- Among health savings account (HSA) owners, Baby Boomers have the highest balances and the fastest account growth (BofA, 2016)

- Millennials represent 33% of overall enrollment in HSAs, up from 9% in 2010 (BofA, 2016)

- One-third of millennials expect health-care costs to be their largest expense during retirement, ahead of housing and utilities (27%) and travel/leisure (18%) (Insured Retirement Institute, 2017)

The millennial workforce may be embracing HSAs in larger numbers these days, but they may not be aware of the potential use of HSAs to save for retirement.

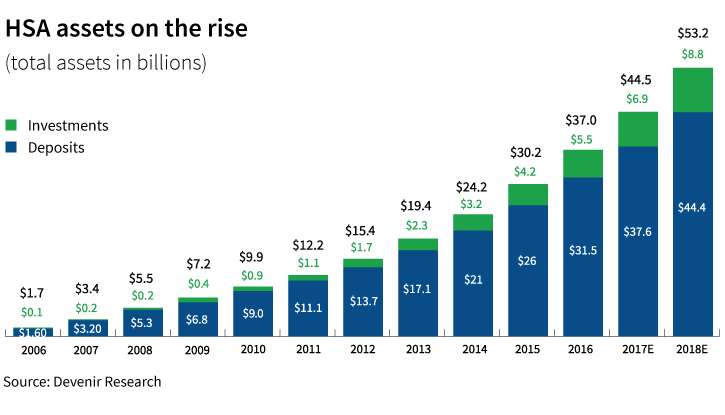

HSAs are available for participants in high-deductible health insurance plans. With more companies offering these plans, enrollment in HSAs grew by 42% in 2016, compared with a year earlier, Bank of America reported. Many millennials are choosing this insurance option and funding an HSA.

Triple tax benefit

HSAs offer a “triple tax benefit” for savers. Contributions are made with pretax dollars, assets grow without incurring a tax on the interest, and money withdrawn is tax free, as long as it is used for qualified medical expenses.

HSAs are receiving more attention among investors as a way to manage near-term health costs and as a strategy to save for retirement. Because there is no time limit for distribution of the funds and the accounts are portable, account owners retain the assets when they change jobs or retire. The HSA may be an additional option for covering health-care costs in retirement. As long as the distribution is for a qualified medical expense, the money may be used tax free.

All generations are aware of rising costs

Health-care costs have outpaced earnings and inflation over the past 15 years and are expected to continue to climb. The number of savers using HSAs for future health expenses is rising, but in a recent survey 46% of workers with an HSA said they are using the account primarily for immediate- or near-term costs.

Younger workers could be using HSAs as a way to save for the future. One study found that millennials are investing 20% more of their salaries in HSAs compared with other age groups (Source: Benefitfocus). With less demand for health-care expenses at younger ages, it may be easier to set aside funds for the future with an HSA.

Millennials are saving — in 401(k) plans, personal savings accounts, and health savings accounts. But most are not planning, the IRI study found. In addition to concerns about health-care costs, only 25% of millennials believe they will receive any meaningful income from Social Security in retirement. About half — 53% — believe their workplace retirement account will provide sufficient income. And while millennials clearly identified areas where they need help — calculating savings goals, paying off debt, and crafting a plan —only 34% have sought advice from a professional advisor (Source: IRI).

308656

For informational purposes only. Not an investment recommendation.

This material is provided for limited purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Putnam product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice. The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication. The views are provided for informational purposes only and are subject to change. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Investors should consult a financial advisor for advice suited to their individual financial needs. Putnam Investments cannot guarantee the accuracy or completeness of any statements or data contained in the article. Predictions, opinions, and other information contained in this article are subject to change. Any forward-looking statements speak only as of the date they are made, and Putnam assumes no duty to update them. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those anticipated. Past performance is not a guarantee of future results. As with any investment, there is a potential for profit as well as the possibility of loss.

Diversification does not guarantee a profit or ensure against loss. It is possible to lose money in a diversified portfolio.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. You can lose money by investing in a mutual fund.

Putnam Retail Management.