Global growth is likely to remain sluggish as the trade rift takes a toll on exports, manufacturing, and investments.

Our Global Nowcast looks just a little bit better. If you squint, you can see that the Nowcast has ticked up, although it is still very close to the bottom of the post-recession range. Overall, we are pretty much where we were a month ago. It is hard to build a strong case for stabilization at the current growth rate. It is also hard to build a strong case that a recession is just around the corner. The central scenario is for global growth to muddle through.

If you squint, you can see that the Nowcast has ticked up, although it is still very close to the bottom of the post-recession range.

Consensus growth expectations continue to drift lower. The Organization for Economic Cooperation and Development, the World Bank, the International Monetary Fund, and the World Trade Organization (WTO) have all cut their global growth forecasts. In October, the WTO said global trade volume is expected to rise 1.2% in 2019 — markedly slower than the 2.6% forecast in April. For 2020, the WTO estimates 2.7% trade growth instead of 3.0%. The forecasts from these international institutions are interesting because they reflect an informed consensus.

Fleeting upturn in China and emerging economies

There are some green shoots of recovery in the Purchasing Managers' Index (PMIs) for emerging markets. PMIs typically measure the prevailing direction of economic trends in the manufacturing and service sectors. However, this may well prove to be fleeting. While data shows that a few large emerging-market economies, especially Brazil and Turkey, are picking up, this is only because they are bouncing back from serious downturns. More broadly, there is a seasonal component at work as orders and trade gear up for the Christmas shopping season.

China does seem to be stabilizing. But growth in China will not bail out the rest of the world. The widely followed Li Keqiang (LKQ) index looks a bit better. Chinese imports, however, continue to drop. Things look worse and worse in Hong Kong, but this will not derail the outlook for mainland China. Overall, we believe the policy measures taken by Beijing are bearing some fruit.

Japan's sales tax takes effect

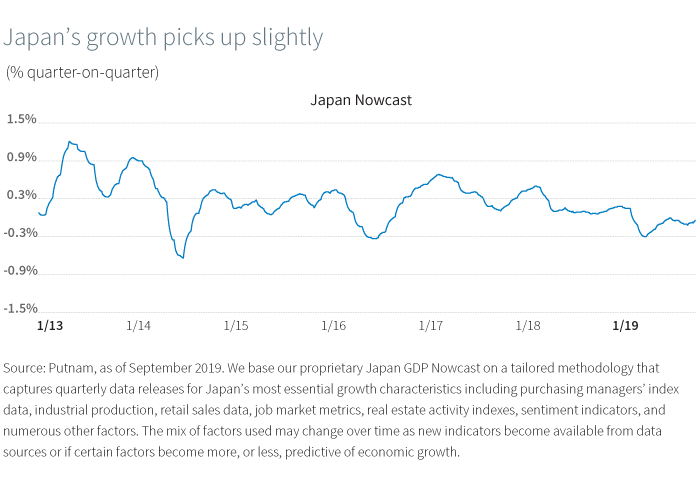

The government raised the value-added-tax (VAT) in October to 10% from 8%. Consumer spending has only now gradually recovered from the previous tax increase in April 2014, when the sales tax rose to 8% from 5%.

The 2014 sales-tax hike dented the economy. The country's GDP contracted at an annualized 7.3% rate in the quarter after an average growth rate of 2.6% during the preceding four quarters as households adjusted their spending habits following the hike. Japan, the world's third-largest economy, has postponed additional increases since 2015.

Japan is clearly feeling the effects of the weakness in global trade. Consumer spending has kept the economy doing a bit better than expected. The Bank of Japan (BoJ) is waiting to see how domestic spending will react to the latest tax increase. We think the prevailing view is that the impact will be smaller than in 2014. The BoJ's quarterly Tankan business survey for September showed sentiment among large Japanese companies has improved. But the survey also showed that big manufacturers and non-manufacturers lowered their business investment plans for the current fiscal year. We believe that suggests no major change in the trajectory of the economy.

Europe's Brexit dilemma

In Europe, we continue to have a gap between the performance of export (and auto) intensive manufacturing, especially in Germany, and the performance of domestically oriented service sectors. Manufacturing has continued to decline. While there are now signs of a spillover into the services sectors, the effects are smaller than one might have expected. In France, for example, domestic consumption indicators still look quite good.

The region would of course be adversely affected by a "no-deal" Brexit, and it could well be enough to tip the eurozone into a recession. Clearly, there have been days when a "no-deal" has seemed quite likely. If this happened, the United Kingdom would suffer the most. While British Prime Minister Boris Johnson displays an irritating combination of ignorance, graceless bravado, and determination on being economical with the truth, we doubt he is prepared to pull the trigger on Brexit. In mid-October, Britain and the European Union agreed to "intensify" Brexit talks. Either there will be a deal by late October or there will be an extension to the deadline and an election.

Next: U.S. manufacturing wavers

More from Macro Report

Download the Macro Report (PDF)Global growth will remain sluggish this year as protectionist tariffs continue to rattle manufacturers, businesses, and financial markets.