Business owners planning for succession face a complex array of challenges and issues. One key challenge for many is how to efficiently transfer business interests from one generation to the next. One planning strategy — an Intentionally Defective Grantor Trust (IDGT) — may help owners transfer wealth to other family members during their lifetime in a tax-efficient manner.

Why is the trust defective?

The trust is called “defective” because it is drafted in a way that the grantor is considered an owner of the trust for income tax purposes, but not for estate taxes.

In order to accomplish this designation, the trust would need one or more provisions that violate the grantor trust rules under IRC § 671–679. For example, if the grantor retains certain administrative powers over the trust, keeps some rights to borrow from the trust, or maintains a reversionary interest (the ability to regain ownership of property). By including any of these provisions, the trust would be considered a grantor trust for income tax purposes.

As a result, the Internal Revenue Service would not consider the trust a separate (income) taxable entity. Instead, the grantor is responsible for any income taxes generated by the assets held in the trust. For estate taxes, assets transferred to a grantor trust are considered removed from the estate of the grantor and held in the trust.

Using a defective trust in succession planning

Typically, a business owner would utilize an installment sale strategy to transfer their business interests to the trust.

Since the trust is not considered a taxable entity by the IRS, the transfer of ownership interest is not considered a taxable event. For example, there would be no capital gains tax due on the transfer of the business interest to the IDGT.

Business interest is transferred in exchange for a long-term promissory note. The business owner/grantor receives a promissory note for fair market value of the property sold. This acts as an “estate freeze” since future appreciation on the property sold to the trust is removed from the grantor’s estate.

The interest rate on the promissory note is based on prevailing IRS interest rates.

This strategy allows for an income tax-free installment sale of property (with appreciation potential) to be made to a trust whose beneficiaries are the heirs of the business owner.

In a typical IDGT structure, a nominal gift of 10% of the property transferred is made to the trust when executed. This is referred to as a “seed gift,” and is based on the concept that in a typical property sale, a down payment would be made.

Sale of a family’s business interest to an IDGT

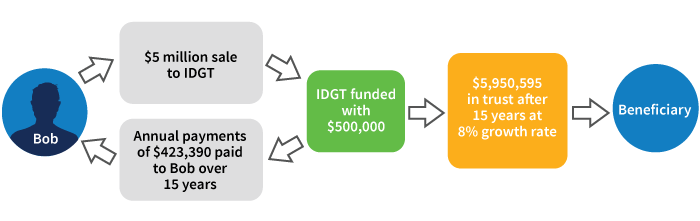

- Bob, the business owner, sells his limited partnership interest to an IDGT for $5 million

- The IDGT is funded with seed capital of $500,000

- There is no capital gain generated on the sale to an IDGT since it is a grantor trust

- The sale includes a 15-year note at 3.15% (AFR rate, January 2019*)

- The IDGT pays Bob approximately $400,000 annually for the term of the note

- Assuming the trust assets grow at 8%, at the end of 15 years, more than $5 million would be transferred without any estate or gift taxes to the trust’s beneficiaries

Seek expert guidance

The IDGT strategy may be useful when succession planning involves a family business and beneficiaries who are family members. The trust must be carefully written to meet the IDGT guidelines. Investors need expert financial and legal advice before employing this strategy.

* IRS Rev. Rul. 2019–03.

317169

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.