Explore our thinking about today's financial markets

Most recent post

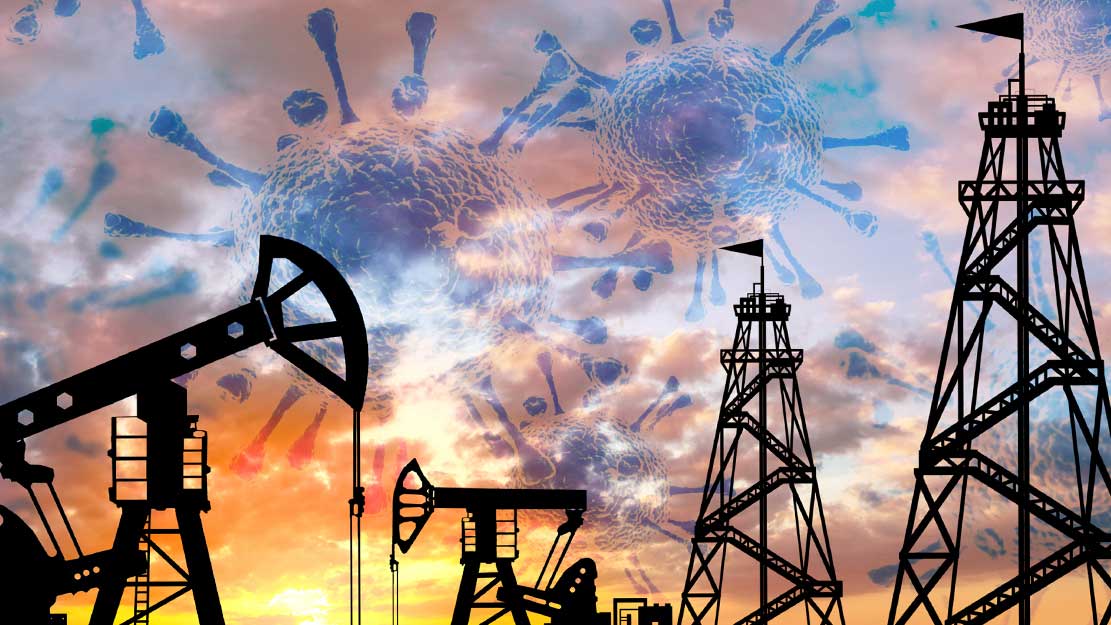

Why Gaza war has not yet caused an oil price spike

November 22, 2023 | Fixed income

The calamity of war in Gaza since early October has so far had a more muted impact on oil prices than might have been expected. We analyze the market and share our outlook.

Fixed Income Outlook

Sticky inflation and Treasury supply likely to push yields higher

November 1, 2023 | Fixed Income Outlook

Stay informed on fixed income markets in the fourth quarter. Get timely updates on currency, credit, and the yield curve.

Equity Insights

The power of diversified alpha

December 20, 2023 | Equity Insights

Our diversified alpha approach seeks to avoid performance extremes. We use a stock-driven, rather than style-driven, process that gives us the chance to outperform our benchmarks in all market environments.

The views and opinions expressed are those of the speaker, are subject to change with market conditions, and are not meant as investment advice.