers will pay more in Social Security payroll tax. Every year, roughly 6% of covered workers have earnings above the taxable maximum. Nearly 20% of current and future covered workers are projected to have earnings above the taxable maximum in at least one year.

Social Security and retirement planning

Social Security provides some portion of income for many retirees. Today, nearly 70 million people receive Social Security benefits. The majority of beneficiaries are age 65 and older.

Some of the changes slated for 2022 could impact an individual’s income or overall financial plan. Retirees who continue to work need to be mindful of their earnings as they relate to their Social Security benefits. Among current workers, freelance or contract workers need to pay particular attention to the new tax thresholds. In general, freelance workers are responsible for paying their own Medicare and Social Security payroll taxes. It’s important to meet with a financial advisor to keep a tax and income-planning strategy on track.

The SSA has released a fact sheet with the highlights of changes for 2022.

To learn more about Social Security claiming strategies and how benefits can play a role in your overall financial plan, read Putnam’s investor education piece, “Five things you need to know about optimizing Social Security.”

327716

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.