This tax season, as investors gather records and prepare to meet with advisors, they will see the impact of tax reform for the first time. Advisors anticipate that most of the leading questions from taxpayers will focus on changes to popular tax deductions.

While many tax code changes were covered widely in the media, such as the limitation on state and local taxes (the SALT deduction), other changes may not have garnered much attention.

The repeal of miscellaneous deductions, for example, may have a significant impact on some taxpayers’ filings.

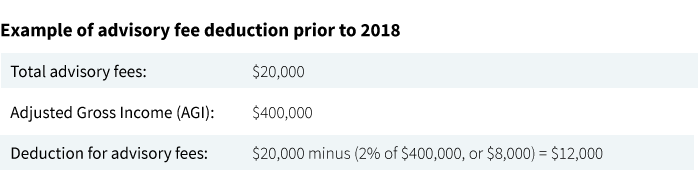

With the industry shift from commission-based investments to advisory accounts, one change in particular may impact many investors: the repeal of the deduction for investment advisory fees. Previously, advisory fees were considered a miscellaneous 2% deduction meaning that a taxpayer could deduct these expenses once the total amount exceeded 2% of adjusted gross income (AGI). Additionally, like other miscellaneous 2% deductions, the deduction for investment advisory fees was not available as a deduction for alternative minimum tax (AMT).

Consider deducting advisory fees directly from retirement accounts

While these fees are no longer deductible from income, existing tax law does allow fees to be deducted directly from retirement accounts without penalty or taxes.* In this case, the taxpayer benefits from using pretax retirement funds to pay the fee. Note that this approach generally does not benefit Roth accounts, where “outside” funds should be used to pay the advisory fee, rather than withdrawing funds from a tax-free Roth. Also, investors cannot deduct funds from a retirement account to pay an advisory fee on the non-retirement portion of the advisory portfolio.

Utilize a trust as owner of the advisory account

Individuals can no longer deduct advisory fees, but a trust as owner may still be able to take this deduction. The repeal on deducting advisory fees under the new law may not apply to irrevocable (i.e., non-grantor) trusts or estates. In Notice 2018-61, the IRS clarified that, post TCJA, trusts could still deduct certain fees (tax preparation, appraisal, and fiduciary fees, for example). With respect to investment advisory fees, an irrevocable, non-grantor trust may still be able to deduct them depending on the specific facts and circumstances of the situation, and the determination of the tax professional filing the trust tax return. A key variable would be whether or not the fee is related to “incremental” services being performed specifically due to the assets being held in the trust structure (as opposed to individual ownership).The IRS intends to issue additional regulations in this area, which may impact the interpretation of these types of deductions for trusts.

Consult a tax professional

With the complexities of the tax code changes, investors considering these types of strategies should consult with a tax professional.

* See Treasury regulation 1.404(a)-3(d)

315333

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.