Advisors: We are constantly monitoring the progress of legislation that could impact your planning discussions. Join us for our November 17 webcast as we focus on year-end planning.

Important update: On November 3, the House Rules Committee released a revised version of the Build Back Better Act, with several provisions of interest including:

- A provision to raise the SALT (state and local tax) deduction cap from $10,000 to $80,000 effective beginning in 2021 through 2030

- Restrictions on large IRA (individual retirement account) balances, including a new required distribution once the aggregate IRA balance exceeds $10 million. This requirement was in the original House Ways and Means proposal.

- Elimination of the “backdoor” Roth IRA contribution strategy and transfer of after-tax contributions from qualified plans to a Roth IRA is disallowed. This proposal was in the original House Ways and Means proposal.

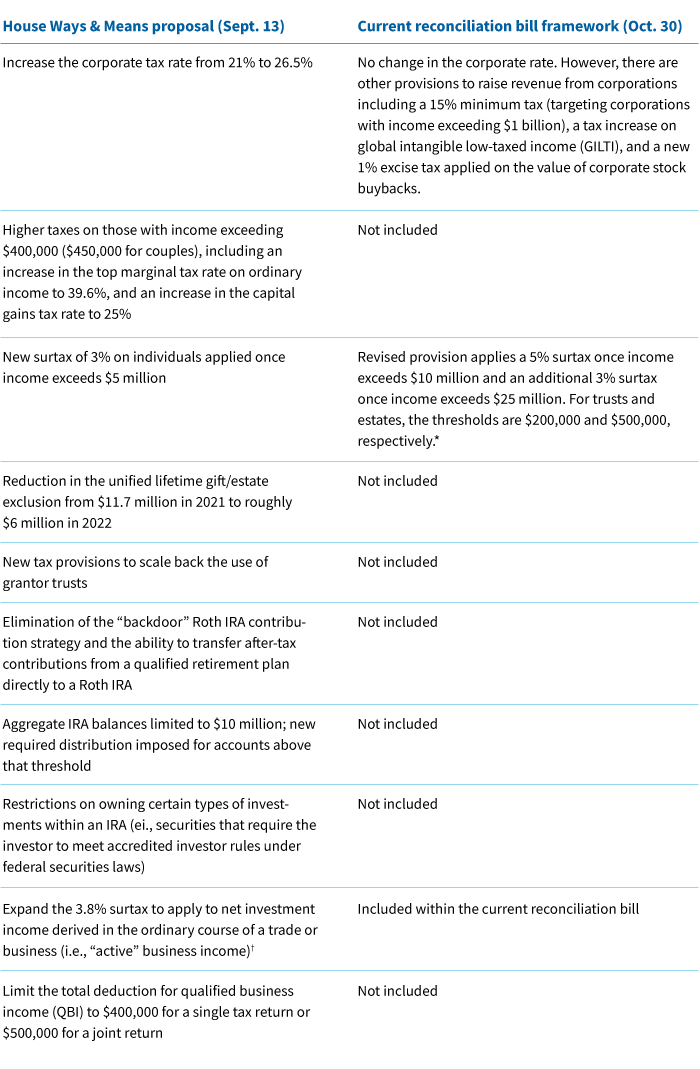

Negotiations on details of the spending and tax reconciliation bill in Congress took a turn recently, as Senator Sinema (D-AZ) signaled she would not support an increase in the corporate tax rate, or tax rate increases on higher-income taxpayers. These measures were included in the original plan released by the House Ways and Means Committee in September.

Because the legislation is being pursued through the reconciliation process, the Democrats cannot afford to lose one vote from their caucus in the Senate. Consequently, lawmakers were forced to seek additional revenue sources to offset the cost of spending objectives. This culminated in an announcement from the administration that a deal for the framework of the reconciliation bill had been reached.

Policy discussions continue to be fluid, so there could be more modifications before legislation is finalized.

Evolving discussions around tax policy — what is still on the table?

Here’s a comparison of the original set of tax provisions included in the Ways and Means Committee proposal and the framework being considered currently. Of course, all of this is subject to change.

*Income defined as modified adjusted gross income (MAGI).

†3.8% surtax does not apply to income subject to FICA taxes.

Similar to the House proposal from September, there is no provision for modifying the $10,000 cap on deducting state and local taxes (SALT). However, leaders within the Democratic caucus signal there will be some relief from the cap in the final legislation. One proposal being discussed currently is repealing the cap for 2022 and 2023, and then imposing the cap in 2026 and 2027 (since the Tax Cuts and Jobs Act (TCJA) expires in 2025, the SALT deduction cap does not currently apply in 2026 and beyond). For planning ideas related to the SALT deduction, read our post, "Plan now as Congress considers SALT changes."

Key spending items in the current framework

Here are some of the major spending proposals:

- Financial support to ensure an eligible family does not pay more than 7% of income on childcare expenses (eligibility determined by income level)

- Funding for universal pre-K coverage over the next six years

- Extension of temporary benefits originally provided through the American Rescue Plan

- Expanded Affordable Care Act (ACA) health insurance premium subsidies extended through 2025

- Enhanced Child Tax Credit (CTC) extended through 2022

- Enhanced Earned Income Tax Credit (EITC) extended through 2022

- Funding for climate-related and green energy initiatives

- Includes an enhanced tax credit to purchase an electric vehicle; maximum credit of $12,500 limited to 50% of the purchase price; not available on higher-priced vehicles (cars exceeding $55,000, SUVs exceeding $69,000, pickup trucks exceeding $74,000) and a phase out of the credit applies once income exceeds $400,000 ($800,000 for married couples filing a joint tax return)††

- New hearing benefit for seniors provided under Medicare Part B beginning in 2024

- Additional funding for affordable housing programs

††Tax credit also available for previously owned electric vehicles, maximum tax credit of the lesser of $4,000 or 50% of sales price for those with modified adjusted gross income of $75,000 ($150,000 for couples)

Source: Build Back Better Act, section-by-section summary.

Advisors: As noted above, my colleague Chris Hennessey and I will host an interactive webcast on November 17, “Top tax-planning considerations,” to discuss year-end planning and the implications of current legislative proposals. Register here for the event.

327768

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.