A 529 savings plan has remained popular among families with college-bound children. In fact, the number of accounts has continued to grow steadily over time, reaching 16 million at the end of last year.

As of June 2023, assets in 529 plans rose to $470.2 billion, according to the College Savings Plan Network. The average account size climbed to $27,741 in 2023 from $13,188 in 2009.1

Reflecting on "529," here are some key facts for families to consider about 529 plans.

5: Top five benefits

Tax advantages

You pay no federal income taxes on account earnings while the account is invested. And you will pay no federal income taxes when the money is withdrawn to pay for qualified education expenses.

Control of account

You control the account, even when the child reaches legal age. As account owner, you retain control over withdrawals for the life of the account. In most cases, contributions to the account can be removed from your estate for tax purposes, yet you can retain control over the assets.

No income or time limits on contributions

Unlike certain accounts, such as Roth IRAs, anyone can contribute to a 529 regardless of their income. There is no age or time limit on contributions, unlike some custodial accounts.

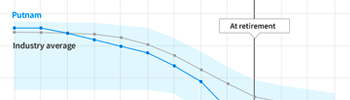

Age or enrollment-date investment options

Savers have investment options such as age-based strategies that are actively managed and become more conservative as a child approaches college enrollment age.

Special gift exclusion

A special exclusion enables you to make up to five years’ worth of gifts in a single year to a single beneficiary without triggering the federal gift tax.

2: Two biggest myths

I won’t be eligible for financial aid if I own a 529 plan.

Actually, 529 plans are treated quite favorably when a student is applying for financial aid and the student aid index is being calculated.

As an asset, 529 plan funds count as a small percentage of parental assets versus other types of savings accounts, such as a custodial account for a minor.

When paying for college, 529 plan distributions from a parent-owned account are not factored as part of the income calculation for the Free Application for Federal Student Aid (FAFSA).

I may have to pay a penalty and taxes if there are funds leftover not needed for qualified education expenses.

Some families find they have saved more than their children need for college. Students may graduate early or attend a less expensive program. 529 plans offer several options if you don’t use all the money in the account.

- Transfer the money to another 529 account (money can be transferred to a sibling or family member in same generation as the original beneficiary)

- Change ownership to yourself to use for education at any accredited school

- Take a non-qualified distribution in the name of the child so the tax rate is lower

- Effective in 2024, transfer up to $35,000 to a Roth IRA

9: Funds can be used for at least nine qualified expenses

- Tuition and fees

- Room and board

- Wifi

- Computers

- Books

- Certified apprenticeship programs

- K–12 tuition. Up to $10,000 per year per student may be used to pay for tuition at any public, private, or religious elementary or secondary school

- Student loan pay back—a lifetime amount of $10,000 may be used to pay back student loans

- Other college-related costs (course materials, lab expenses, etc.)

It is important to note that not all states recognize certain expenses as qualified so there may be state tax implications when withdrawals are made.

Seek advice

When considering a new savings plan or changes to your financial plan, it is important to seek advice from a financial advisor familiar with your situation.

1Source: College Savings Plans Network, 2024 (data as of 2023).

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.