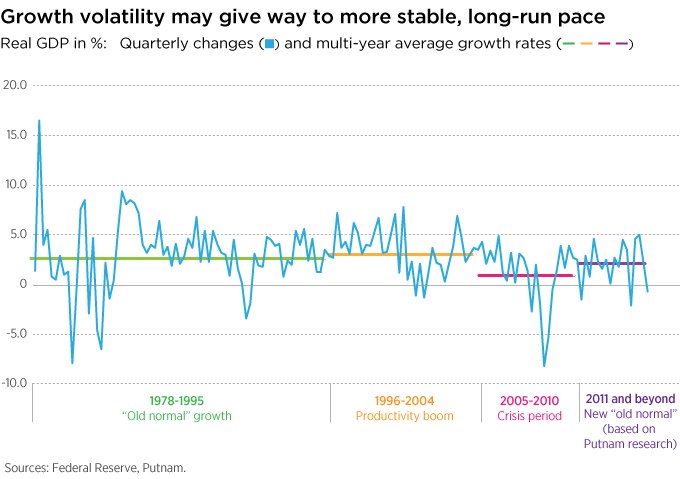

A trending idea among the more apprehensive analysts of U.S. economic growth is that the financial crisis of 2008 somehow crippled the economy for the long term.

We find this pessimistic outlook to be unsupported by fact. Our research suggests that a return to longer-term historical growth trends is more than possible; we think it’s the most likely scenario for the near term.

Interpreting quarterly economic contractions and expansions

Our forecast for long-term U.S. growth is 2.2%. This may seem a bit unexciting next to the 4.6% and 5.0% GDP growth rates during the second and third quarters of 2014, respectively. But, we observe, the quarterly GDP prints for the full year of 2014 illustrate a pattern of contraction and expansion: -2.1%, +4.6%, +5.0%, and +2.2%. Despite the weather-induced negative GDP print in the first quarter of 2015, we think the result in 2014’s fourth quarter heralded the return of the “old normal” rates that pre-date the financial crisis.

The long-run, steady pace

As the U.S. economy has passed from recession to recovery, growth has acted like a spring: When it was depressed, the spring contracted and was much smaller than when it was at rest, or in a neutral state. Conversely, when the spring was released, it expanded rapidly, becoming much bigger than when it was in a neutral state. But all things being equal, the spring eventually returns to its neutral state — or, in the case of GDP, it returns to its longer-run, steady pace.

Overall GDP growth for 2014 was 2.4%, closer to our long-run estimate, though admittedly this is merely a short-run example used to illustrate the point. Interestingly, the conditions that contribute to our long-range forecast of 2.2%, particularly a factor known as “total factor productivity” (or TFP) — a measure of innovation and efficiency-enhancing elements at work in the economy — reveal an internal dynamism of U.S. growth that most observers have tended to overlook.

Financial professionals: Read Putnam's latest research, The "old normal" returns, for more on the outlook for U.S. GDP growth.

295616

For informational purposes only. Not an investment recommendation.

This material is provided for limited purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Putnam product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice. The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication. The views are provided for informational purposes only and are subject to change. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Investors should consult a financial advisor for advice suited to their individual financial needs. Putnam Investments cannot guarantee the accuracy or completeness of any statements or data contained in the article. Predictions, opinions, and other information contained in this article are subject to change. Any forward-looking statements speak only as of the date they are made, and Putnam assumes no duty to update them. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those anticipated. Past performance is not a guarantee of future results. As with any investment, there is a potential for profit as well as the possibility of loss.

Diversification does not guarantee a profit or ensure against loss. It is possible to lose money in a diversified portfolio.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. You can lose money by investing in a mutual fund.

Putnam Retail Management.