As the federal budget deficit rises, so does the likelihood that income taxes will rise.

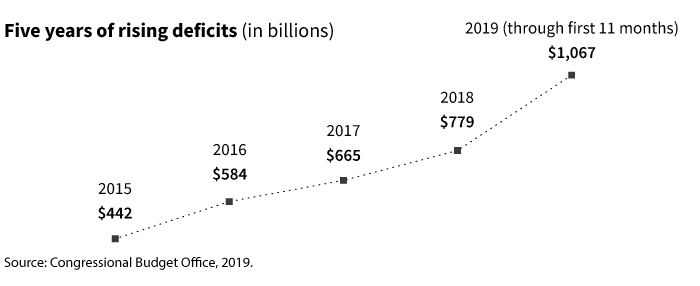

For the first 11 months of fiscal year 2019, the budget deficit exceeded $1 trillion, according to the Congressional Budget Office.

The last time the annual budget deficit exceeded $1 trillion was in 2012.

On the spending side, outlays rose 7% during the same period. This included a 6% increase in spending for the largest mandatory programs, including Social Security, Medicare, and Medicaid.

Current projections indicate that additional funding will be needed to meet obligations in these programs. In their 2019 report, the Social Security Administration Trustees noted that Social Security trust funds are projected to be depleted in 2035. Retirees will still be paid, but they may see a 25% reduction in benefit. Medicare is projected to be insolvent in 2026.

Given the rising deficit and long-term outlook for Social Security and Medicare, it is more likely that tax rates will rise in the future.

Another consideration are the sunset provisions in the Tax Cuts and Jobs Act (TCJA), which could facilitate a tax rate increase. Individual tax rates set by the 2017 law are set to expire at the end of 2025. These laws could also be subject to congressional action prior to the expiration date.

Strategies to prepare for higher tax rates

Investors may want to consider several strategies to hedge against the potential for higher taxes in the future.

Use Roth IRAs to create diversification

- Consider increasing contributions to a Roth IRA or Roth 401(k). Retirement plans offering a Roth option allow contributions via salary deferral into a Roth 401(k) of $19,000 a year (plus an additional $6,000 for those age 50 and older).

- Determine your marginal tax bracket before the end of the year and consider a Roth IRA conversion. The idea here is to “fill up” the remaining room left in your tax bracket with additional income from a Roth IRA conversion. For example, an individual taxpayer with projected taxable income in 2019 of $140,000 could conceivably convert roughly $20,000 of an Traditional IRA to a Roth and still be subject to the 24% marginal tax bracket. Any additional income would be taxed at the much higher 32% marginal tax bracket. These funds (and subsequent appreciation) could be withdrawn tax free in the future.

Additional Roth strategies

• A “backdoor” Roth IRA contribution

High earners may not be able to contribute to a Roth IRA due to income limits. Instead, investors could fund a non-deductible IRA and then convert it to a Roth IRA. Because the non-deductible IRA is funded with after-tax funds, these funds are not taxed upon conversion. Only subsequent earnings would be taxable on a conversion. Note that this strategy does not work well if the investor owns other pre-tax, IRA funds. This is because of a pro rata rule that applies to the taxation of Roth conversions where the individual owns a mix of after-tax and pre-tax IRA funds. Every dollar that is converted to a Roth IRA will consist of a pro rata portion of pre-tax and after-tax dollars when figuring the taxes due. That is, an individual cannot choose to convert only the after-tax IRA funds solely to a Roth IRA.

• A “mega backdoor” Roth utilizing after-tax 401(k) contributions

If an investor’s 401(k) plan allows for after-tax contributions, there may be an opportunity to steer significant contributions to a Roth IRA, regardless of the participant’s income level. See the article, “How to use a 401(k) to fund a Roth IRA.”

• Business owners with specific tax circumstances

Small-business owners who operate as pass-through entities may take advantage of a net operating loss (NOL) to support a Roth conversion strategy. Under the TCJA, taxpayers may deduct NOLs of up to 80% of their taxable income for that year and carry forward the remainder. For taxpayers carrying forward a NOL, the loss may be used to offset a significant portion of additional income from a Roth IRA conversion.

Planning for the future

When Congress considers how to pay for government, they will likely discuss raising revenue to meet debt obligations. One area that is often targeted is income taxes. It is important to note that Roth IRA conversions can no longer be reversed under the TCJA. It is important to discuss tax strategies with a tax and financial advisor to determine if it is appropriate for an overall financial plan.

318587

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.