President-elect Trump's economic priorities

President-elect Donald J. Trump's goals for changing taxes and spending, if approved by Congress, could provide stimulus to the economy and add to the national debt, according to some third-party projections.

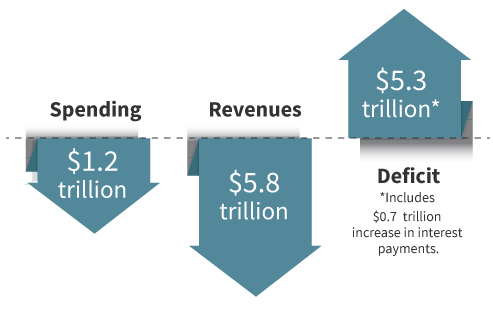

Trump's proposed budget ideas would slash spending and expand the nation's deficit substantially if projected over the coming decade.

Source: Committee for a Responsible Federal Budget. Estimates as of September 22, 2016.

Trump's plan favors a supply-side approach that expects to generate higher GDP growth by using tax cuts to increase the spending power of businesses and consumers.

Source: donaldjtrump.com

Taxes to be eliminated

- Alternative minimum tax

- Estate and gift taxes

- Obamacare Medicare surcharge

Taxes to be reduced

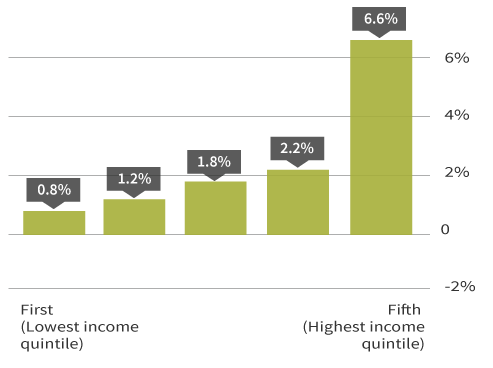

Individual income tax ratesIf Trump's tax plans were enacted for 2017, taxpayers across the lower four quintiles could see an estimated 1% to 2% increase in after-tax income next year, while the highest income level could experience an estimated 6.6% average increase, according to projections.

Source: Tax Policy Center of the Urban Institute & Brookings Institution. Estimates as of October 18, 2016.

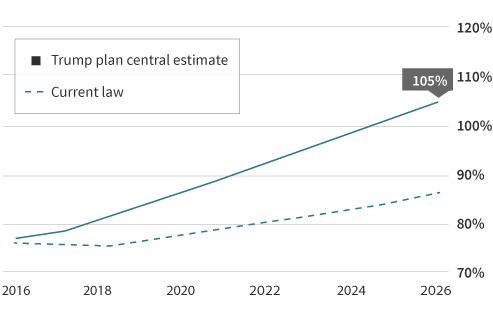

The federal debt is expected to continue to increase, with Trump's plan potentially pushing debt to 105% of current projected GDP over the next decade according to the Committee for a Responsible Federal Budget, a bipartisan think tank, although estimates vary.

Source: Committee for a Responsible Federal Budget. Estimates as of September 22, 2016.