The Congressional Budget Office (CBO) recently released its latest analysis of the federal government’s finances. While the annual budget deficit will not rival levels realized during peak Covid years, the CBO projects a $1.4 trillion deficit for 2023. By comparison, almost $6 trillion in total debt was added to the government’s balance sheet over 2020 and 2021.

Absent any major action by Congress, budget deficits are expected to persist. In fact, government spending as a percentage of GDP (23.7%) easily outpaces revenue (18.3 % of GDP). Also, higher interest rates are increasing the cost of servicing the existing debt. At some point, the debt trajectory will drive discussions on Capitol Hill to increase revenue (i.e., raise taxes), reduce certain government benefits, or, most likely, do both. Investors who have contemplated and planned for these potential risks will be better prepared to meet these headwinds in the future.

Here are some notable observations from the report:

Total debt headed for record levels

Source: Congressional Budget Office, The Budget and Economic Outlook: 2023 to 2033, February 15, 2023.

The high-water mark for government debt as a percentage of the overall economy occurred in 1946 as debt held by the public reached 106% of GDP. Current CBO estimates suggest we will exceed that level beginning in 2028 and eventually reach 118% of GDP by 2033. This assumes that the Tax Cuts and Jobs Act (TCJA) expires as scheduled at the end of 2025. According to recent analysis, an extension of the TCJA through the end of 2032 would increase government outlays by $2.7 trillion. Given these circumstances, extending the current tax rates and provisions will be challenging regardless of which political party controls Congress.

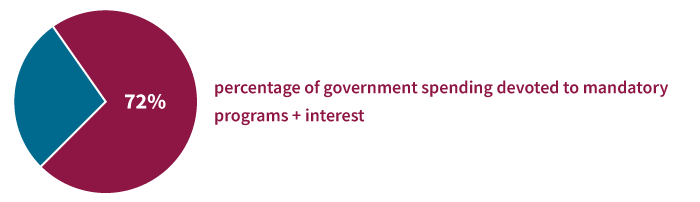

Most government spending is on autopilot

House Republicans are proposing controls on spending as part of the negotiation to raise the debt ceiling. While details are scant at this time, House leadership has declared cuts to entitlement programs as off-limits. The reality is that over 70% of government spending is driven by a combination of large benefit programs like Social Security and Medicare, as well as interest costs on the existing debt. Social Security is the most expensive of these programs with an annual price tag of $1.3 trillion. (Medicare spending is roughly $1 trillion.) Due to rising interest rates, the cost of servicing existing debt is the fastest-growing spending component. For 2023, it’s expected to reach $640 billion, a 35% increase from last year.

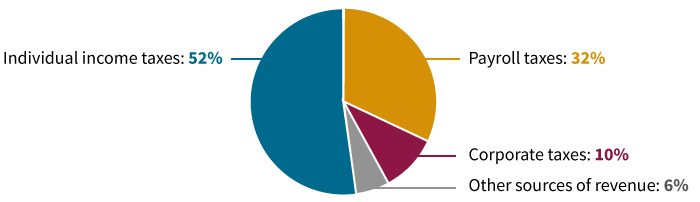

Revenue is driven largely by individual taxes

The federal government overwhelmingly relies on individual taxpayers to fund its operations. More than half of all government revenue comes from taxes on individuals (taxes on employment, capital gains, dividends, interest, etc.). Payroll taxes are also a major source of revenue, generally split by individual workers and their employers. Given these considerations, it is reasonable to suggest that individual taxpayers will bear a significant burden on any federal government attempts to raise revenue.

Planning for an uncertain future

Given the current state of government debt and looming solvency issues with major entitlement programs, it’s reasonable to conclude that revenue needs will lead to tax increases. Whether these will be limited to higher-income taxpayers remains to be seen. For example, many Biden administration proposals have proposed raising taxes on those with income levels exceeding $400,000. However, it may be challenging to generate enough revenue from this small segment of taxpayers. As a result, many taxpayers should consider incremental steps to improve tax diversification. That is, owning assets across different tax buckets (taxable, tax-deferred, and tax-free). Partial Roth IRA conversions, backdoor Roth contributions, health savings accounts (HSAs), and other tax-favored strategies can help hedge the risk of higher taxes in the future. A professional advisor can help develop a personalized plan based on unique circumstances.

Sources: Congressional Budget Office, The Budget and Economic Outlook: 2023 to 2033, February 15, 2023; The Budget and Economic Outlook: 2022 to 2032, May 22, 2022.

333054

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.