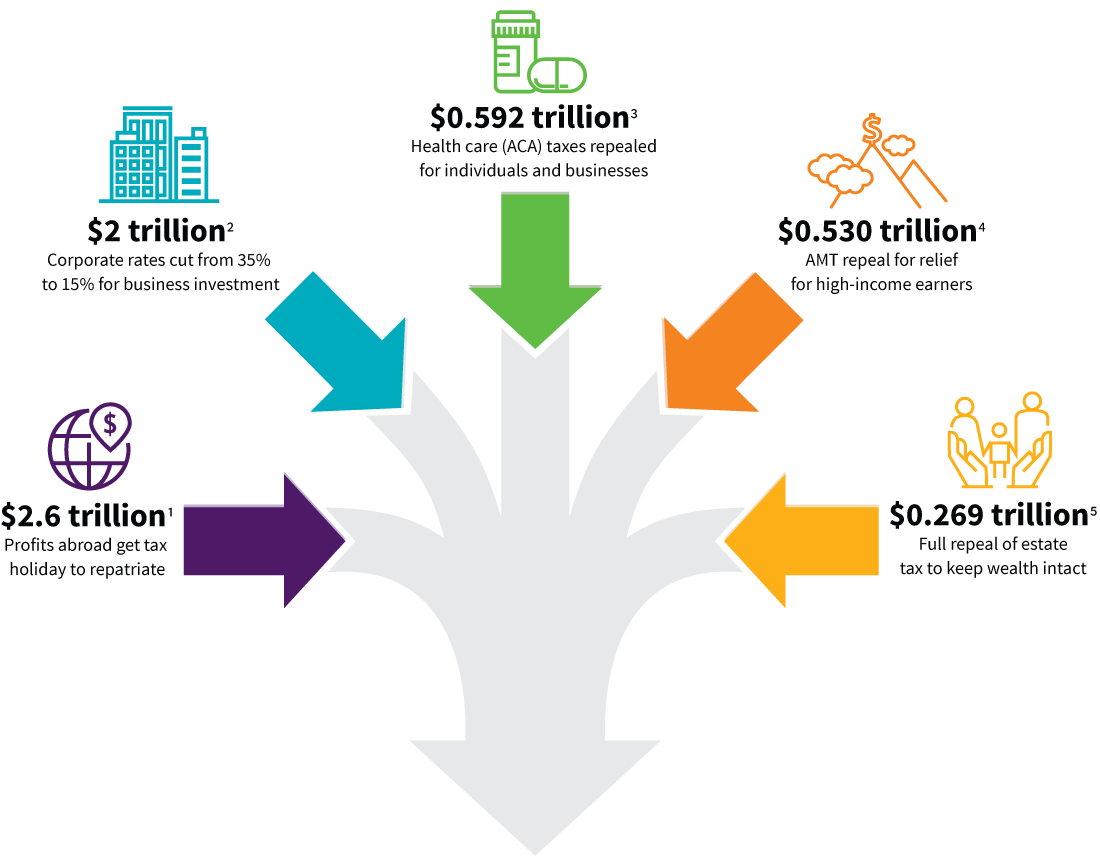

Taxes on the table

The Administration has ambitious ideas to cut taxes on businesses, wealth, and income. Big tax overhauls typically take time to achieve as Washington interest groups square off to shape reform in their favor.

Below are some of the taxes and numbers that might make headlines.

Will it help the economy?

Currently, federal taxes represent more than 17% of GDP. Cutting taxes would put more money in the hands of businesses and consumers, but the ultimate impact on GDP growth depends on whether they spend it or save it.

When do you think tax cuts will lift GDP growth?

Joint Committee on Taxation.

Center on Budget and Policy Priorities, 10-year projection based on Trump Administration April 2017 tax plan.

Congressional Budget Office, estimate of tax revenue reductions in 2017–2026 as a result of repealing many revenue-related provisions of the Affordable Care Act.

Tax Policy Center, estimate of 2017–2027 AMT revenues.

Joint Committee on Taxation 2015 study, estimated estate tax revenues 2016–2025.