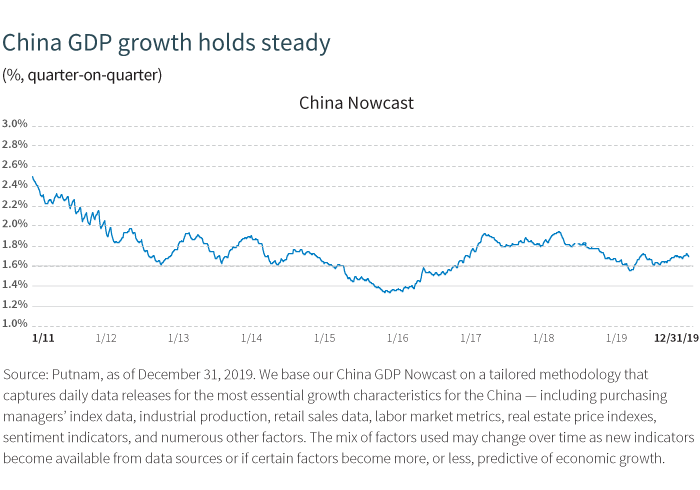

The economy is slowly decelerating, and the government continues to adopt various stimulus measures to buoy growth and manage pressures in the financials sector.

Our view is that China’s policy will not seek to push growth onto a stronger path. The backdrop is slowing growth, driven by a whole host of structural factors and by policymakers’ concerns that fast growth could bring problems in the financials sector. But the government has not abandoned its desire to manage growth along this decelerating trajectory. President Xi Jinping and his government’s approach to policy is highly activist. While China looks to be doing a bit better in the near term, its growth will not bail out the rest of the world.

The number of measures taken is almost entirely irrelevant. China is not taking step after step as some kind of experiment to find the one measure that will push the economy onto a significantly stronger path. It is trying to manage growth given the pressures from structural reforms in the financials sector and the need to address the large, residual state-owned enterprises in heavy industries. Policymakers are also trying to curtail the headwinds from trade tensions with the United States.

Easing monetary policy

Around the turn of the year, the People’s Bank of China (PBoC) announced two measures for the world’s second-largest economy. The central bank has asked banks to price outstanding loans with the new rates. Commercial banks will be required to replace old benchmark lending rates with the loan prime rate (LPR) in pricing their floating-rate loans issued before January 1, 2020. The move will effectively scrap the old benchmark lending rates. There are a lot of bells and whistles on the policy, and banks have some time to revise their loan documentation. But the net effect will be to lower the cost of credit to the private sector. There have been estimates that this revision would lower rates by as much as 40 basis points over 2020. Since most people expect some policy rate cuts this year, we will end up with two effects from this move: lower rates and tighter spreads. But the overall move in interest rates will be quite modest and amounts to about half of the rate cut over the 2015–16 period.

Similarly, the PBoC trimmed the portion of deposits (cash) that commercial banks are required to set aside as reserves. The required reserve ratio for lenders was lowered by 50 basis points starting on January 6, a move that essentially releases about $115 billion into the financial system. While this is clearly an easing action, it is modest. The PBoC released an estimate that it would release credit worth around 0.75% of GDP. China cut the bank reserve ratio three times in 2019.

These measures together are consistent with the story we have been trying to tell for a long time. Repeated policy actions are likely until the authorities are comfortable with the growth performance of the economy. But they are not trying to lift China onto a significantly higher growth path — 6% or so will be the growth rate this year.

Emerging markets tracking sideways

China remains an important trading and financial partner for many developing economies. In these markets as a whole, various PMIs and leading economic indicators show that not a whole lot has changed. The overall pattern of the data suggests a slow pace of growth. While PMIs in emerging markets look a bit better than in advanced countries, the difference shows that consumption goods production globally is doing better than the production of capital goods. That in turn indicates the weak performance of corporate capital expenditures and the relative strength of household consumption spending.

There is more production of consumer goods in emerging markets and more production of capital goods in advanced countries. The slight outperformance of emerging markets reflects a production system that is better geared to areas of the global economy where demand growth is a bit stronger.

More from Macro Report

Download the Macro Report (PDF)We believe the global economy will continue to bounce around the current growth pace. Trade, manufacturing, and oil, along with geopolitical risks, will play a role in determining the trajectory.