Even in the midst of a global pandemic, the overwhelming majority of retirement plan participants kept their savings on track. The Investment Company Institute noted that in the first three quarters of 2020, only 2.2% of savers stopped contributing to their 401(k) plans.

While most participants are well served to retain savings within their employer plan for a variety of reasons (for example, lower fees, access to loans), many plans allow in-service, non-hardship distributions while still working. In fact, more than half (52%) of 401(k) plans offer in-service withdrawals (Plan Sponsor Council of America, 2019).

What is an in-service, non-hardship distribution?

Many 401(k) plans allow participants to take “inservice” withdrawals (withdrawals while currently employed) if they provide proof of hardship. Generally, those distributions must be used to pay qualified expenses, such as medical or educational costs, or to purchase a primary residence. But some 401(k) plans allow in-service, non-hardship withdrawals. This special provision allows participants to take 401(k) withdrawals — without providing proof of hardship — if they have reached age 59½ or have met the requirements specified by the plan document. These participants have the option to directly transfer savings to an IRA without penalty or withholding, assuming certain conditions are met. Transferring savings from the employer plan to an IRA may allow access to a broader range of investment choices for example.

Shifting assets out of the plan

Before implementing this type of IRA rollover, there are several considerations for investors.

- Check applicable state laws regarding protection of assets from creditors. Federal bankruptcy law protects IRA assets rolled over from qualified employer retirement plans from creditor claims in bankruptcy proceedings. But unlike 401(k) assets, which are nearly universally protected from creditor claims outside of bankruptcy as well, states protect IRA assets from creditors outside of bankruptcy to varying degrees. While many states will fully protect IRAs from creditors, others may not provide any protection or limit protection for IRAs to the amount necessary to support the account owner and dependents, which can be subjective.

- Be sure that the 401(k) plan does not offer other benefits that may be valuable but unavailable through an IRA, such as loans.

- If you hold highly appreciated, employer stock in a 401(k) plan, partial distributions may jeopardize valuable tax benefits that may be available with respect to the stock (for example, net unrealized appreciation (NUA) treatment of in-kind distributions of employer stock).

- Consult a qualified tax consultant for more information.

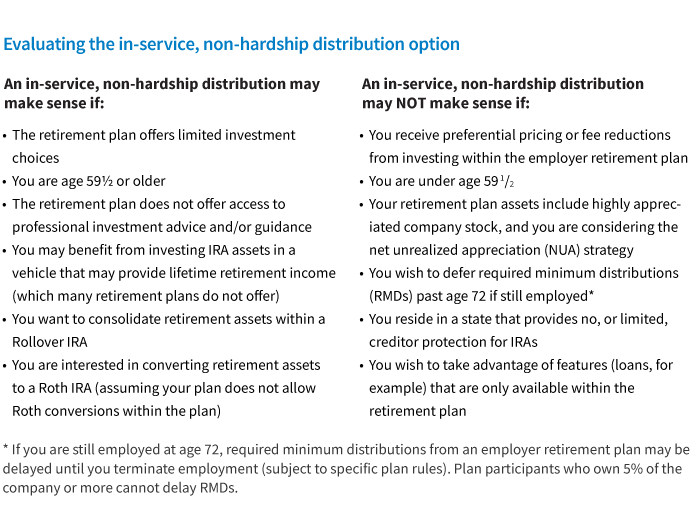

Evaluating whether an in-service, non-hardship withdrawal makes sense

Managing your retirement savings effectively

With a broad array of options available to save and plan for retirement, it’s important to determine the right option, or mix of options, based on your personal circumstances. For more information on key factors on whether to hold retirement savings within an employer plan, or transfer funds to an IRA please refer to these additional resources:

In-service, non-hardship withdrawals

When it’s time to move 401(k) assets

326037

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.