Although Medicare is one of the most important health-care resources available for those 65 and older, many seniors find it confusing to navigate the program.

A review of Medicare’s basic elements can help individuals develop a better understanding before enrolling in the program.

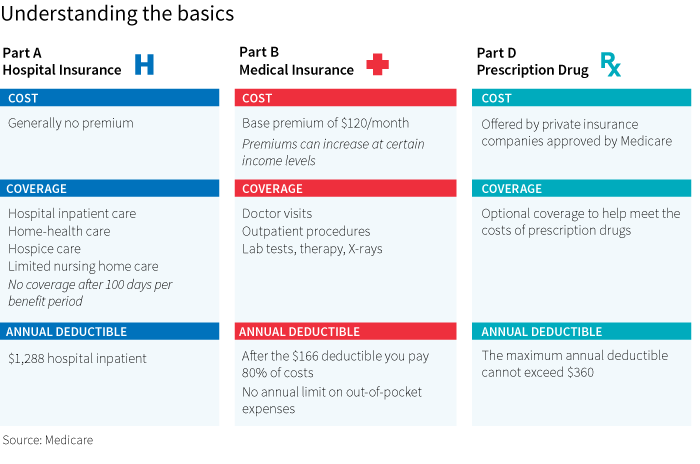

The following chart illustrates the differences among the three basic parts of Medicare coverage.

Pay attention to enrollment timetables

To avoid penalties and gaps in coverage, individuals need to enroll at specific times. Most people should consider enrolling during the initial enrollment period, which is the 7-month period around their 65th birthday. If they file during the first three months, coverage begins on the first day of their birth month. If they file during their birth month, coverage will begin the next month. Filing anytime during the final three months of this period means coverage does not begin until two months later.

Those already receiving Social Security benefits are automatically enrolled in Part A and Part B, beginning the first day of the month they turn 65.

If they were not automatically enrolled and missed their initial enrollment period, they can still apply for Medicare part A and Part B during the general enrollment period, which runs from January 1 to March 31 every year. Coverage would then begin in July.

Special enrollment period

A special enrollment period exists for individuals covered under a group health plan based on current employment. This enrollment period is only available if individuals work for a company with more than 20 employees. The eight-month special enrollment period begins the month after employment ends or the group health-plan insurance ends, whichever happens first.

Avoiding penalties for missed deadlines

Late-fee penalties are levied if retirees do not sign up when enrollment is available, including a 10% increase in the monthly premium for each full 12-month period that coverage could have been obtained. Although the Part B premium amount is based on income, the penalty is calculated based on the standard Part B premium, regardless of income.

For more details on Medicare basics, read Putnam’s education article, “Three key things to understand about Medicare.”

300801

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.