Your new online experience is coming soon

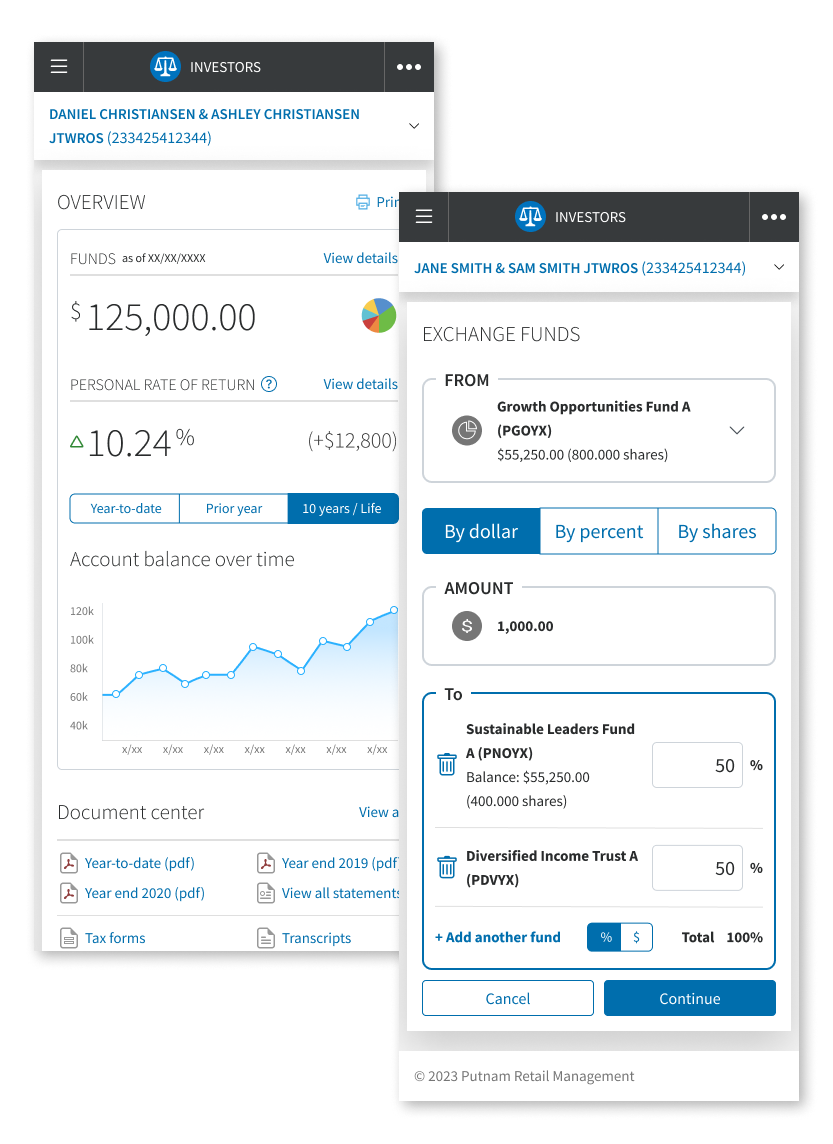

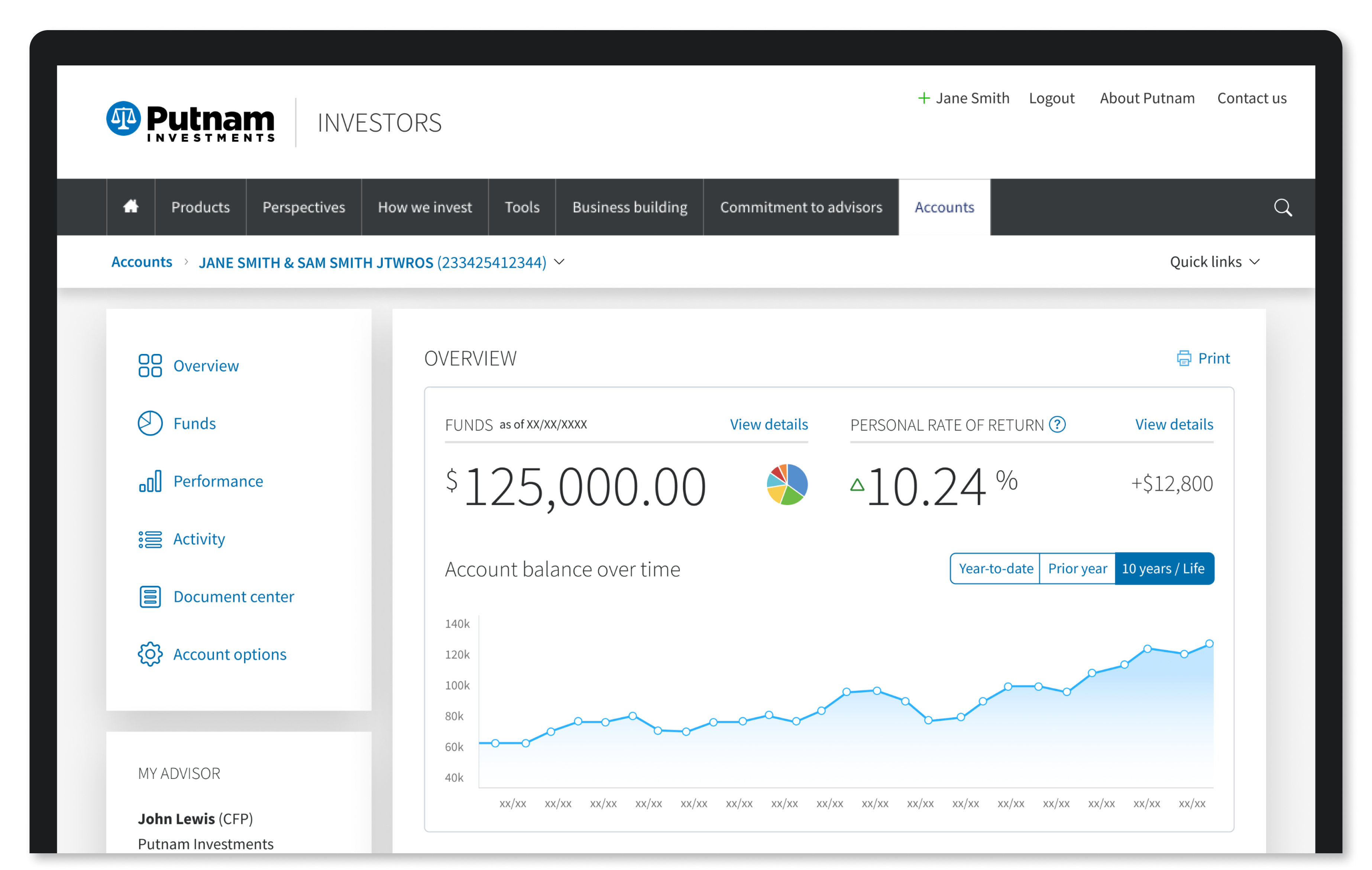

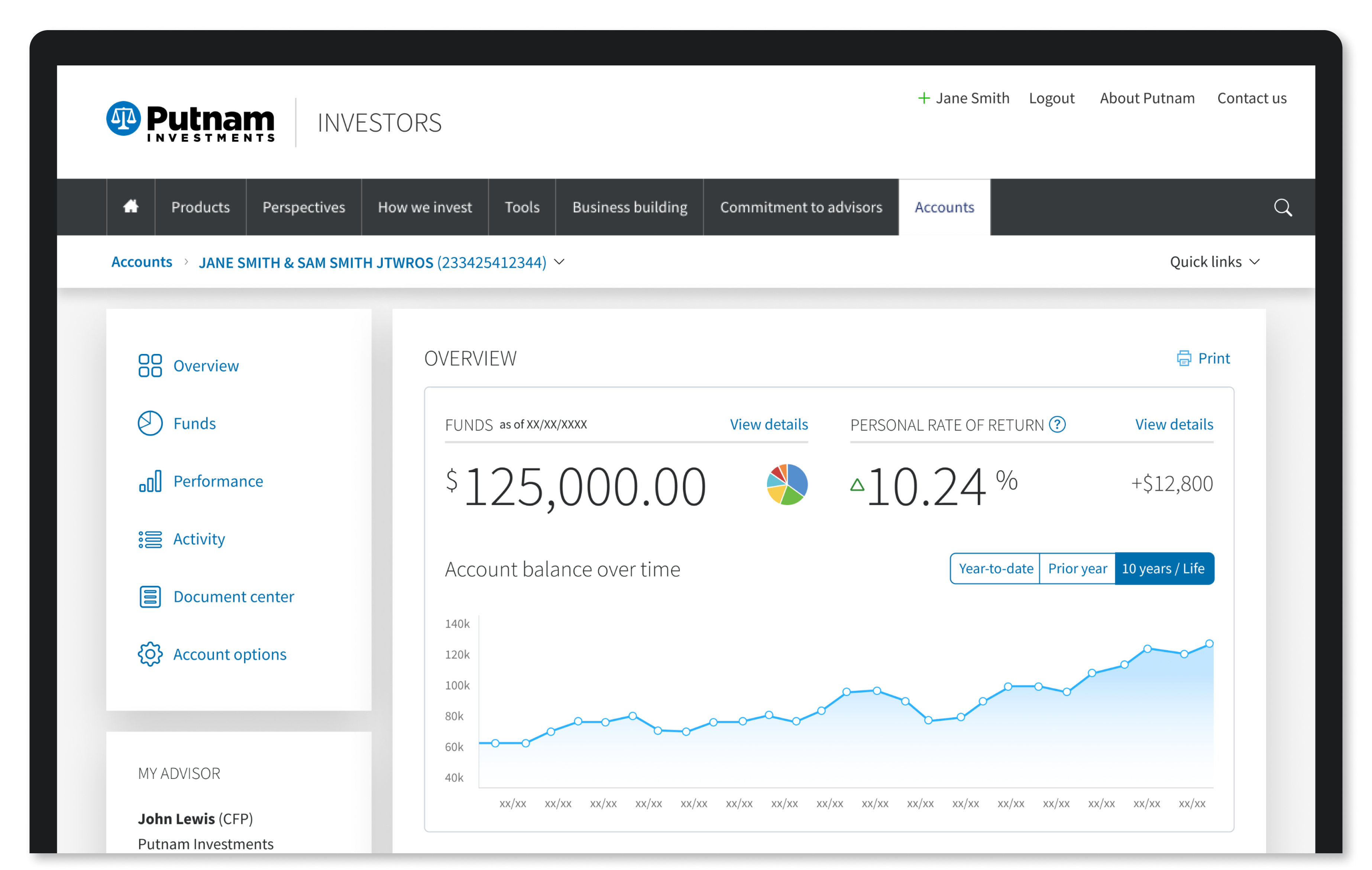

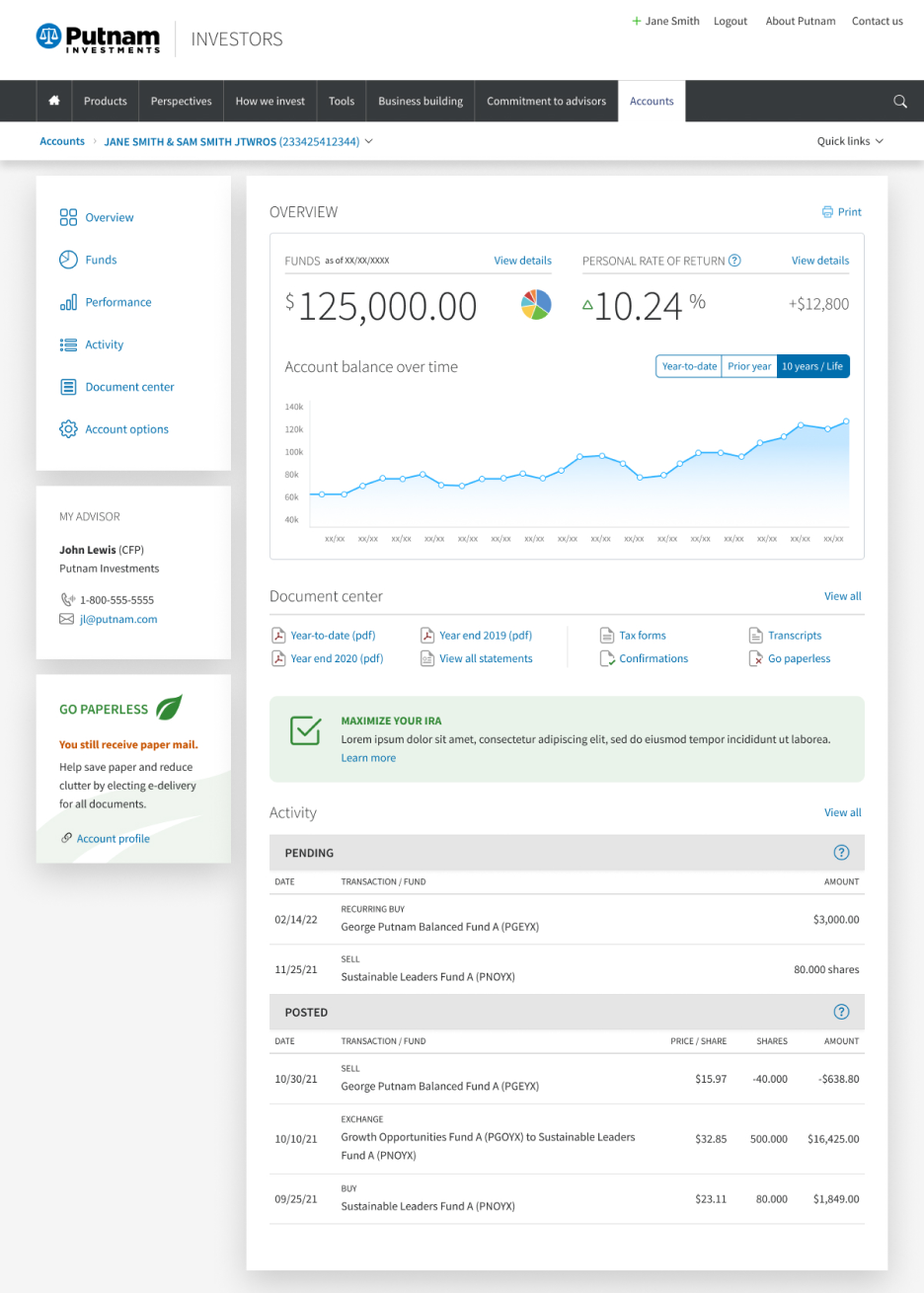

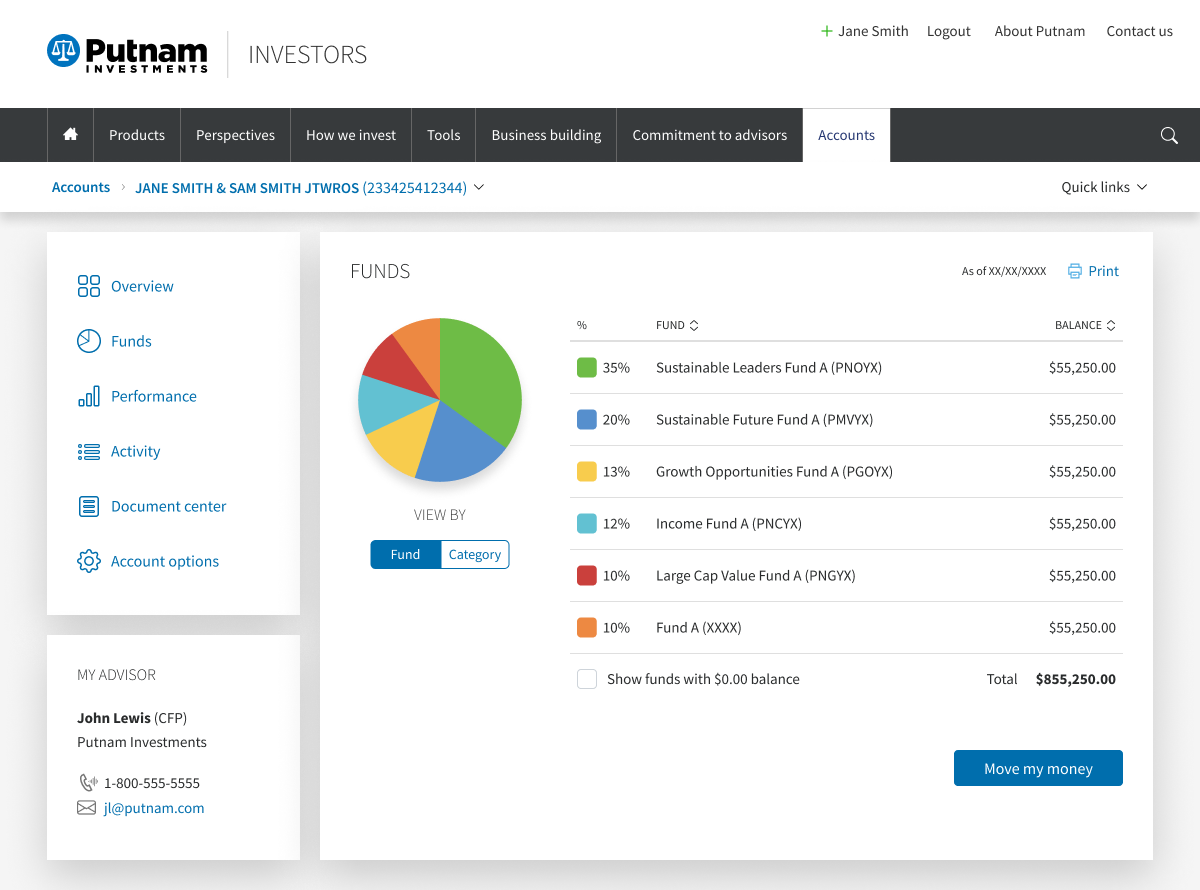

• Balance

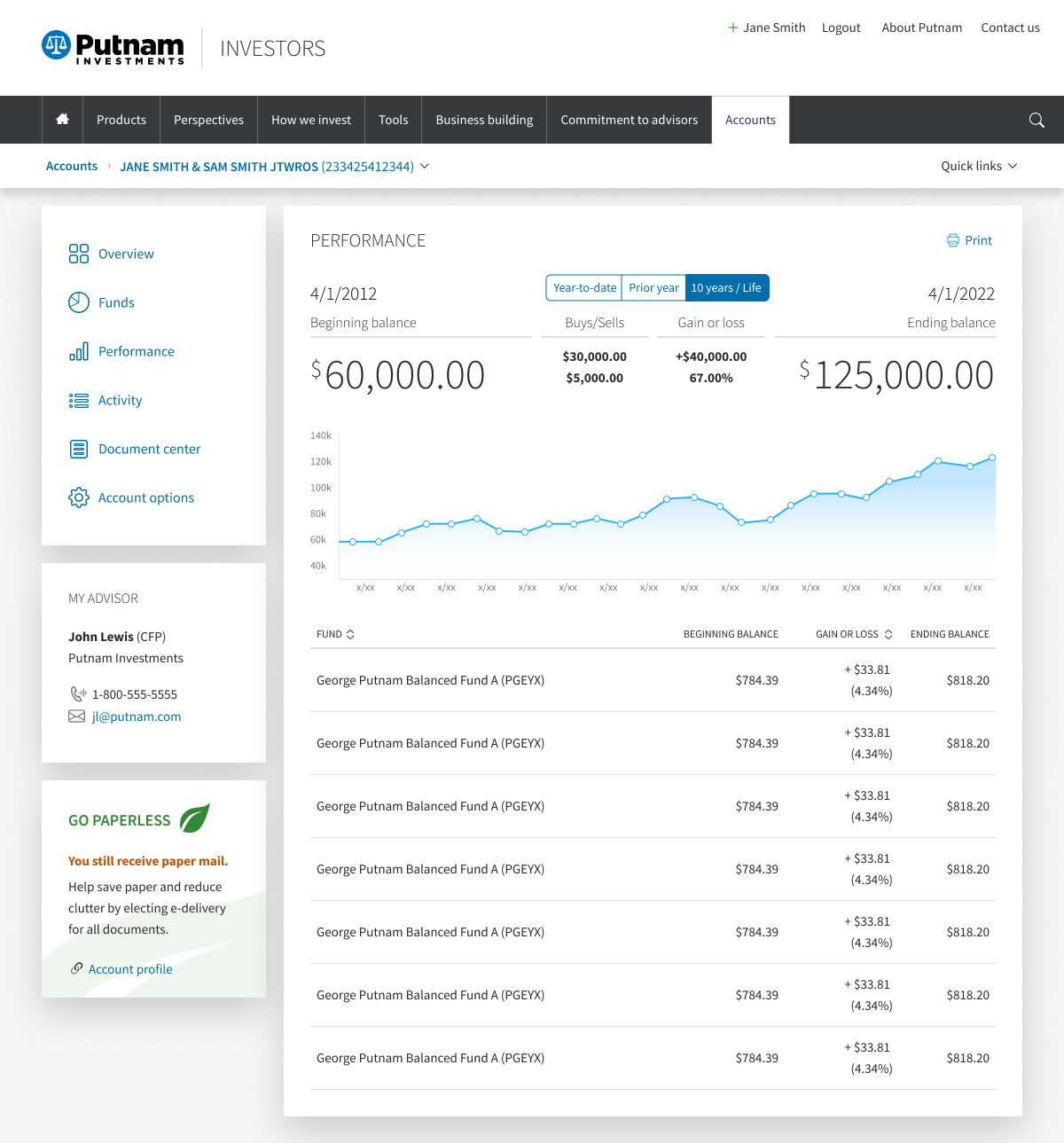

• Balance over time

• Personal rate of return

• Important documents

• Transaction activity

Use the left-side menu or tap individual components for more details.

View different time periods.

See individual fund performance.

Drill down for fund details.

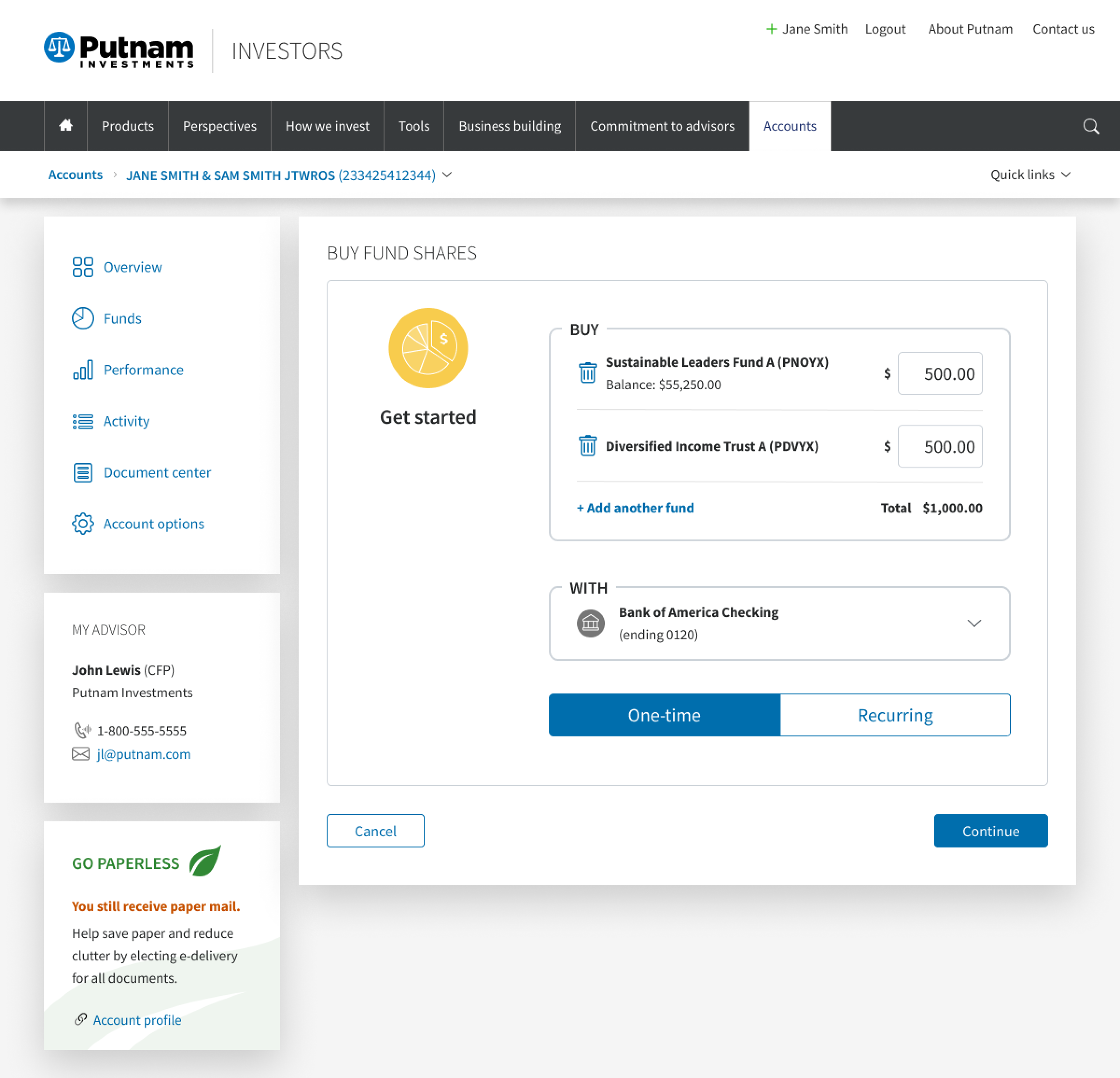

Buy, sell, or exchange funds with one simple click.

Use the left-side menu or tap individual components for more details.