With investors around the world trying to gauge the timing of U.S. interest-rate increases, Fed Chair Janet Yellen in her March press conference did a masterful job of creating maximum flexibility for the central bank. It was no small accomplishment, after she had painted the Fed into a corner during previous communications by giving clues as to what would trigger a rate increase. After following this trail of breadcrumbs, pundits had focused the debate on whether the liftoff would come at the June or September Federal Open Market Committee (FOMC) meeting.

We now think there is a possibility that the Fed could move at just about any time, including between meetings. Credit Yellen’s ability to give enough to both bulls and bears to leave both sides convinced of their arguments. She even stated that removal of the term “patient” from the Fed statement did not mean that the Open Market Committee had become impatient. She also continued to reinforce the idea that the Fed was watching a constellation of data related to both labor markets and inflation. Markets interpreted the Fed’s shift in posture to be dovish, with stocks rising and bond yields falling initially following the Fed meeting.

From our perspective, we think the economy will be strong enough to warrant a rate hike in June. While there was some softness in first-quarter economic data — a number of reports came in shy of consensus expectations — we regard this as likely the result of another severe winter that temporarily delayed some spending. In addition, U.S. West Coast ports experienced a significant slowdown due to labor issues that have now been resolved. We expect to see data bounce back in the second quarter after a difficult winter, much as it did in 2014, and prompt the Fed to consider acting should they view disinflation as less of a threat and should the advance in the U.S. dollar pause.

The Fed ought to be eager to move the policy rate off the zero bound, if only by a token amount, for two reasons. First, a zero-interest-rate policy (ZIRP) is often regarded as an emergency measure to counter deflation, and the United States has not really faced an outright threat of deflation since the financial crisis. But it is also an important consideration to get the plumbing of the money market system re-started after more than six years in stasis by moving to a positive federal funds rate.

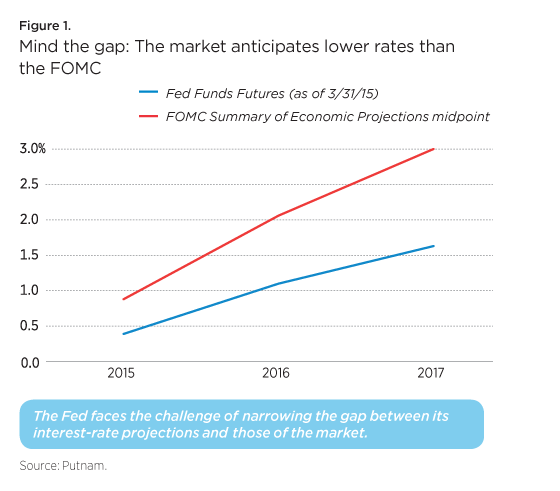

The most important task for the Fed, in our view, is not to time the increase optimally, but to close the gap that exists between its view of the future (as represented by the much-discussed “dots” from its Summary of Economic Projections, or SEP) and the market’s view of the future as expressed by expectations for the yield curve and federal funds futures contracts. For many quarters, the market has anticipated much lower yields and interest rates in the coming years than the Fed has forecast. Fortunately, in their March update, members of the Open Market Committee nudged their forecasts lower. And the second quarter could show whether the market might need to push its estimates a bit higher.

294825