- We view the Fed’s latest rate increase as a tempering of dovish sentiment, not as a hawkish hike.

- To the extent Trump’s promised fiscal stimulus enhances U.S. growth potential, that may temper the Fed’s approach to future interest-rate increases.

- To the extent Trump stimulus raises inflation pressures, we see the Fed as prepared to take a more aggressive approach to monetary policy.

This week’s interest-rate increase by the Federal Reserve did not come as a surprise. Heading into the Fed’s December meeting, the market expected to see the announcement of a 25-basis-point increase in the federal funds rate. This hike marked the first in a year and only the second in a decade. More interesting to market observers was what the Fed would signal on monetary policy in 2017, and how the Fed might react to fiscal stimulus under President-elect Trump. Curiously, what the market appeared to find in the announcement itself and the post-meeting press conference was evidence of a newly hawkish Fed.

A hawkish hike?

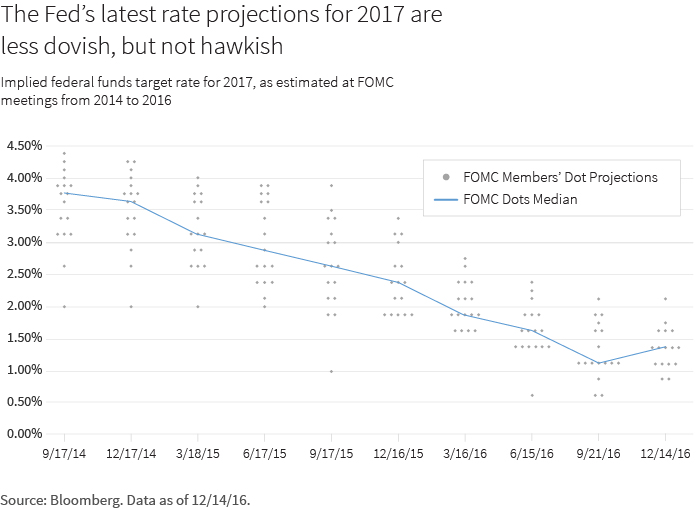

In particular, the market saw the increase in the median number of expected interest-rate hikes in 2017 — an increase from 2 to 3 — as the key signal showing the Fed was preparing to take even more aggressive action in the near future. But where the market sees a big hawk, we see a slightly smaller dove. Looking at the Fed’s “dot plot,” the schematic illustrating rate expectations for individual members of the Federal Open Market Committee, we observe that two of the doves this month became slightly less dovish in their expectations. This shift alone accounts for the elevation of the median number of expected hikes from 2 to 3.

Rather than a hawkish hike, this amounts to a compression of the distribution of expected outcomes, and a lessening of deflation risk. By itself, it does not signal an aggressive tightening regime is on tap for 2017. Rather than a uniform upward shift in rate expectations, the dot plot shows that a minority of members have become somewhat less accommodative. And it is quite likely that this change occurs in reaction to the current economic data flow, which reveals core inflation to be trending upward, nearing the Fed’s target of 2%. Characteristically, in her post-meeting press conference Fed Chair Janet Yellen took pains to stress that Fed action would continue to be data dependent, reflecting the slow and meticulously cautious approach that has been the hallmark of U.S. monetary policy for close to a decade.

The hawks may emerge on fiscal wings

Considering 2017, the Fed, like everyone else, is waiting to learn the details of a Trump-led fiscal policy change. And as investors, it is worth asking how a material fiscal change may affect the trajectory of monetary policy.

In our view, the Fed has been clear that it would welcome a productivity-enhancing fiscal plan. Such a plan, with meaningful infrastructure development, efficiency-enhancing corporate reform, and well-considered educational and training components, could lift economic growth potential without requiring a more aggressive monetary stance. In addition, we think the Fed has been equally clear that an inflationary fiscal package — particularly one that stimulates aggregate demand without also enhancing productivity — could prompt more aggressive monetary tightening. The uncertainty we face in 2017 is therefore twofold: What kind of fiscal stimulus will we see, and when will we see it?

The politics of fiscal policy may be a key risk under Trump

Janet Yellen offered no advice to Donald Trump in her press conference following the Fed’s December 2016 meeting. But she did suggest that the case for stimulating aggregate demand is weaker now than it was a few months ago. In other words, Yellen has articulated that the details of the mix of spending and revenue components in fiscal stimulus will matter to markets and the trajectory of monetary policy.

In our view, a currently underappreciated risk is that the politics of Trump’s fiscal policy may undermine even the best-intentioned stimulus program. Politics, that is, may unavoidably trigger an avalanche of rewards — particularly to reward supporters. Critically, these are not necessarily productivity-enhancing; and in many plausible scenarios, they become merely handouts — political quid pro quo. Corporate tax reform, if handled poorly, could easily produce more inflation than growth. What’s more, with so many vested interests at stake, the race for special tax breaks could bog down the legislative process.

Echoes of Reagan-era dynamics

As of mid-December 2016, rates are rising and the probability of deflation appears vanishingly small. Market-based inflation measures have climbed. The potential for sustained U.S.-dollar strength is high. Enter the political outsider, President-elect Donald Trump, ready to shake things up and make a clean break from his predecessor in every way imaginable.

Sound familiar? Echoes of Reagan-era dynamics are vaguely audible to anyone with a sufficiently long memory. And what we know from that era is that the fallout from ballooning deficits, outsize interest-rate increases, and currency strength can be huge.

In the short term, rates may stay range-bound

In our view, U.S. rate increases may find their limits, at least in the short term. Globally, central banks are far from where the U.S. Fed stands today. Stretching to find new ways to be accommodative — from the Bank of Japan announcing new measures to lower Japanese government bond yields to the European Central Bank extending its quantitative easing program through the end of 2017 — developed markets continue to resist the pull of U.S. rate normalization. This policy divergence from the United States may help keep a lid on U.S. rates, at least in the near term. Looking further out, however, to the end of stimulus abroad, we do see the potential for substantially higher global rate structures, with the U.S. pulling global rates higher once the shackles of quantitative easing are off.

304541