Updated April 13, 2020.

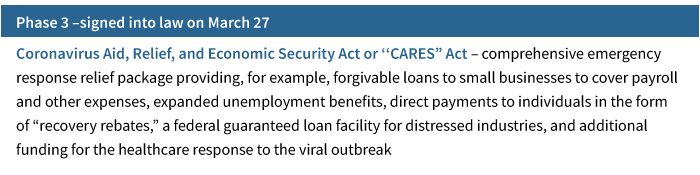

On March 25, the Senate passed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which provides emergency assistance and health-care response for individuals, families, and businesses affected by the 2020 coronavirus pandemic. With a total cost estimated at over $2 trillion, this comprehensive, emergency relief package seeks to stem the impact of the viral outbreak on individuals, businesses, the health-care system, and the economy. While the legislation is vast, we will explore a number of provisions impacting small-business owners and individuals.

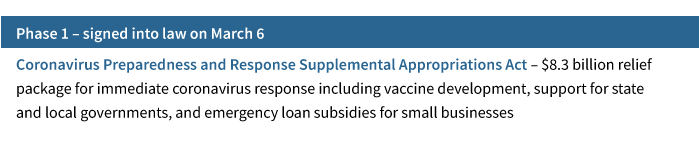

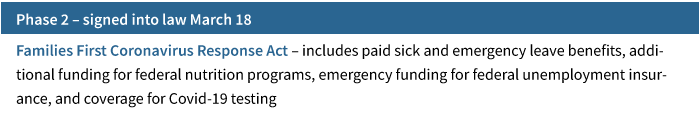

Summary of legislative response to the coronavirus pandemic:

Key provisions providing relief for small businesses

Small-business interruption loans

- Federal loans for businesses with not more than 500 employees

- Loan amount is limited to a maximum of $10 million, and is based on average, total monthly payments for payroll, mortgage, rent, and other expenses

- Loan may be forgiven by meeting certain requirements around maintaining employment and payroll

- Businesses that have laid off employees may qualify for loan forgiveness if employees are rehired by June 30, 2020

Payroll tax credit

- 50% refundable payroll tax credit on wages paid up to $10,000 of compensation (including health benefits) paid to an eligible employee during the crisis (from March 13, 2020 through December 31, 2020)

- Available to employers whose business was disrupted due to shutdowns and kept paying workers

Employer payroll taxes for the rest of 2020 may be delayed

- Half of amount owed must be repaid by the end of 2021 and the other half owed to be repaid by the end of 2022

Modifications to net operating losses (NOLs)

- The Tax Cuts and Jobs Act (TCJA) eliminated the carryback of NOLs, instead requiring them to be applied to future tax returns

- Under this legislation, NOLs realized in 2018, 2019, or 2020 may be carried back a maximum of five years

- The limit on applying an NOL to a maximum of 80% of taxable income in any one tax year is eliminated for these years

Enhancements to paid sick and family leave program

- Builds on the Families First Coronavirus Response Act by providing advance refunding of paid sick and family leave tax credits so that employers can access the funds quicker

Provisions affecting individuals

Recovery rebate payments to individuals

- Payments for individuals through a refundable tax credit of $1,200 ($2,400 for couples) via direct deposit or checks

- Additional payment of $500 per “qualifying child” defined as being under the age of 17*

- Phase outs apply at an income level of $75,000 ($150,000 for couples filing a joint return), the payments are fully phased out at an income level of $99,000 ($198,000 for couples)**

* IRC Section 24(c).

** Income limits based on adjusted gross income (AGI) for 2019 with some exceptions.

Waiver on required minimum distributions (RMDs) for 2020

Penalty-free retirement account distributions of up to $100,000 by the end of 2020 for those affected by COVID-19

- Includes those diagnosed with the virus, or whose spouses or dependents are diagnosed, or those who have experienced adverse financial consequences, such as being laid off or quarantined

- Amount distributed can be repaid or treated as taxable income pro-rated over three years

Retirement plan loans expanded from a maximum of $50,000 to $100,000

- Loan is limited to vested value of the account (increased from maximum 50% of vested value)

- Existing plan loan payments can be delayed for one year

Expansion of charitable contributions

- New $300 above-the-line charitable contribution for filers taking the standard deduction applies to contributions made after 2019

- Temporary suspension of certain limits (based on a percentage of AGI) on charitable contributions for those itemizing deductions on their return for tax year 2020

Delay for federal student loan payments

- Student loan repayments delayed through September 30, 2020

Additional changes

Tax filing deadline is delayed until July 15, 2020

In addition to these legislative changes, the Treasury Department announced earlier this week that the tax filing deadline for 2019 tax returns is delayed 90 days to July 15. This also applies to Q1 estimated tax payments that were previously scheduled for April 15. The Treasury Department also announced that the deadline for Q2 estimated tax payments is delayed to July 15. Due to the change in the tax filing deadline, IRA and HSA contributions for 2019 can be made up to July 15. Note that some states have also taken steps to delay filing. The AICPA provides more information on a state-by-state basis.

Seek advice

Investors are experiencing significant turmoil in their personal and work lives. With the recent volatility in both equity and fixed income markets, investors are more likely focused on the value of their assets in savings and retirement plans. However, these challenging times can present certain financial planning opportunities. Seeking professional financial advice may ease some of the stress around finances. Consider some of these planning strategies to support your goals with “Five planning strategies for volatile markets.”

Financial advisors are welcome to hear about additional strategies from our recent webcast.

321072

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.