Explore our thinking about today's financial markets

Defining consistent performance in retirement strategies

November 2023

Discover the essential principles of investing and how they can help you achieve long-term goals.

How Personalization is changing target-date funds

Traditional target-date funds remain as the qualified default investment alternative (QDIA) of choice for most retirement plans, but newer features of managed accounts (MAs) and advisor managed accounts (AMAs) are bringing innovations to the industry.

Slowing economic growth and fixed income performance

As a follow up to the piece we published in July that focused on decelerating economic growth and equity returns, we thought it made sense to look at how some fixed income sectors fared during the same periods. We researched this concept to better understand the historical relationship between an economic slowdown, credit spreads, and total returns.

Consumer sentiment and forward market performance

In light of decades-high inflation, the Federal Reserve tightening monetary policy, and concerns about an economic slowdown, U.S. consumer sentiment has plummeted.. This year, sentiment is historically low, according to the University of Michigan Survey of Consumers.

Style and factor performance during economic deceleration

Investors are concerned about decelerating economic growth and what this could mean for future equity returns. We researched this question to understand the historical relationship between an economic slowdown, earnings degradation, and any subsequent style or factor performance.

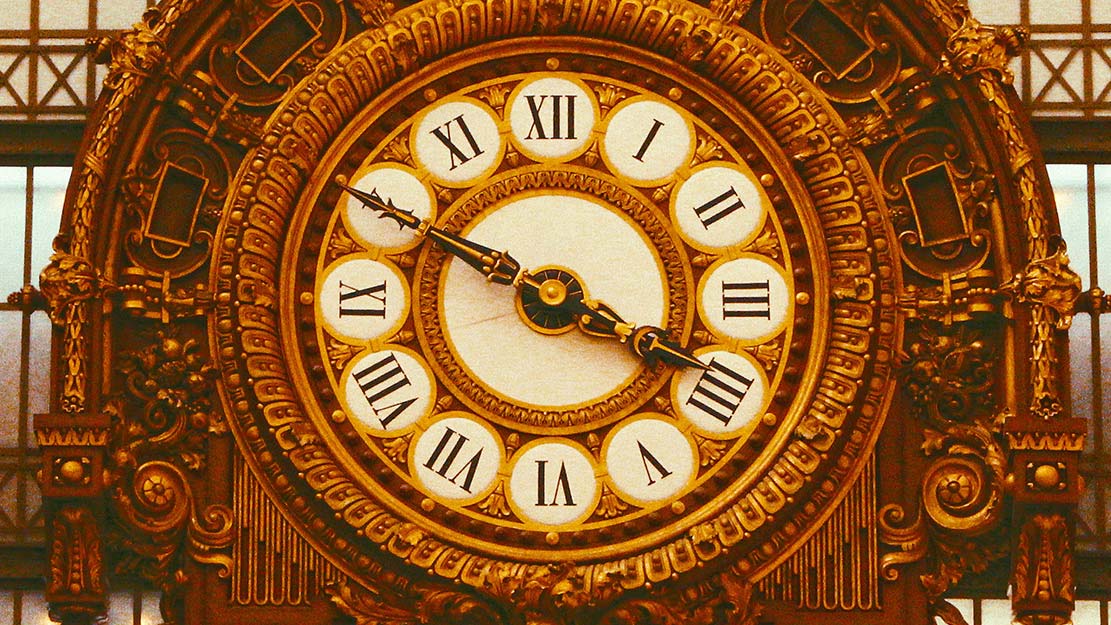

Yield curve inversion and market performance

At its March meeting, the Federal Reserve raised the federal funds rate by 25 basis points. The central bank also indicated that this is likely the start of a tightening cycle, as policymakers attempt to dampen the elevated levels of inflation seen since the start of the pandemic.

The views and opinions expressed are those of the speaker, are subject to change with market conditions, and are not meant as investment advice.