Millions of students are heading back to school this fall, and many are starting their first year of high school.

For students with college as a long-term goal, the high school years are a critical time for students, and parents, to focus more on preparing for college.

Families have many things to do during the high school years to prepare for college. Students will likely be focused on their academic performance and extracurricular activities. Parents may be focusing on savings and financing options to meet the cost of a college education.

Start with a plan

For families focused on optimizing their savings and staying on track, it’s a good idea to have an overall financial plan for college. Students will need to acquire the necessary academic credentials and build a resume for future applications.

The groundwork begins for many in the early years of high school. Putnam has developed a “Four-year action plan” to prepare for college during the high school years.

Considerations for freshman year

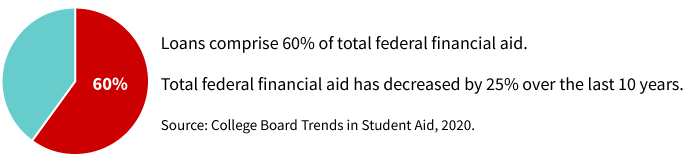

Parents, who started saving early, may already have a plan in place with a range of saving and investment options. Most families rely on a variety of sources to cover college costs. In recent years, the total amount of federal financial aid has declined, underscoring the importance of saving.

The importance of saving

Financial priorities for parents

- Increase saving in a 529 plan and encourage grandparents and other family members to get involved

- Consider allocating some savings to other accounts such as custodial UGMA/UTMA for non-qualified 529 plan college expenses, such as transportation costs

- Research the affordability of college with Putnam's college savings calculator

Action items for students

- Start thinking about your interests and what you might want to pursue later in life

- Set goals to achieve the honor roll and maintain a solid GPA throughout high school

- Participate in extracurricular activities – focus on deeper involvement in a few areas (including work) rather than sporadic participation in many different clubs or activities

- Be aware of your social media presence

- Make meaningful connections with your guidance counselor and teachers when the opportunity exists

Looking ahead – Considerations for sophomore year

Financial priorities for parents

- Continue saving in a 529 plan and review asset allocation to ensure that the investments are on track with the time horizon for making withdrawals for college

- Compare living expenses of targeted schools as costs vary by location

- Consider tax-smart strategies and the impact of income on federal financial aid (FAFSA), since the aid calculation will be based on income information from next year’s tax return

Action items for students

- Begin researching colleges online or visiting local campuses to get a sense of preferences, such as an urban or rural campus, and a small or a large school

- Consider a course schedule for junior and senior year to include Advanced Placement (AP) courses if pursuing more selective colleges

- If pursuing athletics, complete online college recruiting forms and contact coaches

- Attend college fairs or informational sessions

- Open a Roth IRA with summer earnings

A plan can help families stay on track

Having a plan can help families stay on track with savings and academic goals. A timeline can also help families keep the pace and not miss key deadlines. These four years leading up to the final college decision are important. Students and parents will want to use the time efficiently.

327202

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.