A new year of planning brings the opportunity to review current tax plans and consider what lies ahead in 2021.

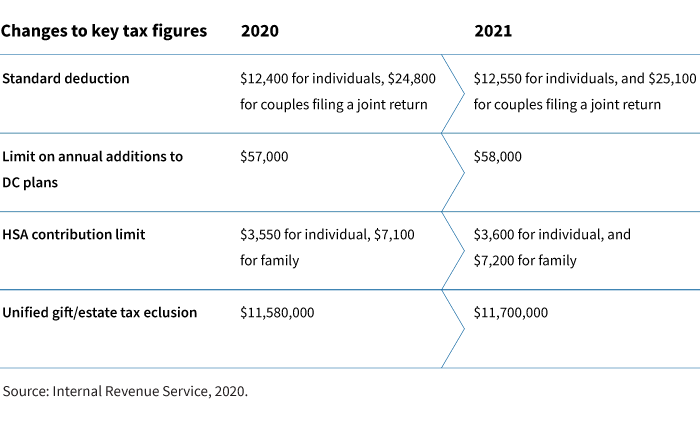

The Internal Revenue Service recently announced the tax rates and contribution limits for 2021. Most of the changes to tax figures resulted from inflation adjustments. Putnam’s “2021 tax rates, schedules, and contribution limits” can be a useful reference to review with a financial advisor.

While there have not been major changes from 2020, some areas need attention from taxpayers. For example, individuals and families will be able to save more in health savings accounts in 2021. The lifetime gift and estate tax exemption was also increased for 2021 and may have an impact on estate plans going forward.

Planning considerations

A first step for investors in tax planning for the coming year is to determine their tax bracket.

1. Review retirement plan contributions

If an investor is not maxing out 401(k) contributions for 2020, they may want to consider deferring additional funds to max out for 2021. Investors may also want to take advantage of the tax benefit of increasing contributions to a health savings account.

2. Consider tax-smart strategies for charitable giving

- For those age 70½ or older, distributing funds from an IRA tax free directly to a qualified charity (up to $100,000 per IRA owner and can include RMDs) may be an option.

- Another strategy is the concept of “lumping” multiple years of charitable gifts into one year in order to itemize deductions on that year’s tax return. For example, instead of a couple gifting $10,000 annually to a charity, consider gifting $30,000 in one year, representing three years’ worth of gifts. The couple could benefit from itemizing deductions for that tax year and claim the higher standard deduction in the next two years.

- The CARES Act pandemic relief bill made two changes for charitable deductions for 2020. Taxpayers, including those utilizing the standard deduction in 2020, can claim an above-the-line deduction of up to $300 of cash contributions to qualified charities. And, the limit on cash contributions to qualified, public charities increased from 60% of adjusted gross income to 100%. These changes were extended beyond 2020 with the passage of the recent pandemic relief bill.

3. Utilize a Roth conversion to take advantage of lower tax rates

A Roth IRA conversion may help investors take advantage of the current lower tax rates and hedge against future higher tax rates.

The federal government has amassed a record deficit for the 2020 fiscal year. With the need to raise additional revenue, the potential exists for higher tax rates in the future. In addition, provisions of the Tax Cuts and Jobs Act of 2017 are set to expire in 2025. A Roth IRA conversion completed this year would allow taxpayers to utilize this strategy while tax rates are still low. However, before considering a Roth conversion it’s important to consult with a tax professional to determine the overall impact to one’s personal tax circumstances.

324686

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.