The year began with a flourish in stocks, which soared more than 10% on a mix of fundamentals and optimism. The Dow Jones Industrial Average and the S&P 500 Index set new records above levels they had last reached before the 2008 crisis.

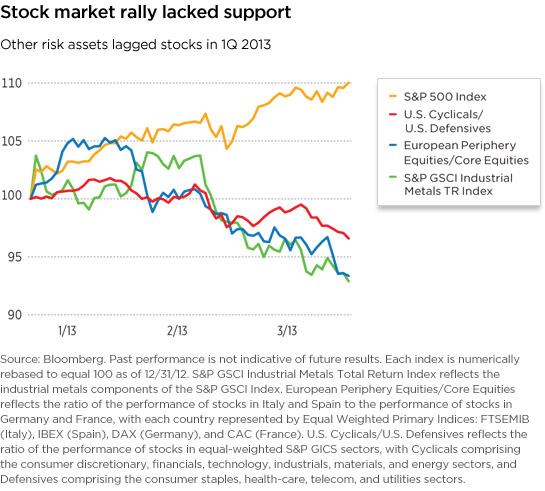

We view this advance somewhat skeptically, because the behavior of other asset classes has not confirmed it as a typical bull market. In the U.S. market, defensive stocks with stable cash flows led cyclicals more geared to economic growth. Commodities had flat results. Stocks in emerging markets generally lost ground, with only a handful of countries posting gains. A bull market usually has broader support.

An alternative view of this rally would attribute it to the positive but less-lasting effects of activist central banks around the world that have subdued three great global macro risks. From this perspective, the rally can be seen as the later innings of global macro risk normalization rather than the beginning of a new upswing in earnings. This view is more consistent with the expansion of stock price multiples in the first quarter. While valuations remain reasonable, further price appreciation would be more convincing if it came with the support of greater earnings and revenues.

Earnings reports due out in April will be very important. The markets will need to see that the improvement in the global growth environment reflects more than optimism, and that better economic performance is translating into rising earnings.