- Target-date funds are capturing an increasing portion of retirement assets

- Many DC plans are now including target-date funds as default investment options

- Plan participants can benefit from using target-date funds as they are designed to be used

Part of the growth of target-date funds can be attributed to the increasing number of plans that offer them. They have become a standard offering in 70% of defined contribution retirement plans (ICI, BrightScope), and many plans automatically default new employees into these strategies.

Use as directed

Although plan participants are putting more money into target-date funds, they might not be using them in the way that they were designed to be used. In such cases, the investment performance might be subpar. Target-date funds were designed to hold all or most of a participant’s savings for retirement. The funds are diversified and allocations are automatically adjusted over time for risk management as investors approach retirement.

Many participants are under-invested

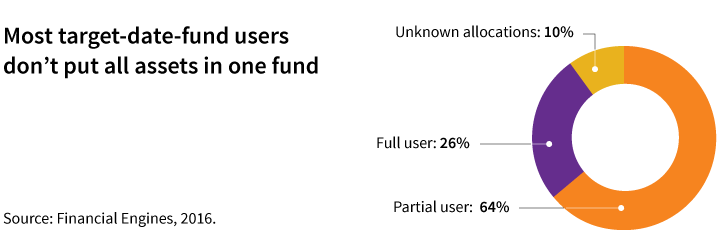

In a Financial Engines study, 38% of plan participants used target-date funds. Of this group, 26% said they invest all or at least 90% of their retirement savings in the target-date strategy. The majority — 64% — reported being “partial users,�? allocating less than 90% of assets. One third reported allocating less than 25% of assets. Another 10% of investors were not sure of their allocation.

Additionally, about 15% of investors said they have decreased their allocation to target-date funds over time, shifting to other investments.

Paying a price in performance

The study noted that individuals who partially invested in target-date funds while also choosing other investments found that their portfolios produced 2.1% lower median annual returns than those allocating most or all assets to a target-date fund.

Investors who put only a portion of their contributions into target-date funds indicated they wanted more personalization or diversification, based on criteria other than asset class. Still, 81% stated they understood that target-date funds were diversified.

More ideas for retirement plan advisors and sponsors at Putnam.com.

306747