The government is struggling to revive a cooling economy in the midst of a protracted trade battle with the United States, raising the risks to global financial markets.

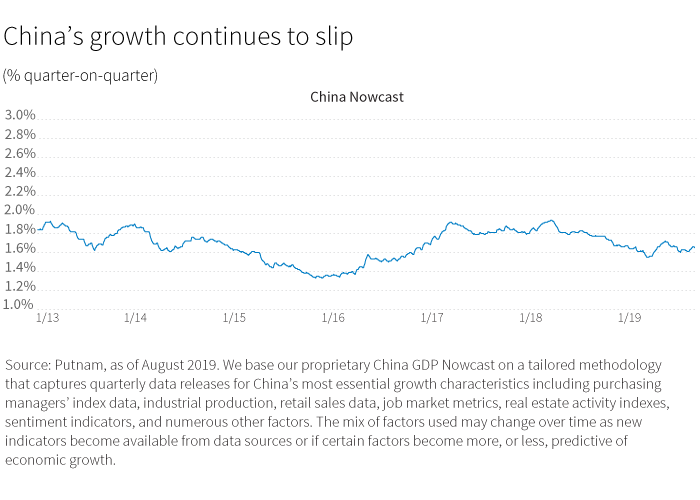

The global outlook depends on the trajectory of the world’s two largest economies: the United States and China. This is just arithmetic given the size of their economies, and their deep linkages with the rest of the world. Although we were reasonably optimistic on China’s outlook and the implications for the global economy, we are now less confident than before. The slowdown in China seems to be a bit more powerful than we had expected. It’s hard to be certain about why this is happening. It may be the trade war with the United States, or it may be that the economy is becoming too big and too complex for the authorities to fine-tune. Although we don’t have a full suite of macro data on China — some of the data are clearly suspect — the dynamics don’t look encouraging. Some on Wall Street expect growth to drop below 6% in 2020.

Chinese authorities have approached policy cautiously. The government has so far adopted a string of modest policies to counter the slowdown in growth. In early September, the central bank announced a new measure to give the country’s slowing economy a jolt. The People’s Bank of China reduced the amount of money commercial banks are required to set aside and not lend — its reserve requirement ratio. The central bank said 900 billion yuan will become available in an attempt to promote lending.

A currency war

The exchange rate has also come into play. This makes us a bit nervous. Over the past year, the renminbi had strengthened to about 6.70 against the U.S. dollar from about 6.95 a dollar in November 2018. Then in early August, the currency weakened past the psychologically important 7.00 to the dollar for the first time in more than a decade. A higher number represents a weaker currency. As of early September, the currency was trading between

7.10 and 7.20, its weakest in nominal terms since 2007.

Policy weapons are political. This exchange-rate weakening is a message to Washington about the trade war. In the Chinese context, however, this kind of currency move is potentially destabilizing because of the threat of large capital outflows. Episodes of renminbi weakness have in the past led to private capital outflows. These in turn caused market volatility and subsequent measures to restrict those outflows. While no capital flow controls are watertight, those backed by the full power of the Chinese Communist Party are more effective than most. So, the risk of a currency collapse — Latin American style — is remote. However, uncertainty over the renminbi’s future will impact private sector expectations and private investment. This in turn will affect growth.

Rising trade and financial links

We are also worried about the linkages between China’s economic prospects and the global economy. China is key to the world’s demand growth. The country accounted for 31% of global consumption growth between 2010 and 2017. It was expected to contribute 28% of global growth between 2019 and 2020 compared with 10.5% from the United States, according to data from the International Monetary Fund. Economic weakness in China will mean less demand for global goods, including Chilean copper and Italian handbags. But it is not just Chinese imports that matter. Many international companies rely on China for part of their profits by selling goods manufactured in China to domestic Chinese consumers.

China’s financial linkages are also cause for concern. Foreigners don’t hold much short-term, liquid assets in China and don’t have exposures that have typically caused crisis in other emerging markets. Foreign direct investment in China is large, but it’s not the kind of asset

base that can move quickly. On the other hand, China’s financial assets overseas are somewhat larger than we had forecast. These assets exceed $3 trillion, according to the latest estimates. Much of the gap between the official data and the true state of affairs arises because lending by public sector Chinese banks is not fully captured by the Bank for International Settlements or the Paris Club. (Note, China is not a member of the Paris Club, an informal group of officials from creditor nations who negotiate workable payment plans for debtor nations.)

Resilience of global markets in question

Global financial markets are at risk if China’s economy slows more than expected. If this weakness creates more problems in the financials sector, the government could repatriate some of its foreign assets to help with the costs of recapitalizing this sector. This is not China selling its U.S. Treasury holdings to push yields higher and “punish” the United States. Rather, it’s similar to what happened in the late 1990s when mounting stresses in Japan forced local banks to repatriate assets held in East Asia. This capital flow triggered the East Asian financial crisis. We don’t want to overstate this risk; it would require a much sharper downturn in China than we think is likely. But this scenario unfolded in Asia 20 years ago. We are now less sanguine about the resilience of global financial markets and

financial flows against a more serious Chinese downturn.

Next: Politics and policy collide

More from Macro Report

Download the Macro Report (PDF)Global growth continues to cool under the weight of the ongoing trade dispute between the United States and China.