One of the few points everyone in Washington should be able to agree on is that a strong economy is vital to Americans’ — and America’s — fiscal health. But that point is often overlooked in the debates surrounding the fiscal cliff, which hinge primarily on two factors: reducing spending and increasing revenues. Growing the economy would do more than either to improve the current state of the nation.

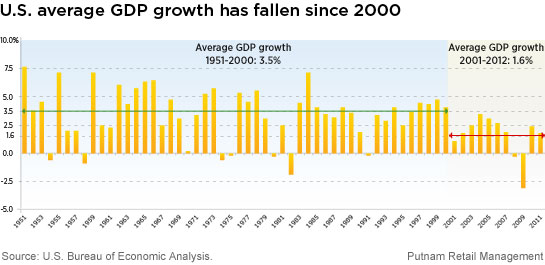

First, here is a little historical perspective: For 50 years before the technology bubble burst in 2001, gross domestic product grew at a healthy clip of 3.5% a year. More than 80 million jobs were created during that time, and the labor force participation rate — the percentage of adults who had or were looking for jobs — hit an all-time high of more than 67%.

Today, of course, we face a very different set of circumstances. Unemployment is 7.7%, a rate it has been at or above since the beginning of 2009, and millions of Americans have stopped looking for jobs and dropped out of the workforce entirely. The labor force participation rate is down to 64%, the lowest it has been in 30 years. Economic growth since the official end of the “Great Recession” in June 2009 averaged an anemic 2.2% per year; since 2001, the start of the “Lost Decade,” growth has been even lower, averaging a tepid 1.6% per year.

It is imperative that we do better. The good news is, we can, and the single factor that will do more than any other to return economic growth to the 3.5% range is reigniting households' and corporations' desire to take calculated risks. I believe reawakening those “animal spirits” begins by reducing risk aversion in the boardroom. Corporations are sitting on record levels of cash — north of $2 trillion today — but are reluctant to deploy those reserves on new equipment or new hires.

Part of the problem is a perceived lack of demand. But another significant part of the problem is a heightened level of uncertainty in the business environment. Ask any CFO, and they will tell you the same thing: It is impossible to make confident cost/benefit projections about new lines of business when the costs are constantly shifting. From Sarbanes-Oxley to Dodd-Frank to Obamacare, there has been a deluge of new regulations over the past decade, all of which have affected the cost of doing business, both within the financial industry and beyond.

I have no doubt that every one of the new regulations on the books was well intentioned, and some were no doubt necessary. But when it comes to corporate governance, the last thing business needs in this environment is a lack of certainty about the costs and requirements of compliance. The worst scandals in corporate America, from Enron and WorldCom to Bernie Madoff, were not the result of too few rules on the books. They were the result of reckless and reprehensible actions that flew in the face of existing regulations. Lawmakers would be doing the country an enormous service by choosing to focus on diligently enforcing the laws already on the books and sending a message to corporate leaders that, for at least the next two years, the goalposts will stay exactly where they are. That should be step one.

Step two is reducing the cost of employing American workers. President Obama and Governor Romney didn’t agree on much during their campaigns, but one issue on which they saw eye-to-eye was corporate tax rates. At today’s 35% level, the United States has one of the highest corporate tax rates in the developed world. President Obama has recently come out in favor of reducing that rate to 28%, and that would be a meaningful step in the right direction. At a rate of 20%–25%, the cost savings from lower taxes would not only encourage American corporations to stop outsourcing jobs overseas, but also entice multinational corporations to start creating new jobs in the United States. That is a win-win. Any reduction in the corporate tax rate would demonstrate that Washington, D.C., is serious about making the United States more competitive in the global economy, and business leaders would respond.

This combination of introducing a moratorium on new regulations and reducing corporate taxes would change the mindset of corporate leaders, and help convince companies across the country to stop focusing on playing defense and start competing to win new business. It won’t happen overnight, but this changed mindset would lead to new jobs, lower unemployment, increased consumer sentiment and spending, higher federal revenues, and smaller deficits. If there were ever a position that deserves unconditional bipartisan support, a strong economy is it. Let’s take the first steps today.