The economy will matter in next year's general elections as both Democrats and Republicans vie to take control of a divided nation.

A deeply polarized American electorate will head to the polls in November 2020 to decide whether they want to vote for President Trump or his Democratic rival. So, the election will be one of the key events we will be following closely next year. We highlight a few key issues that will frame the discussions over the outlook in the run-up to the elections.

Incumbent presidents normally win re-election. In the post- War era, there are only two exceptions: Jimmy Carter lost his re-election bid to Ronald Reagan because of the Iranian hostage crisis, a weak economy, and a well-run Reagan campaign; and George H.W. Bush lost his re-election bid in 1992 partly because the economy was slow to recover from the 1990–1991 recession, and because Ross Perot, standing as a third-party candidate, siphoned off some Republican votes. The weight of experience, therefore, suggests Trump is favored to win.

An unpopular presidency

With Trump, of course, things are not that simple. He is remarkably unpopular and has been throughout his Presidency. In November 2016, he lost the popular vote by a large margin but won the electoral college. That handed him the presidency. He is being impeached, and although it's hard to imagine that the Senate will convict him, it complicates his re-election campaign, or rather reinforces the campaign strategy he will use.

Impeachment has not been good for the electoral prospects of an impeached president's party. The Democratic field is crowded, and all the major candidates have some clear disadvantages in a general election. Who emerges as the Democratic candidate will have a large influence on the outcome.

The key battleground states will be more or less the same as in recent elections. The Trump campaign is trying to open up Colorado, New Mexico, and Nevada as contestable states. The Democrats want to make Georgia a presidential, Senate, and House battleground state. The most important states will be Ohio, Pennsylvania, Michigan, Wisconsin, Iowa, and Florida. If those other states come into play, the dynamics of the election would be very different and might well have implications for the House and Senate. Absent a landslide, government will remain divided. The Republicans will likely retain control of the Senate, and the Democrats will likely retain control of the House.

Elections matter for the economy

The off-year elections in Virginia and Kentucky showed a continued suburban backlash against Republicans and President Trump. The gender gap in opinion polls is also very large. This may be the only development in the elections with broader relevance, and it underscores the Trump strategy: There is simply no point in Trump trying to appeal to moderate voters. If moderate voters are unhappy with the policies proposed by the Democrat candidate, they are more likely to stay at home than to vote for Trump.

If we are correct about these dynamics, then they matter for the economic outlook. In mid-December, the United States and China reached a preliminary agreement in their long-running trade war. A new round of tariffs slated to take effect during the month will not go into effect, and the two countries plan to begin negotiations on more contentious issues. We expect trade issues will continue to simmer in 2020, but not come to a boil, because a recession would significantly harm Trump's reelection chances.

Second, the chances of a progressive Democrat winning election with working majorities in the House and the Senate are not very high. The Democratic base, like the Republican base, is drifting away from the center. Any candidate with progressive views would reduce turnout among centrist voters for the presidential and down-ticket races. This matters for the Senate, where (very) heavy turnout is needed to produce Democrat victories. Nonetheless, the strong possibility of a close election, and the fact that economic issues are likely to play a role in the campaign, may well keep corporate investment subdued.

Low recession but high policy risks

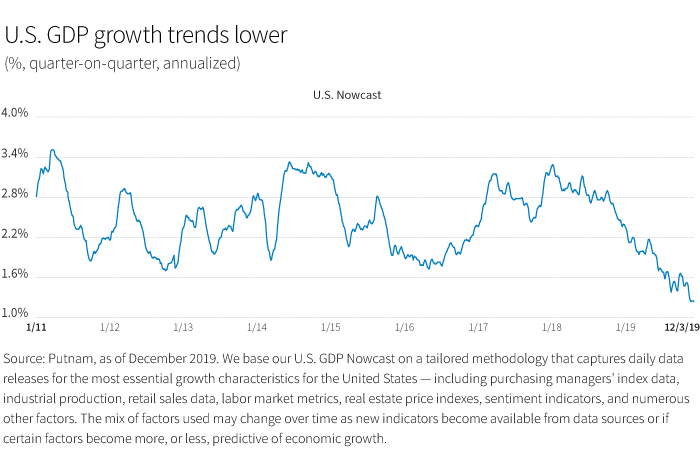

All of the above brings us back to U.S. growth prospects. Recession probabilities have not really changed. Our two favored models still show recession risks are low. The models that place a lot of weight on the Treasury yield curve still suggest a recession is certain, even though the curve has steepened recently. Those models use average levels and don't flip their signal based on a few days' worth of data. The Conference Board's leading indicator continues to edge down, largely because of the persistent weakness in manufacturing and some hints of softening in the labor market.

While we are a little less worried about higher policy risks, our concerns have not entirely dissipated. Clearly, the economy is not in recession now, and the models have been providing the right guidance over the course of this year. We still think risks are higher than the models would indicate because of the risks that are present — from the trade war, from monetary policy, and from global political stresses.

Next: Fiscal policy U-turns

More from Macro Report

Download the Macro Report (PDF)2020 is likely to be another year of sluggish growth with continued risk of a sharper downturn.