Much is shifting across the higher education landscape. Distance learning has become the new norm for many students, at least temporarily, due to the pandemic.

Uncertainty also persists in the near term. Prospective students are considering how and where to apply to colleges, while returning students are trying to understand the logistics of getting back to classes in the fall.

Some things continue to improve, including the value of a college education.

A degree can enhance careers and health

The value of earning a college degree can mean different things to individuals. In an effort to quantify the return on investment of a college education, the College Board began studying this issue in recent years.

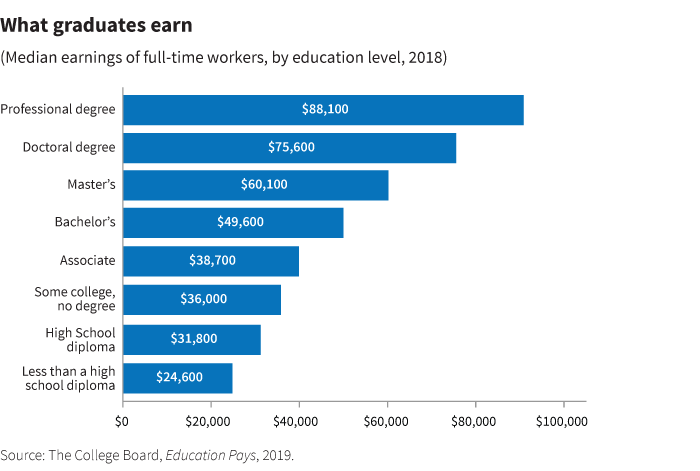

In its 2019 report, “Education Pays 2019: The Benefits of Higher Education for Individuals and Society,” The College Board found that for individuals with a college degree, the unemployment rate was lower, average income was higher, and lifestyles were healthier compared with their peers without a degree.

Earnings power

Most families realize that college graduates on average earn more money in the workplace than individuals without college degrees. In 2018, median earnings of full-time workers with associate and bachelor’s degrees were 24% and 61% higher (respectively) than the earnings of high school graduates. People with advanced degrees could command even higher salaries. Consider the range. For example, among high earners — full-time workers age 35 to 44 earning $100,000 or more in 2018 — 2% did not have a high school diploma, 5% were high school graduates, 28% held a bachelor’s degree, and 43% had advanced degrees.

Job prospects tend to improve as well. In 2018, 83% of adults with bachelor’s degrees or higher were working, compared with 69% of high school grads. The unemployment rate for workers with a college degree has remained steady at about half the rate for high school graduates. The report noted that the unemployment rate for those with a bachelor’s degree was 2.2%, compared with 5.7% for high school grads.

Impact on health

The College Board looked at other measures of value. The report noted that individuals with college degrees tend to have greater access to health care and retirement plans. Data point to healthier lifestyles and increased civic engagement. Voting rates, for example, were higher (73%) among those with a degree, compared with high school grads (41%).

Another area that proved consistent was the rising cost of college. The cost of tuition and fees and room and board has risen 2.2% above inflation each year in the last decade. Saving can become increasingly challenging for many families.

Saving for college

While saving for college can be challenging at any time, it is particularly so in this period of economic crisis. Some families may not be able to save as much as they typically could due to job losses or reduced work hours.

It’s important to consult with an advisor when creating a long-term plan. Using tax-advantaged accounts such as 529 college savings plans may help families stay on track and save more in the long run. A 529 plan, for example, allows families to save and earn interest tax free. When it’s time to start college, distributions are made free of taxes, provided the funds are used for qualified expenses.

Just as important as saving is having a plan for spending down college savings when the tuition bills are due . It’s never too early to start thinking about college planning. For more information on savings strategies, read Putnam’s investor education piece, “Strategies to make the most of college savings.”

Learn about the advantages of a Putnam 529 for America account and how it may help families reach their college savings goals.

321833

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.