Infographics

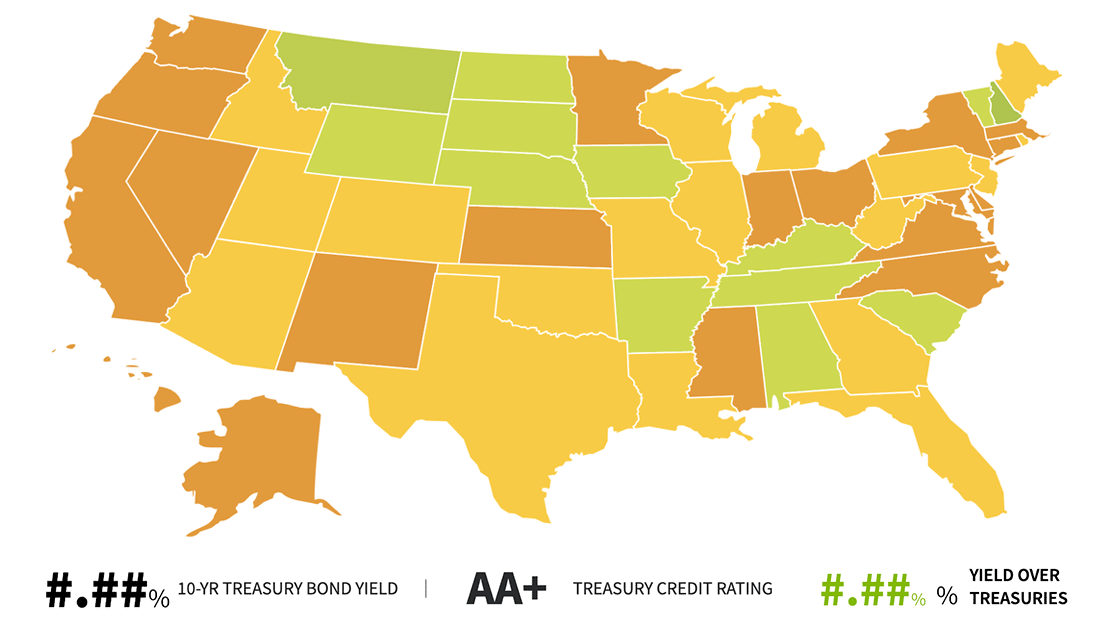

The muni bond advantage

When you invest for income, explore the tax advantage of munis and look beyond pretax yields.

Try this interactive tool for a more personalized yield picture

Data as of 12/31/23

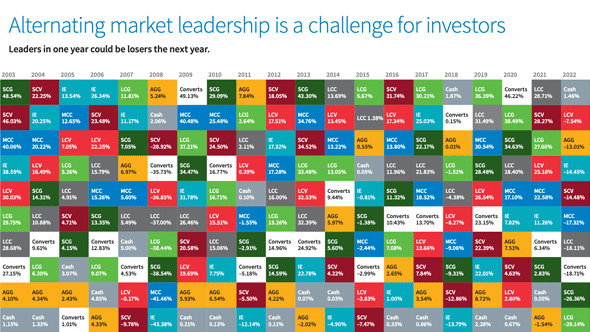

Why diversify? Market leadership changes

In dynamic financial markets, the performance of investments can change frequently. Diversifying a portfolio across many assets is a classic strategy to avoid the risk of picking one investment that can fall out of favor.

Data as of 12/31/21

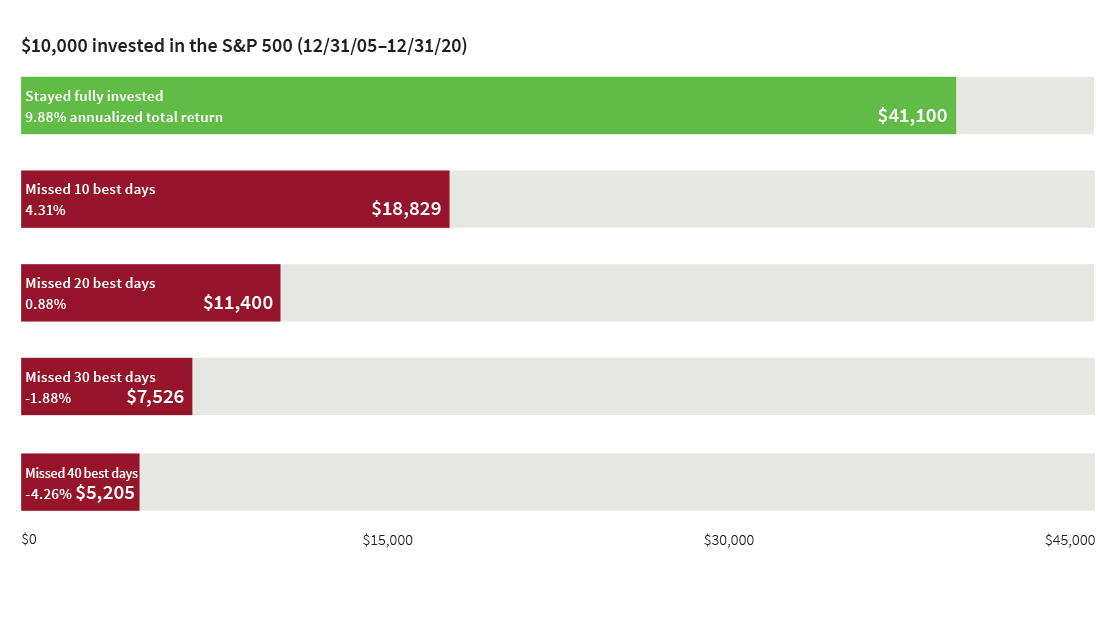

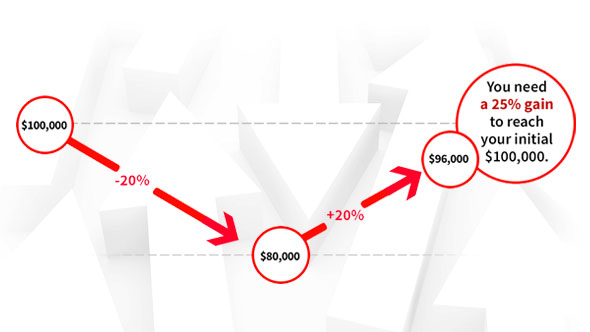

Up and down markets are not symmetrical

After a market drawdown, it takes a larger upswing to get back on track.

Understand the math of market risk

Data as of 12/31/17