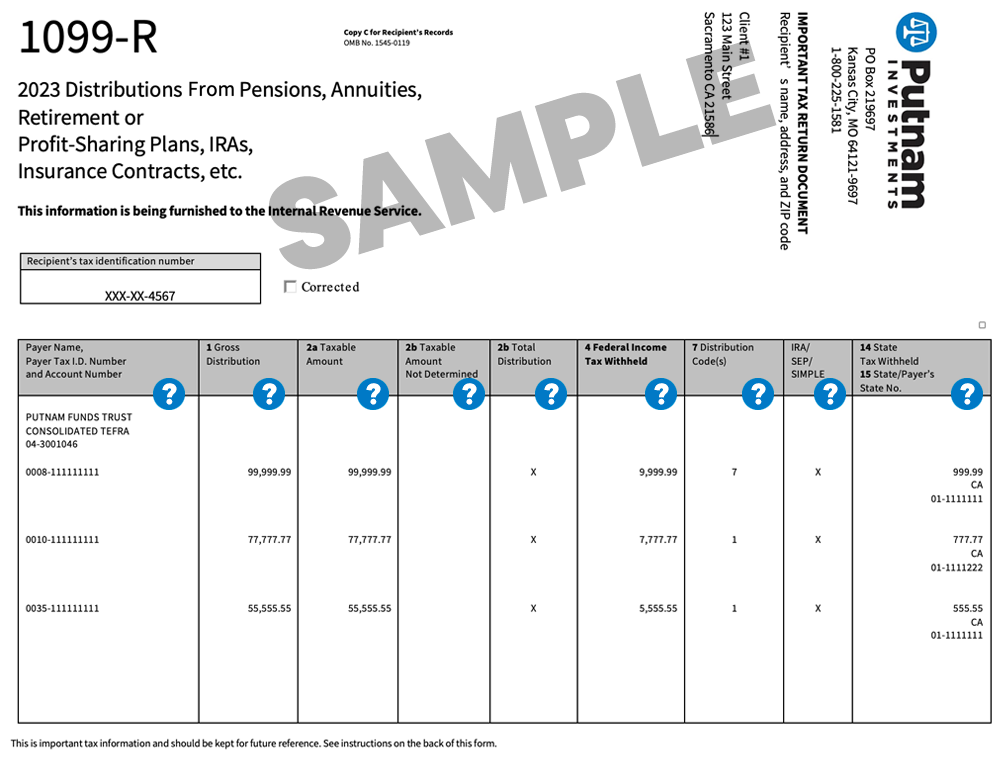

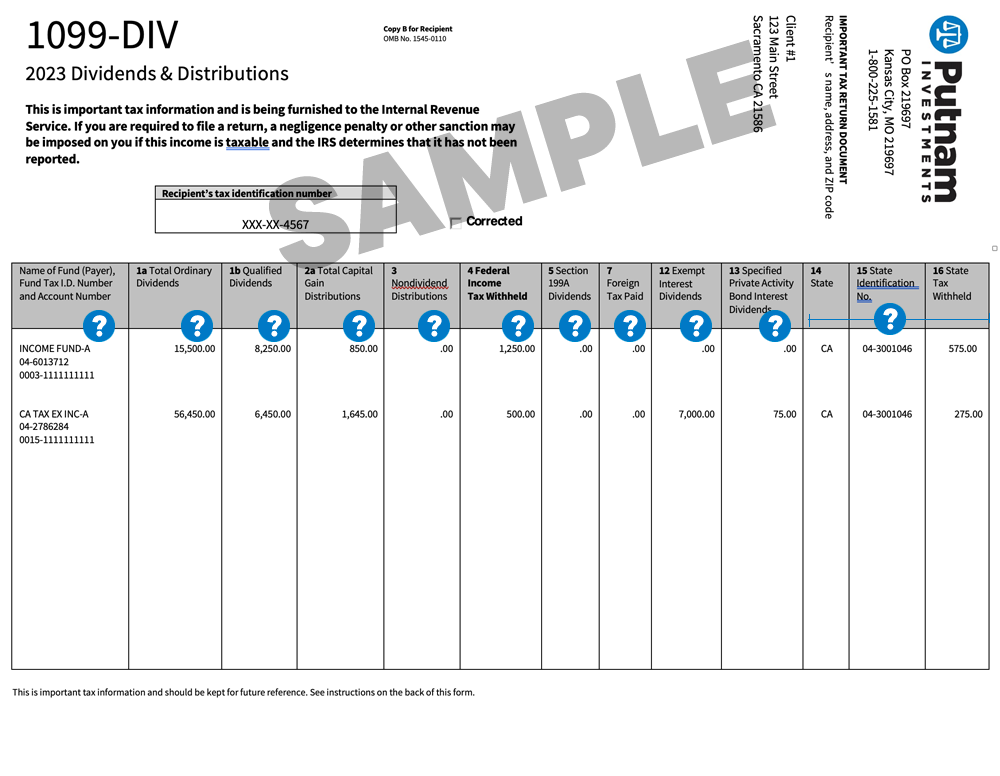

Putnam's consolidated Form 1099-Div lists all taxable dividends, exempt interest dividends, and qualified dividends. It will also list capital gain distributions, nondividend distributions, federal and state income tax withheld, foreign tax paid and specified private bond activity. The dividends and capital gains shown on Form 1099-DIV are considered taxable even if you reinvested your distributions in additional fund shares instead of receiving them in cash. Form 1099-DIV is reported to the IRS. Please consult your tax advisor or state tax authority regarding the tax treatment of dividends, including income from U.S. Treasury obligations. This information is being furnished to the Internal Revenue Service (IRS).

To view the tax filing information for a form section, click on the appropriate icon below.

-

Why doesn't my form 1099-DIV match my year-end statement?

Putnam determines each fund's taxable income and capital gains after mailing your annual statement. At year-end, it is sometimes necessary for Putnam to adjust a fund's distributions to properly reflect the fund's actual taxable income and capital gain for the year. This process is known as reallocation. For example, in some cases a fund must reallocate ordinary dividends (short-term capital gains) to long-term capital gains. Thus, if a reallocation occurred on a fund in which you have an investment, the information provided on your annual statement and Form 1099-DIV will differ. For tax purposes, you should use your tax forms and not your annual statement.

Why aren't short-term capital gains listed separately on my form 1099-DIV?The IRS requires that short-term capital gains paid by mutual funds be treated as ordinary dividend income on Form 1099-DIV.

Are reinvested dividends used to purchase additional fund shares taxable to me?Yes. They are taxable whether you take the dividends in cash or reinvest them in additional fund shares.

What are qualified dividends?Qualified dividends are those received by an individual shareholder from domestic or qualified foreign corporations that may be eligible (depending on holding period, etc.) to be taxed at the reduced capital gains tax rates. Review IRS Publication 550 and consult your tax advisor for more information.

What is Specified Private Activity Bond Interest?If you are subject to the alternative minimum tax (AMT), then this amount needs to be reported as a tax preference item on Form 6251. If the fund invests in certain private activity bonds, then the income subject to the AMT will be shown on Form 1099-DIV.

Why did I receive a Form 1099-DIV for my Uniform Gift or Uniform Transfer to Minors Account?The IRS requires us to report all income, no matter the age of the account holder. Minors who have earned over a certain dollar amount may be required to file a Federal Income Tax Return. You may want to consult your tax advisor regarding your reporting situation.

What are the holding period requirements associated with qualified dividends?Generally, a security must be held more than 61 days of the 121-day holding period surrounding the security's ex-dividend date to qualify for favorable tax treatment of the dividend. With distributions from mutual funds the holding period requirement applies on both the fund level and the shareholder level. This means that in order for a dividend to be qualified, the fund must have held the security for at least 61 days of the 121-day period. On your Form 1099-DIV, Putnam will provide you with the total of qualified dividends, based on the fund's holding period; however, in order for the dividend to actually qualify, you must have also held the mutual fund shares for at least 61 days of the 121-day period. To calculate your holding period, count the number of days you held the shares starting with the day after the shares were purchased. If the shares were sold, count the number of days held, including the date sold.

Why are nondividend distributions listed on Form 1099-DIV?Nondividend distributions are distributions from your fund which are a return of capital to you. You must reduce your cost (or other basis) by the amount shown in Column 3. However, if you get back all of your cost (or other basis), you must report future nontaxable distributions as capital gains even though Form 1099-DIV shows them as nontaxable. Review Publication 550 for assistance in determining if the amount shown in Column 3 is truly nontaxable to you.

Why did I receive Form 1099-DIV for my tax-exempt fund?Capital gains distributed from any fund are fully taxable. If the tax-exempt fund in which you invested earned short- or long-term capital gains from the sale of securities held in the fund's portfolio, the fund is required to distribute these capital gains in addition to its regular tax-exempt dividends. The fund must also distribute taxable ordinary income resulting from the sale of certain bonds purchased at a discount by the fund. These taxable distributions, as well as any short-term capital gains are reported to you and the IRS (as required) in Column 1a of your Form 1099-DIV, under Total Ordinary Dividends. Long-term capital gains are reported in Column 2a of your Form 1099-DIV, under Total Capital Gain Distributions. You must include these taxable distributions when preparing your income tax return(s).

-

Income from U.S. Government Securities

Several Putnam Funds invest at least a portion of their assets in U.S. Treasury securities. Since interest income from U.S. Treasury obligations is often exempt from state and local taxation, this could translate into a state tax break for you. Your applicable Treasury income from your fund was based on your state of residence as of the last business day of the calendar year and was calculated in accordance with the rules for your state.

However, certain states currently differ in their treatment of passthrough of U.S. Treasury income from mutual funds. Therefore, you should consult your own tax advisor, accountant, or state department of revenue to determine what restrictions, such as threshold requirements, your state may impose on this exemption.

Putnam also calculates each fund's Treasury, GNMA , direct federal obligation and other mortgage-backed security asset percentages.

Please contact us for the current Treasury Income/Asset information on any Putnam fund.

Foreign Taxes PaidMutual Funds that invest in foreign equity securities earn dividends and pay taxes on those dividends to various countries. This payment of foreign taxes is a fund expense. If a fund has more than 50% of its assets invested in foreign securities, the fund may elect to pass through this foreign tax expense to its shareholders, giving them the opportunity to claim either a foreign tax credit or a deduction. Shareholders in a fund which has made this election are placed in the same position as a person directly owning the foreign security. As such, the shareholder must include in their gross income (in addition to taxable dividends actually received), their proportionate share of such foreign taxes paid.

Since the Foreign Tax Paid amount on Form 1099-DIV, column 7, is included in the Total Ordinary Dividends amount in column 1a, the shareholder may choose between taking a credit or deduction for the Foreign Tax Paid on their Form 1040.

Please contact us for a complete listing of all Putnam foreign equity funds along with their total ordinary dividends distributed per share from securities in various countries and the foreign tax paid by the fund to those countries.

Dividends-Received Deduction for Corporate ShareholdersPutnam calculates the percentage of each fund's Qualifying Dividends eligible for the corporate dividends received deduction. Corporate shareholders may contact us for this information.

None of the information in this web site should be considered legal or tax advice. You should consult your legal or tax advisor for information concerning your own specific tax situation. The forms and numbers shown in this web site are for illustrative purposes only.

Putnam Investments is a Franklin Templeton company.