- Tax reform changes how businesses handle a net operating loss (NOL)

- New limits apply for “excess business losses”

- Taxpayers may consider a Roth conversion to offset a business loss

Business owners may want to review their tax filing strategies as the Tax Cuts and Jobs Act (TCJA) made some significant changes to the rules for managing net operating losses.

A net operating loss (NOL) may occur during tax a year in which business deductions exceed income, with the result being negative income. Historically, taxpayers could apply the NOL deduction to prior tax returns — a move known as a “carryback” — going as far back as two years, and in some cases five years. Taxpayers could also apply the loss to future tax returns — which is termed a “carryforward” — for up to 20 years.

The TCJA made some key changes to NOLs:

- Beginning in 2018, taxpayers are no longer able to carry back NOLs, but instead, may carry forward NOLs for an unlimited number of years

- Taxpayers can deduct NOLs in amounts no greater than 80% of taxable income in that year (instead of 100% of taxable income as allowed previously)

- New limits are imposed on deducting “excess business losses”

Also, business owners are restricted from deducting business losses in excess of $250,000 per taxpayer (individuals) or $500,000 (married couples filing a joint return). Business losses above this limit must be carried forward to the following tax year. This new limit applies to businesses other than C corporations from 2018 through 2025.

Apply a Roth IRA conversion to an NOL deduction

Unlike net capital losses, where taxpayers are limited to $3,000 annually for taxpayers to offset any ordinary income, there are fewer restrictions on how an NOL can be used to offset ordinary income. For example, taxpayers carrying forward NOLs may use those losses to offset a portion of additional income from a Roth IRA conversion.

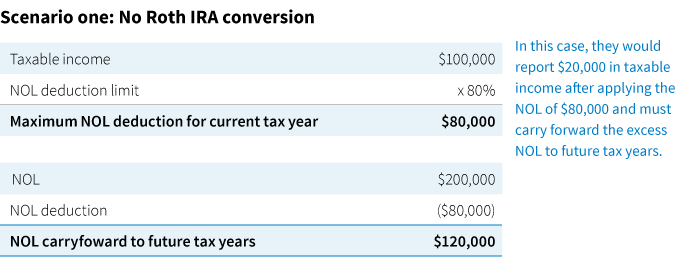

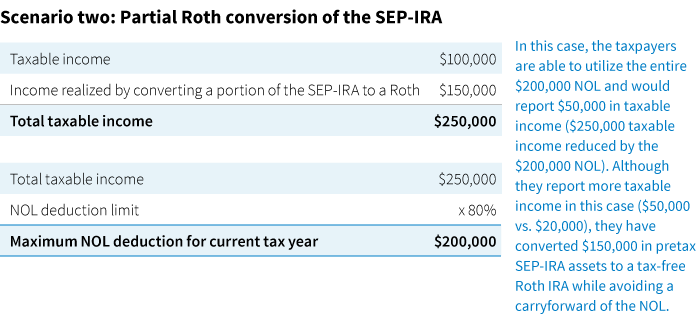

Consider this example:

- John is a sole proprietor reporting an NOL of $200,000 after figuring business income and losses on Schedule C

- He also owns a SEP-IRA with a current value of $500,000

- John and his spouse report $100,000 in taxable income from her employment earnings and income from investment accounts

- As a result of the new rules, John and his spouse must carry forward any unused NOL deductions and are limited to offsetting 80% of their taxable income

What if John converted $150,000 of his SEP-IRA to utilize the entire NOL deduction for the current tax year instead of having to carry it forward?

Consult with a tax professional

Rules for calculating and utilizing NOLs are complicated and require expertise from as qualified tax professional. For additional information, refer to Putnam’s investor education piece, “Transform a net operating loss into a tax-free Roth IRA.” For additional information on NOLs refer to IRS Publication 536, Net Operating Losses (NOLs) for Individuals, Estates, and Trusts.

314082

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.