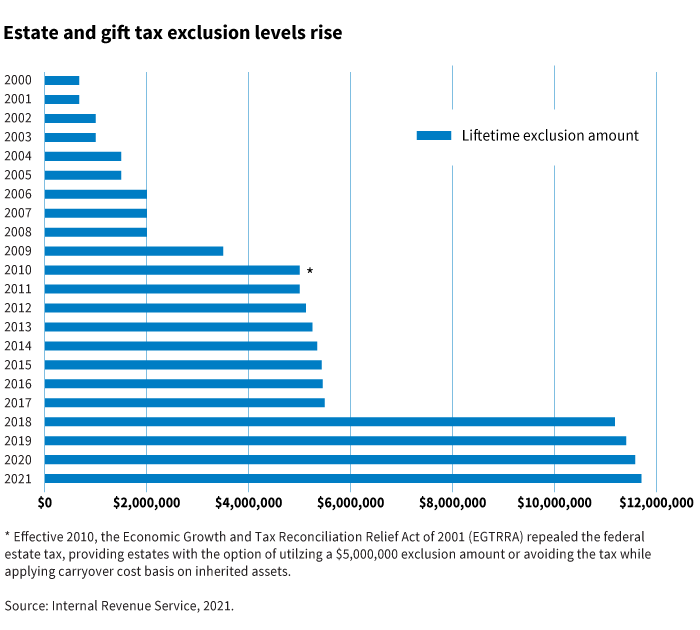

The Tax Cuts and Jobs Act (TCJA) created higher exemption levels for federal estate and gift taxes that could change in a few years, if not sooner.

Provisions within the TCJA impacting federal gift and estate taxes will sunset after 2025. If Congress does not take action before then, federal gift and estate tax law will generally revert to rules in place in 2017. In that case, exemption levels will be reduced and more estates could be subject to federal taxes.

While the current tax environment may be favorable, it is not too early to consider tax-efficient planning strategies.

1. Review estate planning documents and strategies

The increase in the lifetime exclusion amount for gifts and estates ($11.7 million per individual in 2021) may have unintended consequences for some individuals and families with wealth under that threshold. They may think that they do not have to plan for their estate. However, taxes are just one facet of estate planning. It is still critical to plan for an orderly transfer of assets or for unforeseen circumstances such as incapacitation. Strategies to consider include proper beneficiary designations on retirement accounts and insurance contracts, wills, powers of attorney, health-care directives, and revocable trusts. Additionally, existing trusts should be reviewed to determine if changes are needed as a result of the recent tax law changes.

2. Plan for potential state estate taxes

While much attention is focused on the federal estate tax, certain residents need to know that many states have estate or inheritance taxes. There are a number of states that are “decoupled” from the federal estate tax system. This means the state applies different tax rates or exemption amounts. A taxpayer may have net worth that is well below the $11.7 million exemption amount for federal estate taxes, but that also may be well above the exemption amount for his or her particular state. It is important to consult with an attorney on specific state law and potential options to mitigate state estate or inheritance taxes, such as utilizing permanent life insurance to provide liquidity at death.

3. Develop a strategy for low cost-basis assets

Ensure stepped-up cost basis is maintained when property is transferred at death. For example, careful consideration should be made around lifetime gifts that may jeopardize a step-up in cost basis on property at death. When property is gifted, the party receiving the gift generally assumes the original cost basis. Additionally, certain trust provisions may be utilized to ensure that property receives a step-up in cost basis at death.

Estate planning remains critical

While most estates will fall below the current exemption level, this does not mean that only individuals and families with significant wealth need to focus on estate planning. Proper estate planning extends beyond minimizing or preparing for federal estate taxes. An estate plan is critical for investors to ensure an orderly transition of wealth to heirs or charities. Plans can also be used to avoid a costly probate process or address state taxes.

When considering making changes to estate or gift plans, it is important to consult a financial advisor. Individuals considering advanced strategies should work with a qualified estate planning attorney who has knowledge of their financial situation and goals. For more detail on tax-planning ideas read Putnam’s “10 income and estate planning strategies” for more information about tax-smart strategies for 2021.

324867

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.