In its 2017 report on college savings, Sallie Mae found that nearly 90% of families surveyed said they knew their child would attend college as early as their enrollment in preschool. Considering the many responsibilities competing for savings, it’s never too early to include college savings as part of a financial plan.

Starting early allows savings to benefit from compounding over time. Establishing an account early allows savings to be invested over the course of multiple market cycles, giving assets time to grow and weather market swings. If parents choose a 529 plan, they may select a growth-focused strategy early to take advantage of a long time horizon. Adding to a 529 plan in the later high school years means fewer years of tax-free growth. There are several types of accounts that parents may use to save for college.

Here are some considerations for starting to save.

Start saving with a 529 plan. Parents can establish a 529 plan even before the baby is born by using their Social Security number and naming the child as a beneficiary at a later date.

- Starting early allows the account to grow with the benefit of compounding.

- Parents may also choose an aggressive growth option to start.

- Account minimums are typically low.

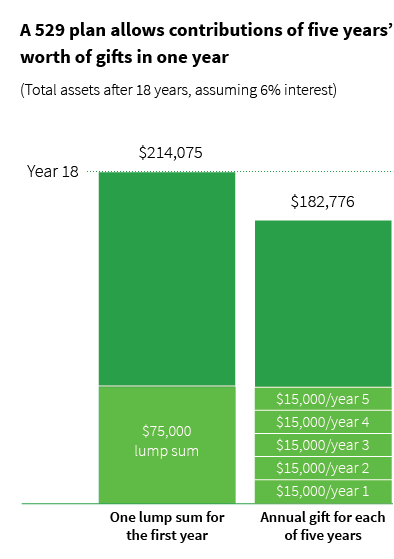

Consider contributing five years’ worth of gifts at once. A provision unique to the 529 plan allows contributions equal to five years’ worth of gifts in a single year without triggering the federal gift tax.

- Encourage grandparents and other family members to contribute as a baby gift.

- Grandparents can also open accounts for their grandchildren so the child can have multiple 529 accounts.

- The 2018 gifting limit is $15,000 annually for an individual ($30,000 for a married couple).

Consider the following example comparing a five-year lump sum gift versus contributing $15,000 annually for five years. Assuming a 6% growth rate, the lump sum yields more.

Consider various types of savings vehicles. Parents may want to consider a prepaid tuition plan from a well-regarded in-state school.

- An in-state tuition plan locks in the price of college and is not subject to market swings. If a child attends an out-of-state school, however, they won’t receive the full value of the plan. But if there are multiple children in the family, the account can be rolled over to a child who decides to attend an in-state school. Public and private institutions are both eligible.

- Parents may also consider saving in a Roth IRA. The withdrawal of earnings for higher education expenses are not subject to an early withdrawal penalty.

- A custodial UGMA/UTMA account may be used for non-qualified 529 plan expenses. These accounts automatically transfer ownership to the child at the age of majority, depending on the state of residence.

Seek advice for using a 529 plan for K-12. The Tax Cuts and Jobs Act expanded eligible uses of 529 plan assets to include K-12 tuition expenses. Parents may distribute up to $10,000 per year per child under this provision. A parent considering sending their child to a private school may want to weigh this option with a financial advisor.

Be mindful of overall planning with a growing family.

- Establish a will/trust and a health-care proxy.

- Make changes to beneficiaries on insurance and medical plans.

Having a plan is important

According to a Sallie Mae report, more than one-third of families have a plan to pay for all years of college, Sallie Mae reported. In the study, parents who always knew their child would go to college are more likely to have a plan, compared with those who made a decision about college later. Students from families without a plan are more likely to use federal student loans and less likely to receive income and savings from a 529 plan.

Parents need to remain mindful of other financial demands, including mortgage debt and saving for retirement. Keeping up with these strategies can sometimes be challenging, and it may be helpful to seek professional advice to develop a comprehensive financial plan that includes college savings.

For more information on saving for college and planning strategies, read Putnam’s investor education piece, “Early college planning for a growing family.”

311472

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.