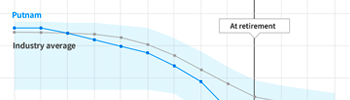

Active managers pursue outperformance

Active, fundamental research by experienced portfolio managers — it’s what separates Putnam funds from passive approaches. Our diverse and talented investors work within a risk management framework to pursue outperformance for retirement plan participants.

Learn more about our portfolio managers and the strategies they pursue.

-

-

Brett S. Goldstein CFA

Co-Chief Investment Officer, Global Asset Allocation

14 years in the industry

-

-

-

-

-

-

-

Jo Anne Ferullo CFA

Portfolio Manager, Director of Sustainable Investing

35 years in the industry

-

-

Robert J. Schoen

Co-Chief Investment Officer, Global Asset Allocation

34 years in the industry

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-