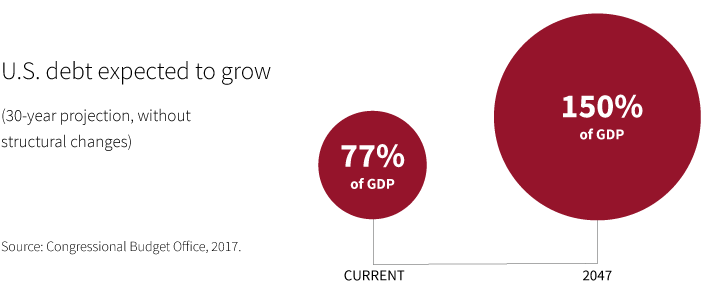

The federal debt is at its highest level in decades and could double in the next 30 years without structural changes.

As lawmakers create new budget proposals and try to reduce the deficit, they will likely focus on sources of revenue, including taxes.

While impossible to predict future of tax policy, investors may want to include tax-efficient planning and tax diversification strategies as a basis for their financial plans.

Government debt continues to grow

In its recent report on federal finances, “The 2017 Long-Term Budget Outlook,” the Congressional Budget Office noted that total federal debt is about 77% of total GDP, marking its highest level since the end of World War II.

What is driving the debt?

From 2009 through 2012, annual federal deficits exceeded $1 trillion as a result of the Great Recession.

Today, the United States is experiencing a modest economic recovery with an improving job market. However, several factors continue to drive up the debt, including entitlement programs.

- The cost of Medicare is on the rise, considering the aging population and the rise in health-care cost inflation. Medicare costs are expected to rise 60% over the next 30 years, from 5.5% of GDP to 8.8% of GDP in 2047.

- Social Security is another driver of debt. Currently about 15% of the population is age 65 and older. Many baby boomers are retiring and beginning to collect Social Security benefits. By 2047, Americans over the age of 65 are projected to comprise 22% of the population. Social Security costs are projected to rise 30%, from 4.9% of GDP to 6.4% of GDP.

- The fastest-growing factor driving debt is likely rising interest payments. As interest rates normalize, the amount the government project to pay in interest payments will increase from about 1.4% of GDP to more than 5.0% of GDP in 30 years —a 250% increase.

At the same time, government revenues, from taxes and other sources, are projected to rise only 8%, from 17.89% of GDP to 19.3% of GDP.

Plan early with tax strategies

While the rising debt is a challenge, the CBO notes these are projections. Alternative economic scenarios and policy changes could cause significantly different outcomes.

Still, given the state of the federal government’s finances it is important for investors to factor in the potential impact on their financial situation. For example, some members of Congress have introduced proposals to reform Social Security, and others have introduced ideas to rein in Medicare costs.

Long-term planning considerations may include:

- Increasing retirement savings because of the potential for reduced Social Security benefits in the future.

- Funding a Health Savings Account (HSA) or other savings account to devote to health-care expenses. HSAs can provide a tax-free account in retirement for medical expenses. This can be an important strategy in the event of changes or reductions in Medicare benefits.

- Using a tax diversification strategy. With rising federal budget deficits, it is possible that Congress will look for more revenue through tax increases in the future. Having a plan with varying accounts that are diverse based on tax status may provide investors with more options for tax planning.

306312

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.