While Congress has failed to pass comprehensive tax and spending legislation so far, there are discussions among lawmakers looking to re-group and consider a scaled-back alternative.

In November, the House passed the Build Back Better Act of 2021 but efforts to advance the bill stalled in the Senate. If lawmakers decide to prioritize a few spending initiatives (for example, green energy tax credits, funding for universal pre-K, or increased subsidies for Affordable Care Act premiums) then offsetting revenue sources — including tax increases — will be needed.

One provision under consideration would increase taxes on certain pass-through businesses. Specifically, the existing 3.8% surtax would be expanded to apply to net investment income derived in the ordinary course of a trade or business (i.e., “active” business income).* Since its inception as part of the Affordable Care Act, the 3.8% surtax has applied to passive business or partnership income, and excluded active business income. Under consideration is an expanded 3.8% surtax that would apply once modified adjusted gross income exceeds $400,000 ($500,000 for married couples filing a joint tax return). This new provision would raise significant revenue — approximately $250 billion over the next 10 years, according to the Joint Committee on Taxation (JCT).

*The proposal would ensure that all pass-through business income of higher-income taxpayers is subject to either the net investment income tax (NIIT) or self-employment tax.

Impact of tax hike on business owners

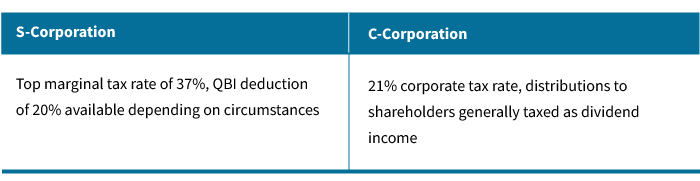

For higher-income S-Corp business owners, the addition of a 3.8% surtax on net business income would increase their top marginal tax rate to over 40%. While some business owners can take advantage of the 20% deduction on qualified business income (QBI), this deduction can be reduced or fully phased out depending on the circumstances. Additionally, the 20% QBI deduction expires at the end of 2025, resulting in a tax hike for pass-through business owners who are currently claiming it.

Current tax comparison

Does a conversion to a C-Corp make sense?

Due to the sunset clause of the Tax Cuts and Jobs Act (TCJA) many provisions in the tax code expire at the end of 2025. However, the corporate tax rate will remain the same unless Congress acts. The TCJA reduced the tax rate on C-Corporations from 35% to 21%. If S-Corp owners face higher taxes on pass-through business income, will it make sense to convert their S-Corp to a C-Corp in favor of the lower 21% tax rate on corporate income? While the statutory tax rate for C-Corps is much lower than the top rate applying to S-Corps, there are some key considerations.

- In general, the process to revoke an S-Corp election and convert to a C-Corp should follow certain steps outlined by the IRS (see IRS instructions.)

- The business may have to adjust its accounting practices. An S-Corp converting to a C-Corp is generally required to change from the cash method to the accrual method

- While the statutory tax rate for C-Corps is relatively low at 21%, earnings from a C-Corp are subject to double taxation. These earnings are taxed first at the corporate level and then again at the individual shareholder level when distributed as dividends

- Depending on the timing of the conversion, the business may have to file two tax returns for the year†

- Once an S-Corp is converted to a C-Corp, the option to elect S-Corp status again is typically not available for the next five years

- Some states may impose taxes on C-Corps that would discourage pass-through business owners from converting

- S-Corp owners may access a personal tax benefit from business losses such as individual net operating losses (NOLs), which may be used to offset a portion of household taxable income

† If revoking S-Corp status to be effective the first day of the tax year, the revocation is due by the 16th day of the third month of the tax year.

Other benefits a C-Corp may provide

- There may be other benefits afforded to C-Corps including preferential treatment upon the sale of Qualified Small Business Stock (QSBS) under IRC §1202, ability to issue preferred stock, more flexibility to raise capital, and more favorable tax rules for offering employer-provided benefits

- Unlike C-Corps, S-Corps are limited to no more than 100 shareholders who must be U.S. citizens/residents

A conversion requires careful consideration

The decision to revoke S-Corp status and convert a business to a C-Corp is very complex and requires careful legal and tax analysis. There may be adverse tax issues associated with the conversion that could be averted by keeping the current business structure.

329616

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.