Until 2018, the tax deduction for state and local taxes, better known as SALT, was one of the most widely utilized tax breaks in the code.

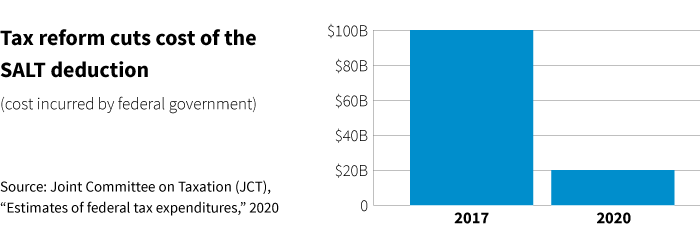

The use of the deduction was reduced sharply when the Tax Cuts and Jobs Act (TCJA) introduced a $10,000 cap.

With a new administration and Congress controlled by Democrats, several lawmakers on Capitol Hill have introduced legislation to repeal the cap and restore the SALT deduction. Whether their efforts will be successful is unclear.

What is SALT?

The SALT deduction includes:

- State and local income taxes

- Local property taxes as well as taxes on personal property

- An option to deduct state/local sales taxes in lieu of deducting state/local income taxes

Signed into law in late 2017, the TCJA radically changed the treatment of tax deductions. Beginning in 2018, it doubled the standard deduction while reducing, or eliminating altogether, many itemized deductions.

A cap of $10,000 was placed on the SALT deduction, which applied to both individual and joint taxpayers ($5,000, if married filing separately).

As a result, the overwhelming majority of taxpayers now claim the standard deduction on their tax returns.

Does the political landscape mean change for the SALT deduction?

With Democrats controlling both the Senate and the House there has been talk of lifting the cap on the SALT deduction. Just in the last week, several bills have emerged in Congress, including one introduced by Senate Majority Leader Chuck Schumer that would repeal the $10,000 cap.

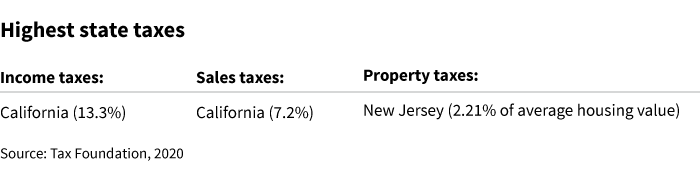

Since the 2017 tax law changes, taxpayers in high-tax states such as New York, New Jersey, and California, have called for a full restoration of the SALT deduction. Lawmakers from those states have argued that their constituents were unfairly impacted by the $10,000 SALT cap under the TCJA.

Restoring the SALT deduction will be a tough political challenge as it would cost the federal government significant revenue. It would also direct more than half of the tax benefits to households with more than $1 million in income (according to the Joint Committee on Taxation).

Other considerations for restoring the SALT deduction

- A move to restore the SALT deduction would also likely bring back the Pease limitation, which resulted in a phaseout of itemized deductions for those at higher income limits

- The Pease limit was repealed by the TCJA when many deductions were reduced or eliminated altogether

- For the 2017 tax year – the last year the Pease limit applied – itemized deductions began to be phased out at an adjusted gross income of $261,500 ($313,800 for married couples filing a joint return). At a maximum, a taxpayer could lose 80% of itemized deductions under the Pease limit

- There has also been a proposal from the Biden administration that would restrict the benefit of all itemized deductions above the 28% marginal tax bracket

- The Alternative Minimum Tax (AMT) also served to limit the tax benefit of the SALT deduction for higher earners. Taxpayers subject to the AMT are unable to benefit from the SALT deduction

- The TCJA reduced the scope of the AMT by significantly increasing the AMT exemption amount. An attempt to restore the SALT deduction may prompt lawmakers to revisit the framework of the AMT so that certain, higher-income taxpayers would not disproportionately benefit

- It is also unclear whether there is enough political support from Democratic lawmakers in lower-taxed states for making changes to the SALT deduction

Outlook for SALT

- Lawmakers supporting a restoration of the SALT deduction will have to consider the overall cost

- There is also potential political fallout associated with bringing back a deduction that primarily benefits higher-income households, especially considering the current environment, in which many households are suffering because of the pandemic

- As a compromise, we may see a temporary lifting of the SALT deduction cap from its current level of $10,000 to a higher level, paired with some provisions implemented to restrict the benefits for higher-income taxpayers

Smart planning for tax deductions

In the meantime, taxpayers should consult with their tax professional on a strategy for optimizing tax deductions on their returns. For example, taxpayers may want to consider “lumping” as many tax deductions as possible into one year in order to itemize deductions on their tax return. Or, for those age 70½ or older, consider charitable giving from an IRA, especially if claiming the standard deduction on the tax return.

For more information deducting state and local taxes, please see the Internal Revenue Service discussion of deductions.

324907

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.