The bipartisan SECURE 2.0 Act became law in late 2022 as Congress passed the legislation as part of a larger spending bill.

The new policy changes strengthen the retirement system and pave the way for savers to enhance their retirement savings plans.

Our latest piece, “SECURE 2.0: Key provisions & planning considerations,” offers a detailed look at the key provisions that will have an impact on financial and retirement planning. In addition, we examine strategies and cite planning considerations that result from the changes.

SECURE 2.0 builds on the original SECURE Act (Setting Every Community Up for Retirement Enhancement Act of 2019) that expanded access to retirement accounts, promoted participation, and preserved savings.

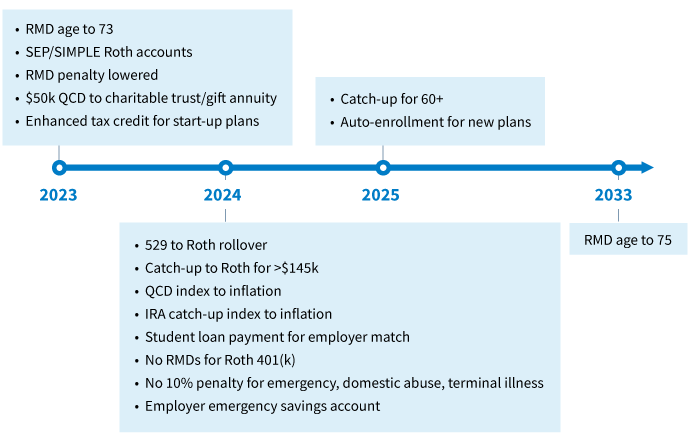

Provisions roll out over time

While some changes will take effect in 2023, many will be phased in over the next few years.

Sources: Consolidated Appropriations Act, 2023, Division T; SECURE Act of 2022, Senate Finance Committee; SECURE 2.0 Section by Section summary. Based on current interpretation of the legislation, subject to change.

Impact on planning

The law seeks to enhance retirement savings across a range of account types. From IRAs to 401(k) plans, changes will be introduced impacting how people save and distribute retirement funds. Savers may also have the potential to improve savings and achieve tax efficiency.

Here are some considerations for planning as a result of the new law:

- IRA owners benefiting from the increase in the RMD age may consider using the “extra” years available before RMDs apply to donate funds to charities using QCDs (beginning at age 70½) or make Roth IRA conversions

- Plan participants aged 60 and older can consider making additional catch-up contributions (available beginning in 2025)

- Plan participants in lower tax brackets may want to consider directing employer-matching contributions into a designated Roth account

- Parents and grandparents may consider overfunding 529 accounts knowing that unused amounts (up to $35,000) could provide a way to jump start retirement savings into a Roth IRA for 529 beneficiaries

- Business owners who are not sponsoring a retirement plan should consider taking advantage of the enhanced tax credits available to establish a new plan

For more details on the provisions and the impact on a range of planning actions, read, “SECURE 2.0: Key provisions & planning considerations.”

332531

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.